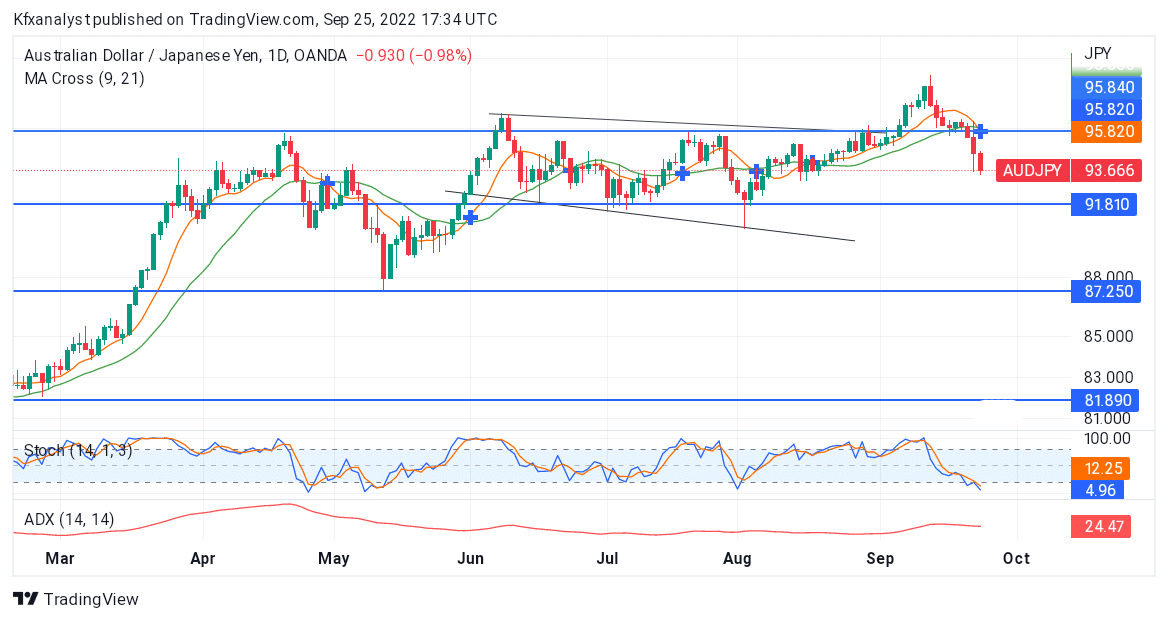

AUDJPY Analysis – Market Stays Bearish as Price Deploys Back to the 91.8100 Key Zone

AUDJPY stays bearish as price tends to flirt back to 91.8100 key zone. The selling price has been making a massive deployment downward all of the last two weeks. However, this indication shows us that the possibility of sellers dominating so well is higher in the coming days. The bears will therefore cause the price tendency to be deployed down to the 91.8100 trade level as sellers continue to hold influence. Market traders looking for a sell opportunity can look forward to getting a perfect entry this week as bearish composition continues.

AUDJPY Key Levels

Resistance Levels:95.81000, 91.81000

Support Levels: 87.2500, 81.8900

At this point, we have begun to see price reversals as the currency pair traded against the buyers. As a result, the sellers devalued the price trend below 95.8400, the key zone. The price is currently back in the ranging channel as we anticipate a drop close to the 91.8100 market level. The Moving Average Crossing has been indicted with a cross over to illustrate that sellers are still in control as we expect a price drop in the coming days. The Average Directional Index is also increasing in strength as the bearish arm gets stronger to go lower on the daily chart. A decline down to a significant level of 91.8100 is anticipated.

Market Expectations

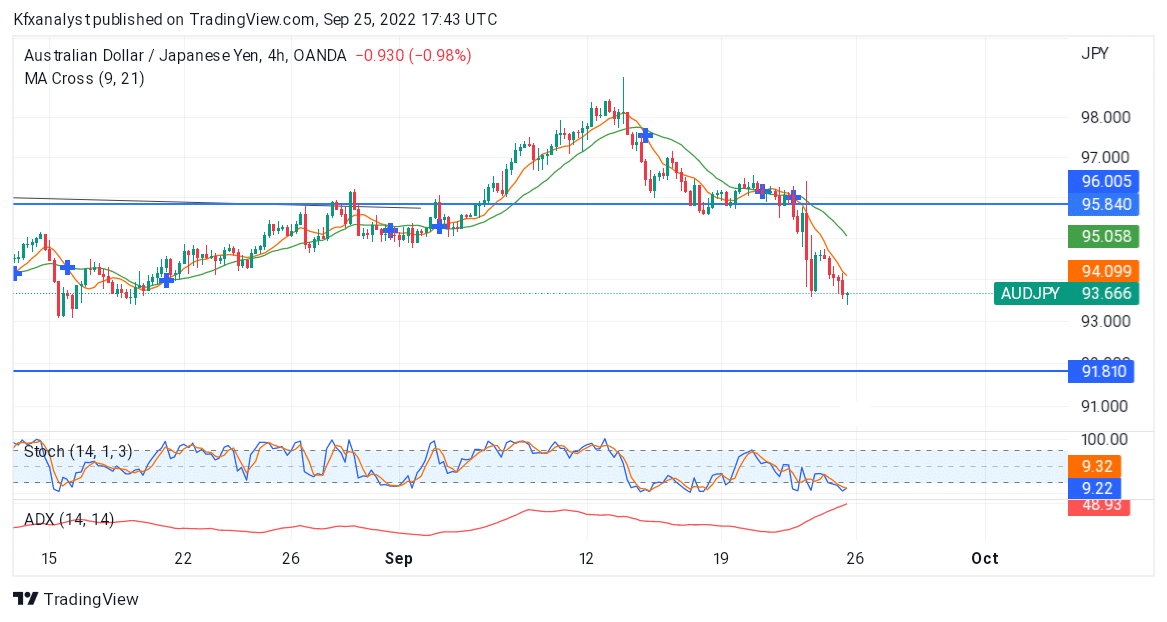

The bears are running with liquidity shown downward on the 4hr chart. The moving average 9 to 21 crossing is expanding as the bear keeps going lower. Selling focus is bound to continue as the Stochastic Oscillator also leads in selling moments for a bearish dump back to the 91.8100 key zone.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.