AUDJPY Analysis – October 3rd

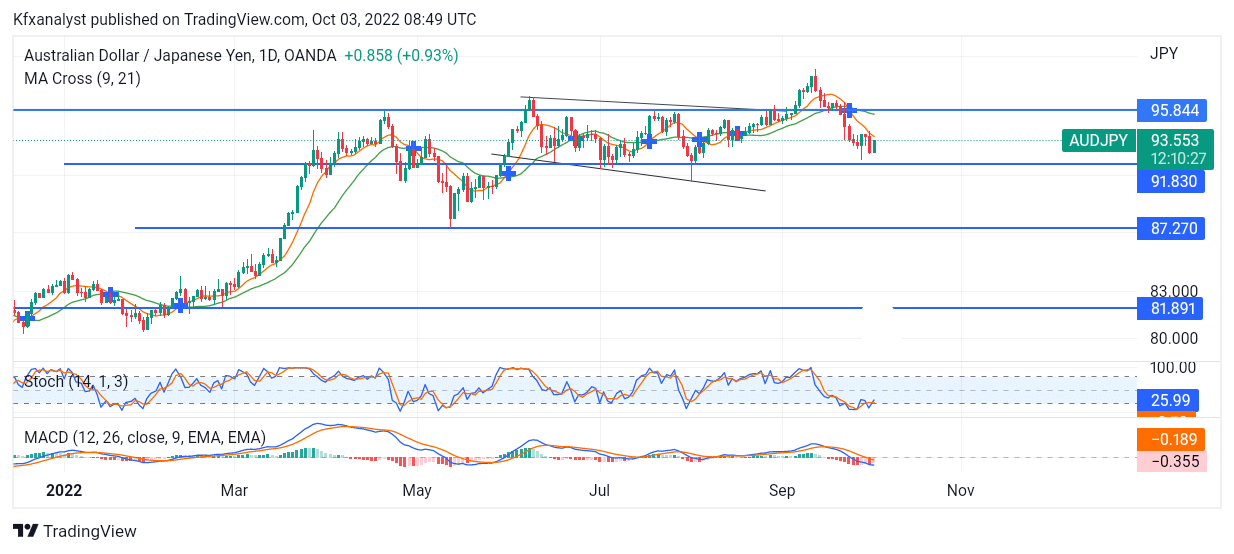

AUDJPY sellers seek long-term projections as traders are positioned for more selling moments. The sellers have been making a substantial movement downward as selling pressure is still causing a major spill in price in the current phase. There has been a consistent sell trend back into the consolidation zone following a bullish break beyond the 95.8440 key level. The bull traders made their attempt to ride up north following this outbreak. However, their bullish run was eventually dissolved before it even began to progress further on the currency pair.

AUDJPY Key Zones

Resistance Zones: 95.8440, 91.8300

Support Zones: 87.2700, 81.8910

AUDJPY Long-Term Trend: Bullish

Since the buyers failed to make a rally beyond the 95.8440 key zone, a sell revolution emerged as the price began to drop lower. At the edge of the key zone of 95.8440, the Moving Averages indicator of days 9 and 21 gave a solid cross, which indicates a solid cross-section as sellers are now holding prices momentarily. As the sell traders began to ride lower last week inside the consolidation zone, the buy traders are causing a hold-up currently before more impact can be felt on the AUDJPY currency pair. The moving average of days 9 and 21 is still expanding despite the selling hindrance down beyond the 91.8300 key zone.

The daily chart shows buyers holding ground as the Stochastic Oscillator is oversold. As a result, buyers will continue to cause delays before selling their project at a loss. However, the line is the Moving Average Convergence & Divergence indicator shows selling conversion downward as the line is below the middle. Therefore, this shows that the sellers still have the upper hand in the market as more displacement is yet to be seen beyond the 91.8300 key zone.

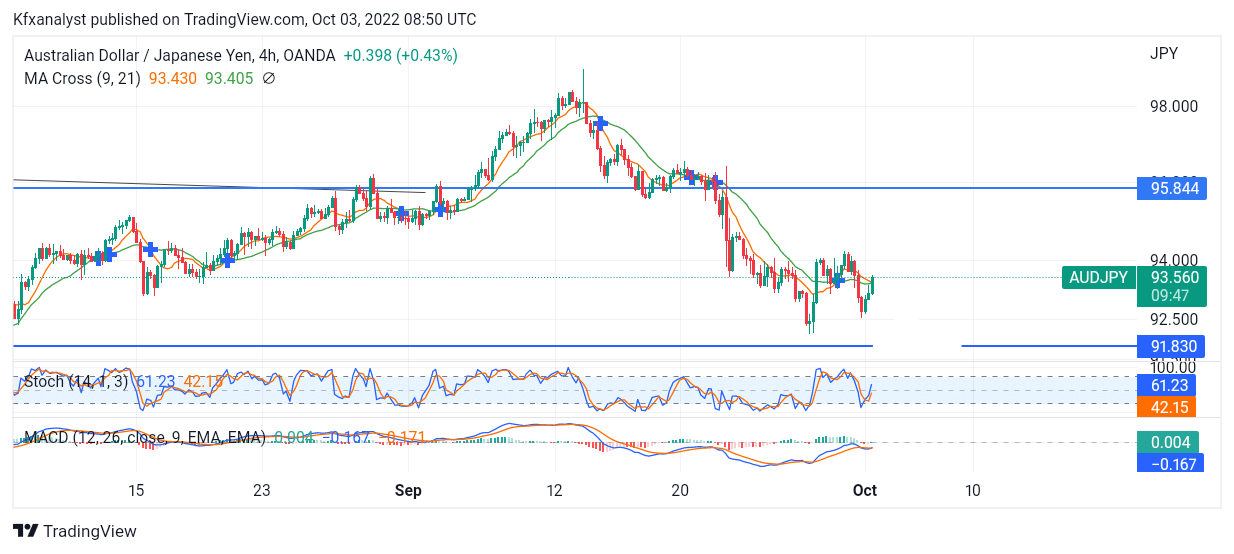

AUDJPY Short-Term Trend: Bearish

The buyers are causing a ride back on the 4hr chart as more displacement is yet to be seen. The MACD indicator still shows selling continuity as the trading pair progresses.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

NOTE: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.