AUD/JPY has decreased a little in the short term after escaping from a major range. It has come back down to test and retest the immediate support levels before jumping higher again.

The Japanese Yen was strong in the short term only because the Nikkei (JP225) dropped. Still, the Japanese stock index maintains a bullish outlook despite yesterday’s sell-off.

JP225’s growth should force the Yen to depreciate versus its rivals.

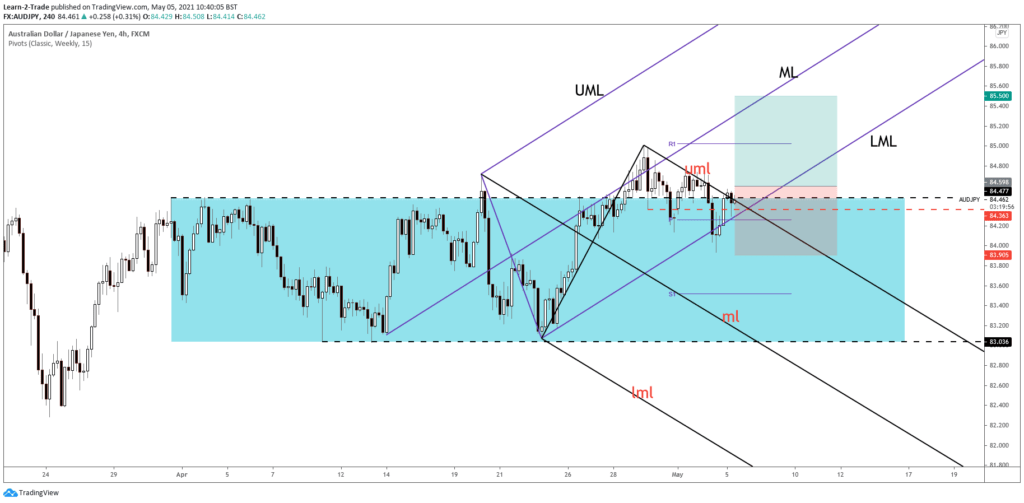

AUD/JPY H4 Chart Technical Analysis

AUD/JPY is traded back near 84.477 static resistance after failing to stabilize below the weekly pivot (84.261). It has only registered a false breakdown through the ascending pitchfork’s lower median line (LML).

Now is pressuring also the upper median line (uml) of the descending pitchfork. A valid breakout above this line and a new higher high, a bullish closure above 84.569, could signal a further growth at least towards the weekly R1 (85.025).

Conclusion!

AUD/JPY may resume its growth if it manages to stabilize above 84.477 range resistance. The bias remains bullish as long as the rate is located within the ascending pitchfork’s body.

The median line (ML) is seen as an upside target if the price continues to increase. The upside scenario could be invalidated by a new drop below the weekly pivot of 84.261.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.