AUDUSD Price Analysis – January 2

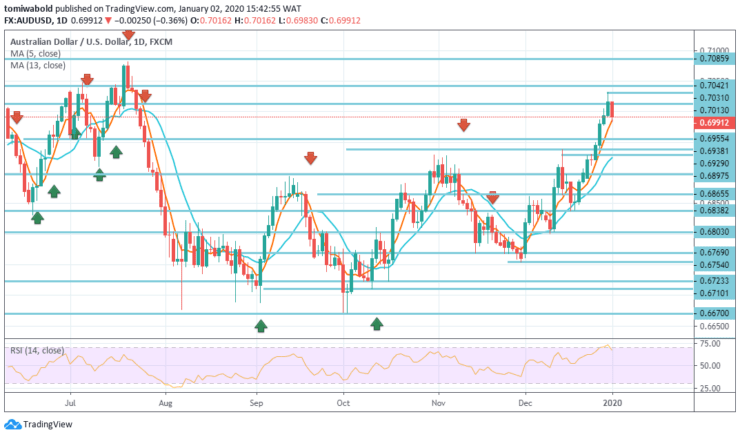

The AUDUSD FX pair closed the last trading days of 2019 in a positive zone while arriving at its highest level since late July on the level at 0.7031 on December 31. As traders returned from the New Year holiday, the pair reversed course and fell beneath the level at 0.7000. As of this writing, the pair fell 0.35% on the day at 0.6992.

Key Levels

Resistance Levels: 0.7205, 0.7085, 0.7031

Support levels: 0.6938, 0.0.6754, 0.6670

AUDUSD Long term Trend: Bullish

In the larger pattern, while the 0.7085 resistance level remains unchanged, there is no clear confirmation of the trend reversal yet. This means that the downtrend from the level at 0.7205 (high) is still expected to continue to the level at 0.6670 (low).

However, a decisive breach of the 0.7085 level may confirm the long-term bottom and resume a strong rise behind the upper horizontal resistance area (now at 0.7205).

AUDUSD Short term Trend: Bullish

AUDUSD went off-course its momentum after it reached the level of 0.7031 and dropped 100% to the level from 0.6670 to 0.6929 from 0.6754 at 0.6992. The daily bias changed to neutral initially. At this point, there is a more moderate rise in favor as long as the resistance at 0.6938 level already turns into support stability.

A break of 0.7031 level might approach the major resistance level of 0.7085 level. However, a break of 0.6938 level might be the first sign of a short-term reversal. In this scenario, intraday bias may be reverted to the downside to test the next 0.6838 support level.

Instrument: AUDUSD

Order: Buy

Entry price: 0.6938

Stop: 0.6838

Target: 0.7085

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.