Wall Street veteran, Ned Davis, lent a voice to the increasing worries over the bubble, citing the rate at which the index was advancing and the soaring share volume as evidence. Meanwhile, the NDX dropped by 2.8% on Thursday, erasing all its gains for the week.

In other news, Tesla (NASDAQ: TSLA) Inc., reported better-than-expected earnings for the fourth consecutive quarter, snapping a hurdle that could cause the electric carmaker to be included in the S&P 500 Index.

Also, Twitter (TWTR) Inc. rose by 6% after a goodish yearly growth of daily users report, despite recent sinking ad sales.

However, of major concern to bulls was the drop in Microsoft (NASDAQ: MSFT) Corp., which dropped by 1.6% as its flagship cloud computing business Azure reported quarterly sales growth below 50% for the first time.

The largest internet and software companies—gathered under the Fang umbrella—has now dropped for several sessions in a row, recording a 4.6% loss since March.

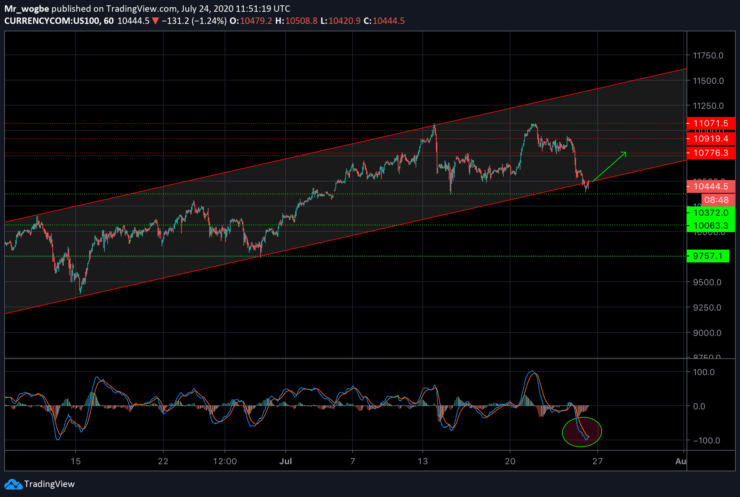

Nasdaq 100 (NDX) Value Forecast — July 24

NDX Major Bias: Bullish

Supply Levels: 10776.3, 10919.4, and 11071.5

Demand Levels: 10372.0, 10063.3, and 9757.1

Although the NDX has been on a bearish streak for some days now, it appears to have found strong support at the 10372.0 level. The NDX is expected to move back into the range of our ascending channel, with the 10776.3 being the immediate target. This bullish move seems even more likely considering that we are now treading in oversold conditions.

On the flip side, a sustained move below the immediate support could open the NDX up to see the 10000.0 level once again.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.