AUDJPY Analysis- November 14

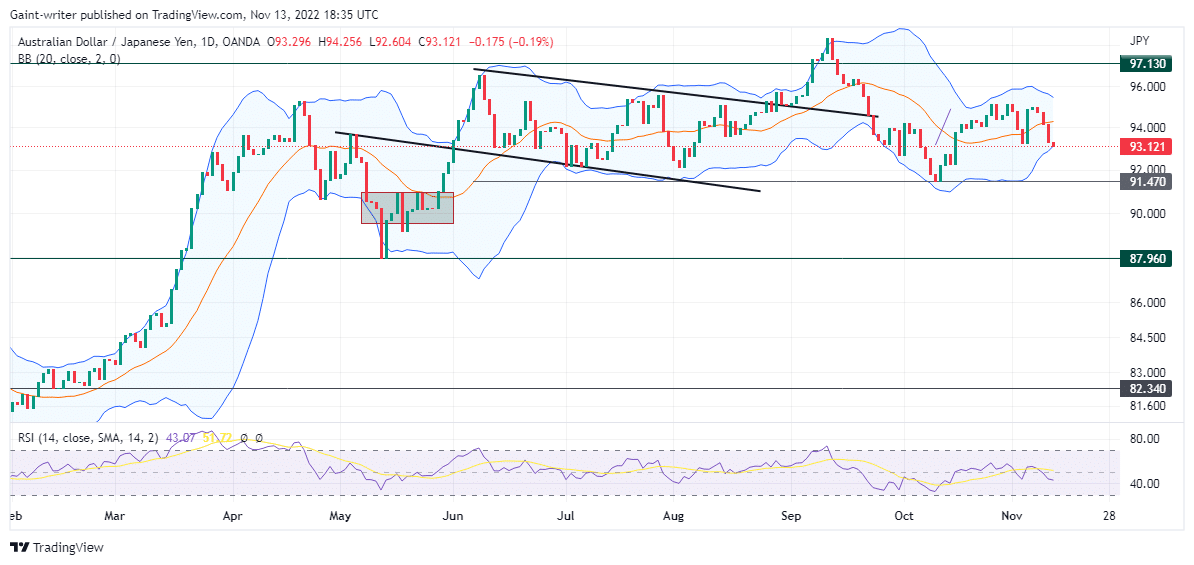

AUDJPY price is chipping away back to the 91.470 key zone as more expectations are raised by sellers. On the AUDJPY market, the sell traders seem to be lowering the bar as price action is now seen slipping. Taking a look at the Bollinger Band Indicator, the price action is seen to be ranging. As confirmed on the daily chart, the market pair just recently broke through the middle band level, as the price is now trading down to the lower band. This, therefore, explains the seller’s interest, even though the tide is close to changing very soon.

AUDJPY Market Levels

Resistance Levels: 97.130, 91.470

Support Levels: 87.960, 82.340

AUDJPY Long-Term Trend-Bearish

Before a price consolidation on the market pair. The bulls had previously traded the major market trend for a long time. The bulls activated their buying clause as the price began expanding from the 82.340 significant zone. An easy slash-through was seen on the daily chart at 87.960 percent. The buying activity didn’t just get engaged there alone, but the price eventually made its way up to the 97.130 key zone. However, before the price reached this level, a sell retracement caused by a lack of sell flow liquidity kept the price at 87.960.

As a result, the AUDJPY has remained in a ranging phase for some time. The sellers and buy traders continue to vary and displace price action at the moment. The RSI (Relative Strength Index) interprets the price signal as sellers continue to chip away at the market’s price action. We believe that a change in tide is inevitable, as the AUDJPY price is still consolidating.

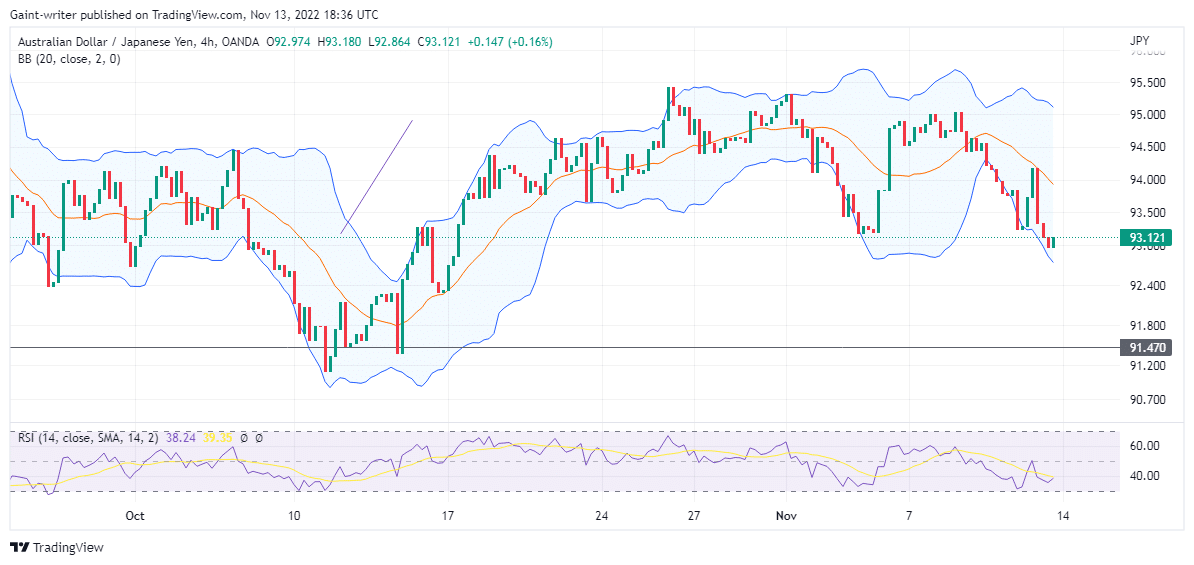

AUDJPY Short-Term Trend-Bearish

Despite ongoing selling, the 4-hour chart already shows buyer interest. The price is still set to push lower, but a change in price trend is also more plausible to take place soon. A reversal could be seen close to the 91.470 order block as sellers plan to drip lower.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.