S&P 500 Price Analysis – February 11

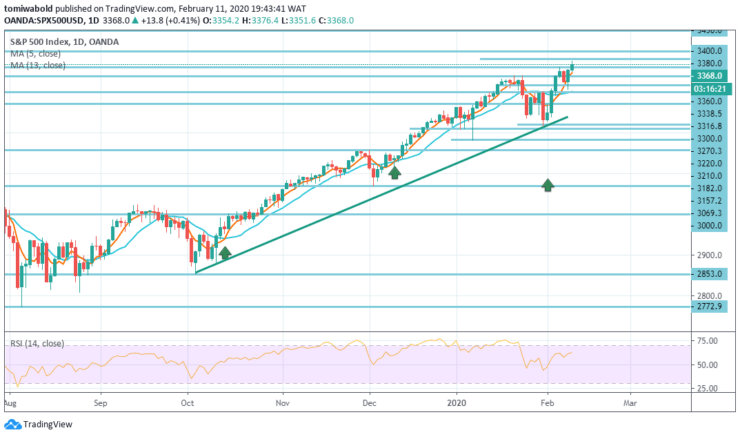

S & P 500 rose significantly during the trading session on Tuesday, breaking above 3360 levels as the market is at a record high, and it shows no signs of a return of these gains.

Key Levels

Resistance Levels: 3450, 3400, 3380

Support Levels: 3338.5, 3300, 3270.3

S&P 500 Long term Trend: Bullish

S & P broke through the 3360 levels in an endless bullish trend to reach the 3370/3400 level in the near term, and possibly to 3478/80 levels this week.

Failure to stay past the 3360 level risks slipping back to 3338 levels, and possibly to 3316 levels while the decline is expected to be contained, but beneath the 3338 risks farther to the 3316/3300 levels.

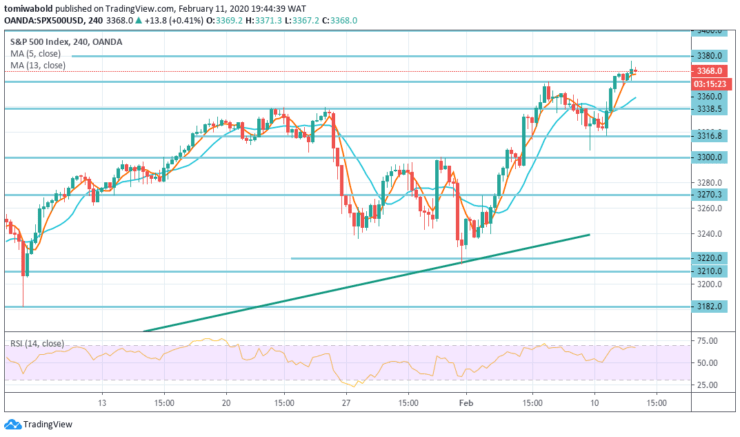

S&P 500 Short term Trend: Bullish

On the other hand, there is the likelihood of some type of rollback to get a little support, and the look at the recovery continues from there. The moving averages 5 and 13 are floating directly along with the trendline, thereby giving ample chance to finding buyers below.

Besides, unless something fundamental is altered, it is hard to imagine that the stock market could fall apart. Rollback to the levels of 3300 or again to the trend line, since value prepositions, nevertheless, at the moment, major bears are almost impossible.

Instrument: S&P 500

Order: Buy

Entry price: 3360

Stop: 3338

Target: 3400

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.