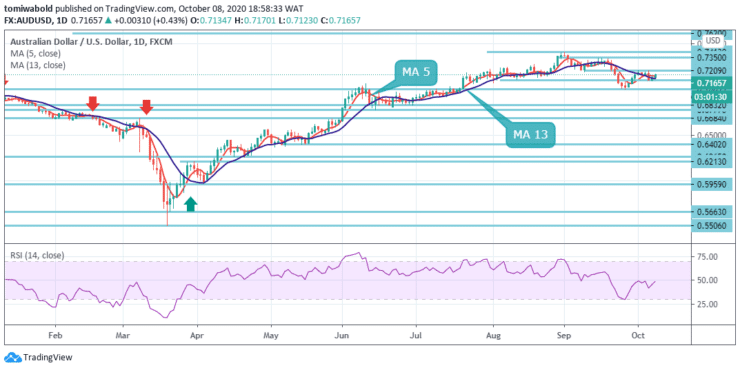

AUDUSD Price Analysis – October 8

On Thursday, the AUDUSD pair gained momentum and increased to a daily high of 0.7171 after holding on to gains beyond the level of 0.7100. The revived hopes for the next round of US fiscal stimulus measures, while alleviating investor concerns, remained supportive of the prevailing upbeat market sentiment.

Key Level

Resistance Levels: 0.7413, 0.7350, 0.7209

Support Levels: 0.7100, 0.7003, 0.6832

The swings in US equities continue to affect AUDUSD, which in turn holds political news intensely. A difficult resistance for the Aussie is established by the 0.7200 area. Annihilating this, and before confronting the multi-month high of 0.7413 level, the nearby horizontal barrier may exceed the high level of 0.7350.

In the wider sense, while the rebound from the level of 0.5506 was impressive, there is still insufficient evidence to support the bullish trend reversal. That is, within the long-term upward trend, it may be just a correction as emphasis would be turned back to a low 0.5506 level.

Today, AUDUSD decreases dramatically but rebounds after breaching a minor support level of 0.7100. First, intraday bias stays impartial. The rebound from the 0.7005 level may restart on the upside, breaching the resistance level of 0.7209. That will also mean the completion of the 0.7413 level correction.

In this scenario, the further rally may be seen to retest the high level of 0.7413. Nevertheless, on the downside, the firm breach of the 0.7100 level may suggest that the correction from the level of 0.7413 is restarting. Intraday bias at 0.7005 level would be shifted back to the downside, and then retracement of 38.2 percent from 0.5506 to 0.7413 at 0.6685 levels.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.