On Friday, the Australian dollar (AUD) and New Zealand dollar (NZD) maintained significant weekly gains as the sharp decline in Treasury rates hurt their American counterparts and indications of a loosening of China’s zero COVID policy raised risk sentiment.

AUD and NZD Tap Monthly Peak Against Weakening USD

The Australian dollar, which yesterday hit a three-month high of $0.6847, was resting at $0.6815 at press time. As a result, it ended the day 0.9% firmer for the week and 6.1% higher for the month of November as a whole.

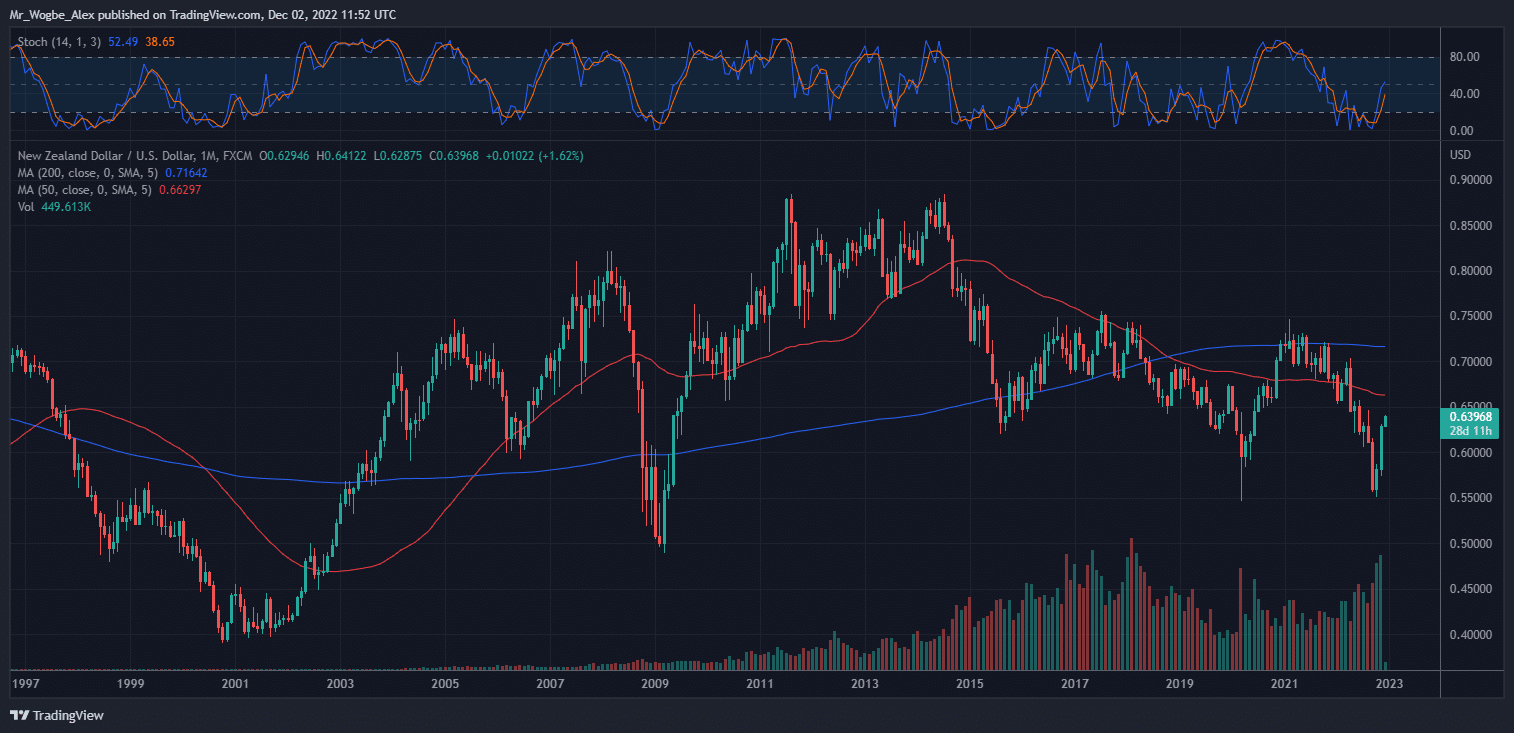

Likewise, after reaching a four-month high of $0.6400, the kiwi was up at $0.6375 against the dollar (USD).

Meanwhile, Australian 10-year interest rates (AU10Y) have fallen 18 basis points to 3.409%, the lowest level since mid-August, indicating that bonds have also had a tremendous week. The price of three-year bond futures (YTTc1) has increased by 24 points as markets have priced in lower cash rate peaks in the US and at home.

There was even speculation that the Reserve Bank of Australia (RBA), in response to an unexpectedly low figure on monthly inflation, may suspend its tightening program the following week.

Futures are still favoring a quarter-point increase to 3.1%, but it is much more uncertain now than it was a week ago.

Commenting on the possible RBA move, David Plank, the head of Australian economics at ANZ, said:

“We do think a December pause will be considered, but with the RBA not meeting again until February and the recent wages and employment data being robust, we expect the cash rate target to be lifted by 25 bps.”

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.