AUDUSD Price Analysis – March 12

The AUDUSD pair continues to drive lower on Thursday, capitalizing on risk-off flows with the greenback. As of the time of writing, the pair had registered its lowest level at 0.6266 in 11 years, erasing around 3 percent daily. Increased concerns over the spread of coronavirus are triggering a prolonged global recession.

Key Levels

Resistance Levels: 0.7031, 0.6684, 6434

Support Levels: 0.6314, 6266, 0.6008

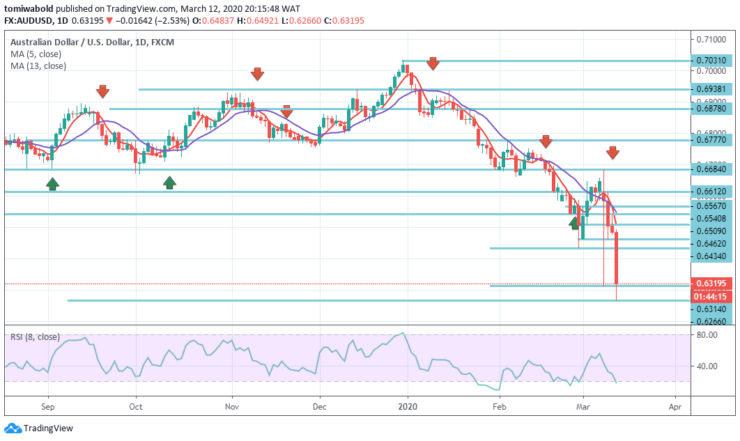

AUDUSD Long term Trend: Bearish

The fall of AUDUSD from 0.7031 (high) level is still in the process of a larger structure. This is part of a larger downtrend from 0.7085 (high). The deviation of 5 and 13 moving averages confirms its long-term bearish dynamics.

The next target, however, is the level of 0.6008 (low). The trend may remain bearish as long as the resistance level of 0.7031 remains unchanged, even in the case of a strong rebound.

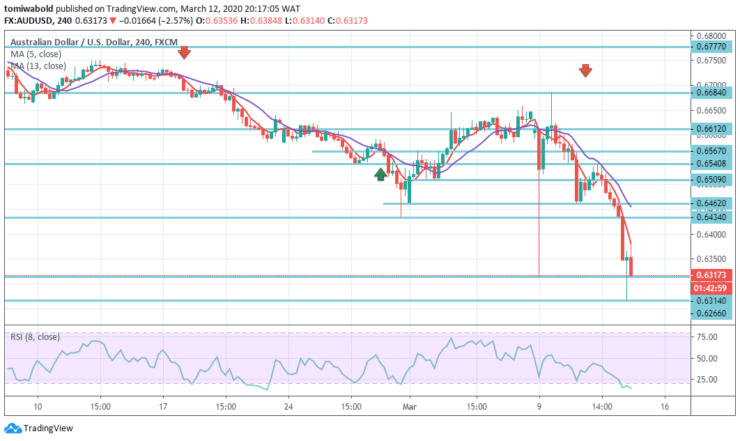

AUDUSD Short term Trend: Bearish

A breakdown of the AUDUSD level of 0.6434 ultimately indicates a greater recovery of the downtrend. The shift during the day returns to its lower side. The current decline can reach an estimate of 0.7031-0.6434, amounting to 61.8 percent from 0.6684 to 0.6314, and then 100 percent to 0.6086 level.

On the other hand, a breakout of the resistance level of 0.6684 is necessary to confirm the short-term bottom, even in case of recovery, the trend may remain bearish.

Instrument: AUDUSD

Order: Sell

Entry price: 0.6314

Stop: 0.6434

Target: 0.6266

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.