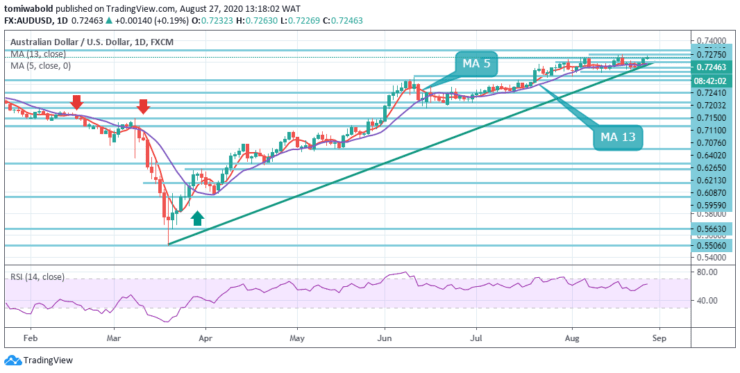

AUDUSD Price Analysis – August 27

During the early European session, the AUDUSD pair shot to through one-week highs, around the 0.7260-65 range, but rapidly crawled back a few pips later on. Although the pair got traction for the third straight day despite being overbought. The traction was supported solely by the predominant selling bias that engulfed the US dollar ahead of Powell’s speech.

Key Levels

Resistance Levels: 0.7400, 0.7311, 0.7275

Support Levels: 0.7203, 0.7150, 0.7076

The exchange rate is currently trading near the upper limit of an ascending channel trend and may be poised for a breakout. If the breakout emerges, a surge to 0.7275 level within this session may be anticipated. If the channel trend holds though, bearish traders are likely to hit today’s horizontal support line at 0.7203 level.

Yet more rally may be seen towards upside barrier (now at level 0.7311). This might probably be the best scenario as long as it stays beyond the horizontal support line (now at 0.7076 level). Even so, persistent trading beneath ascending trendline support may shift focus back to 0.5506 low level regardless.

AUDUSD remains in range beneath 0.7275 level and the intraday bias stays initially neutral. With 0.7110 level intact, the further increase could be seen. Long-term rise from 0.5506 to 0.7311 may extend beyond 0.7275 level.

Nevertheless, a breach of 0.7110 support level may indicate short term topping given persistent bearish divergence condition in 4 hour RSI. For correction towards 0.6776 support level, the intraday bias is turned back to the downside.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.