AUDUSD Price Analysis – October 14

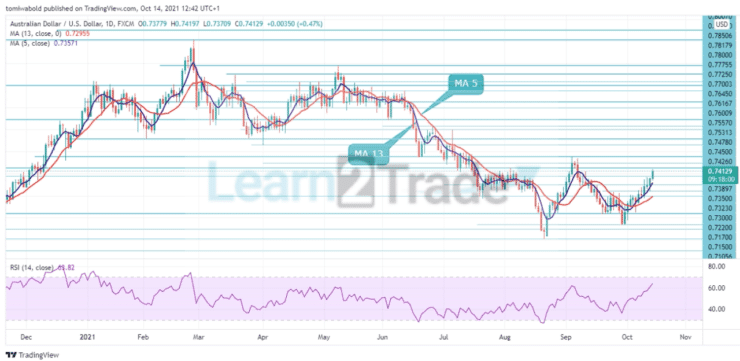

The AUDUSD pair is above 0.7400, climbing over the moving averages 5 and 13, indicating an advancing trend. According to the markets, the price may challenge the higher level at 0.7426 before continuing upwards to 0.7450. Despite mixed Australian jobs and Chinese inflation data, the pair is building on the prior day’s rise, as buying appetite in the Aussie remains strong.

Key Levels

Resistance Levels: 0.7645, 0.7557, 0.7450

Support Levels: 0.7350, 0.7220, 0.7150

The AUDUSD continues to show optimistic signs daily, with the market strengthening its two-month-old consolidation after advancing to 0.7478 and then posting another higher to 0.7419 in the present session.

At least on the first try, we expect growth to be constrained by the key resistance level of 0.7450. A violation of the 0.7350 support level on the downside could signal balancing in the near term and a shift in the downward bias for the 0.7300 support level on the contrary position.

In the short term, it’s tough to rule out further strength because the price is hovering above the 5 and 13 moving averages, and the RSI appears to be gaining velocity as it approaches the 70 bullish points. However, unless the market closes below the 0.7400 mark and continues to deteriorate inside the upward channel, any pullback may not be a serious concern.

However, if the currency exchange rate continues to rise in the ascending channel, a drop to 0.7350 could be imminent. If the bullish trend continues, the AUDUSD pair may begin to rise again in the coming sessions.

Note: learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.