AUDJPY Analysis- October 10

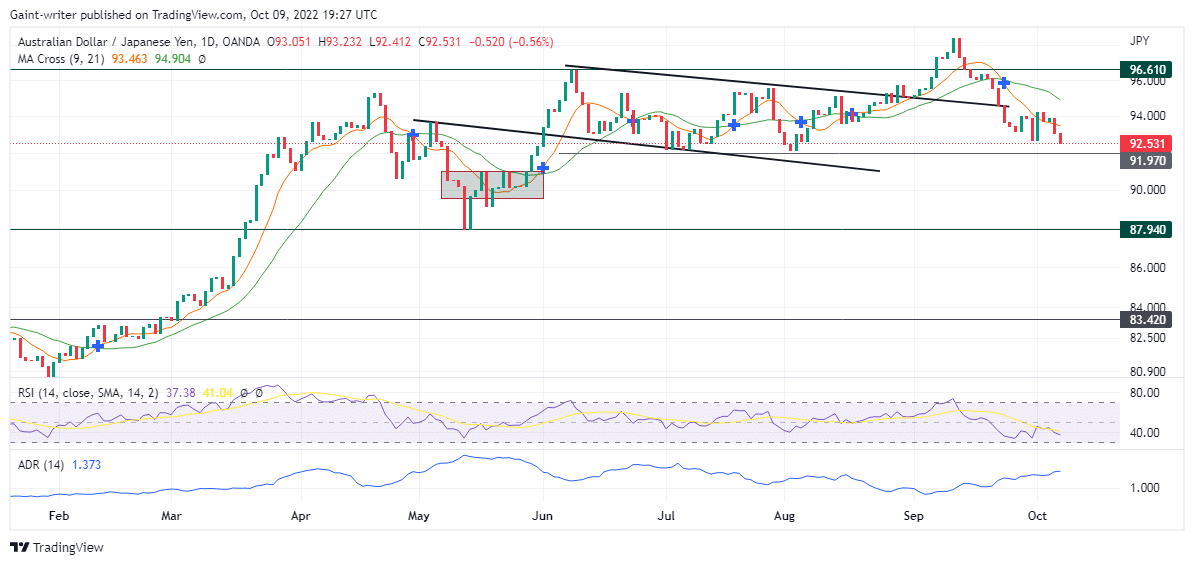

AUDJPY driving force is trading lower in the market, and the sellers are the ones in charge of the wheel. The bears are subjecting the price at the moment to a downtrend after going awry upon the price’s arrival at the 96.100 significant zone. The sellers are therefore aiming to cause price flow beyond the 91.970 significant zone as price focus is already beginning to shift towards a selling tendency. The daily chart shows the moving average participation of days 9 and 21 widening apart in the market. This implies that selling influence is yet to be exerted on the currency pair.

AUDJPY Key Zone

Resistance Zones: 96.610, 91.970

Support Zones: 87.940, 83.420

AUDJPY Long Term Trend: Bearish

The AUDJPY market tendency is currently inside the price range. The market has been trading consistently inside the range of prices for about 5 months now. We get to see the bulls attempting to break out but eventually being shifted southward by the sellers. The bulls were previously strong contenders as price value rose from about 83.420 keg level up to 96.610 in the space of three months. Price consolidation, currently ongoing, shows that the currency pair is still indecisive as regards its direction of flow.

The sellers are still showing signs of dominance currently in the market. The price strength continues to increase as the sellers place more orders at a higher price. The Relative Strengths Index is also trending lower as sellers are making more attempts to drive prices lower on the daily chart. More selling force should be anticipated on the selling side at the moment.

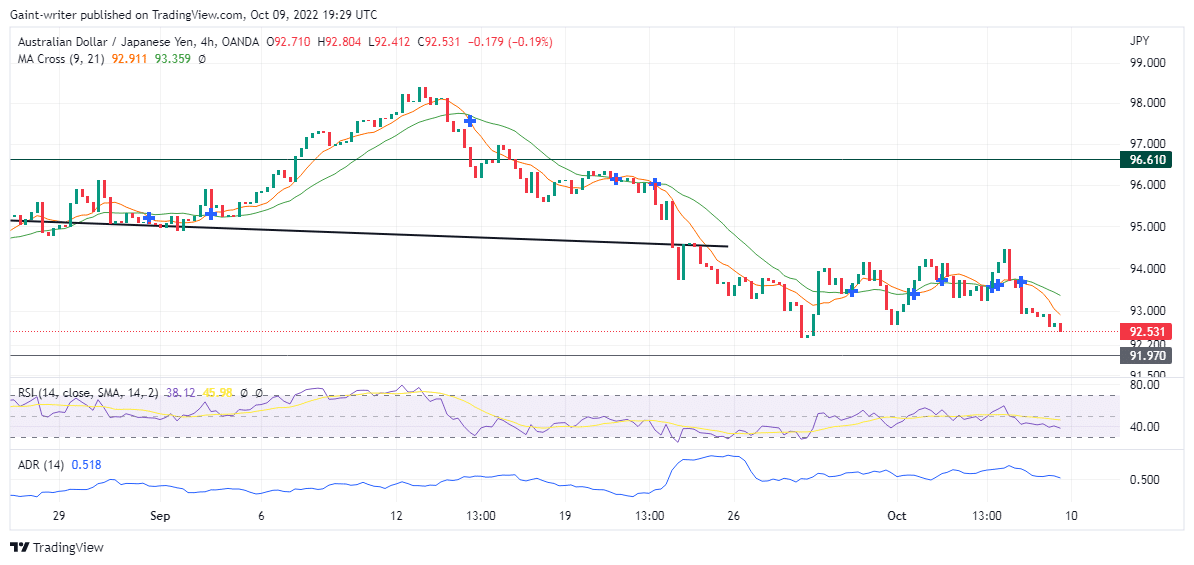

AUDJPY Short Term Trend: Bearish

The sellers are causing the prices to consolidate in an attempt to make the price activity fall. The buyers are also toiling with prices at this moment on the 4hr chart. However, the selling impact is still having the upper hand on the market as the RSI shows the price is still declining till the price trades down to the 91.970 key zone.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.