Meanwhile, the Australian Dollar (AUD) has been one of the major underperformers, and not just as a result of the USD Price action, but also as a result of the repricing in the Reserve Bank of Australia (RBA), ahead of its October 6 meeting.

Dovish comments from RBA Deputy Governor Debelle about exploring several monetary options disposed to the bank has sparked worries that the cash rate could be lowered by 10 base-points, alongside a cut-down in the 3-year yield curve target. As a result, several traders have now set their focus on the 1.0700 psychological area.

Furthermore, the RBA is set to ease its monetary policy, while the Reserve Bank of New Zealand (RBNZ) remains unchanged for the time being. A relaxation in both the RBA and RBNZ monetary policies, ahead of the October RBA meeting, could put the AUD/NZD in a very precarious situation and could open the pair up to the 1.0600 support.

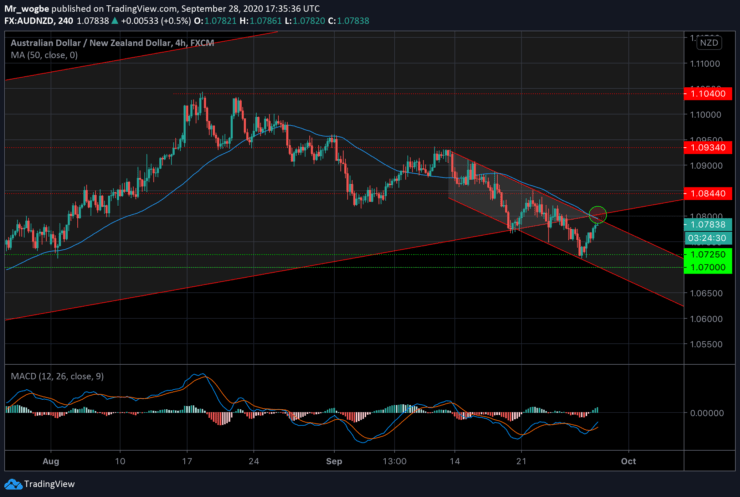

AUD/NZD Value Forecast — September 28

AUD/NZD Major Bias: Bearish

Supply Levels: 1.0800, 1.0844, and 1.0934

Demand Levels: 1.0725, 1.0700, and 1.0664

The AUD/NZD appears to be charging towards the 1.0800 resistance following an easing in the greenback’s bullishness. However, this rally might not last considering the confluence of resistance at the 1.0800 level. Meanwhile, a bearish channel has emerged on our 4-hour chart, indicating that this corrective move in the AUD/NZD might come to an end soon.

That said, it would be interesting to see how this pair reacts with that level in the near-term.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.