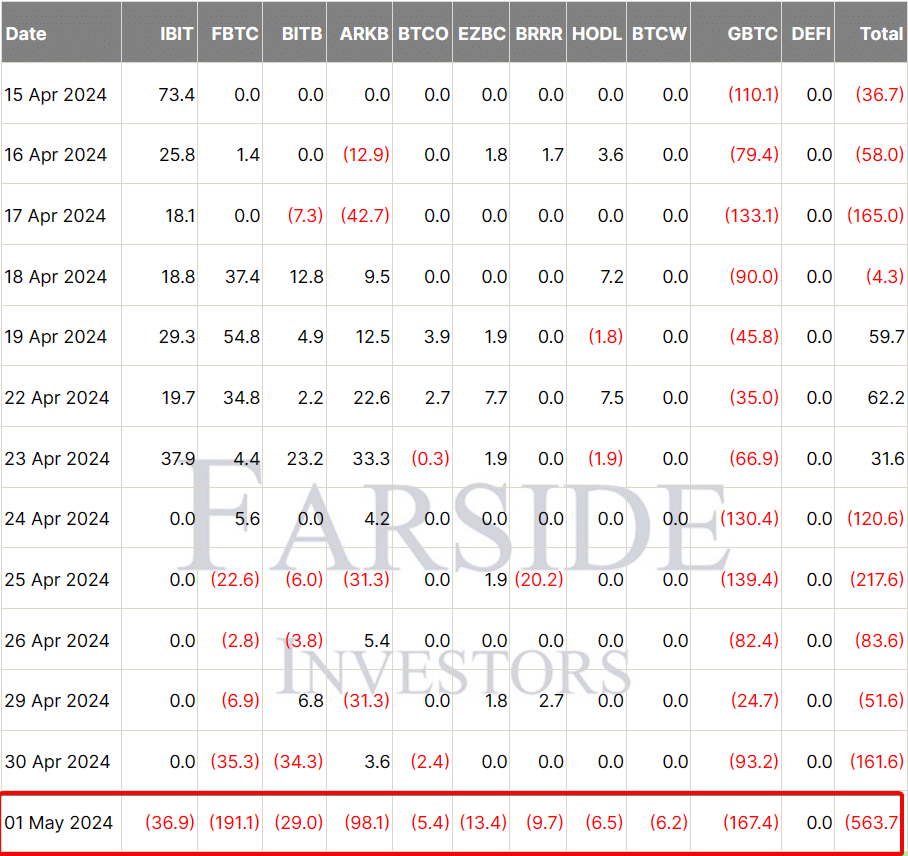

Bitcoin exchange-traded funds (ETFs) in the United States faced an unexpected wave of selling this Wednesday, with investors pulling out a staggering $563.7 million from 11 ETFs, marking the largest outflow since their inception on January 11. This comes despite Federal Reserve Chairman Jerome Powell’s recent comments dismissing immediate interest rate hikes.

All Bitcoin ETFs in the U.S. Recorded Outflows on May 1

The sell-off is part of a broader trend over the past five days, with total outflows from these ETFs reaching nearly $1.2 billion since April 24, according to data from Farside Investors. Even BlackRock’s iShares Bitcoin Trust (IBIT) saw outflows for the first time, with $36.9 million exiting the fund.

So, iShares Bitcoin ETF has first day of outflows ($37mil)…

Has taken in $15+bil ytd.

For perspective, iShares Gold ETF has $1bil *outflows* this yr.

SPDR Gold ETF has $3bil outflows.

And gold is up 16% ytd.

This is what ETFs do. Inflows don’t go up in straight line.

— Nate Geraci (@NateGeraci) May 2, 2024

The largest withdrawal was seen from Fidelity’s FBTC, which experienced $191.1 million in outflows. This change in sentiment is significant, considering both FBTC and IBIT had previously been receiving consistent inflows in the first quarter, counterbalancing the substantial outflows from the more expensive Grayscale ETF (GBTC).

GBTC itself experienced the second-largest outflow at $167.4 million, followed by ARKB and IBIT at $98.1 million and $36.9 million, respectively. These outflows occurred despite Powell’s generally dovish stance, which typically supports risk assets like Bitcoin by prioritizing economic growth over stringent liquidity measures.

Updates from the FOMC Meeting

During a press conference, Powell emphasized the strength of the economy, pushing back against concerns of imminent rate hikes or liquidity tightening due to recent inflation data. Additionally, the Federal Reserve announced a significant reduction in its quantitative tightening (QT) program starting in June, while the U.S. Treasury initiated a debt buyback program for the first time in over two decades to boost liquidity in the bond market.

Bitcoin, along with other risk assets, is known to be sensitive to liquidity expectations. Following Powell’s comments, Bitcoin briefly surged from $56,500 to $59,397. This was accompanied by a decrease in yields on 10- and two-year Treasury notes, as well as a dip in the dollar index.

Despite the recent surge, overall sentiment toward spot Bitcoin ETFs seems to have soured, with net outflows totaling $343.5 million in April, halting a three-month streak of inflows. GBTC led the outflows in April, with a significant $2.5 billion leaving the ETF.

This shift in investor behavior highlights the market’s response to changing economic indicators and Federal Reserve policies, suggesting a potential evolution in the cryptocurrency investment landscape.

Want reliable crypto signals to capitalize on market swings? Join us on Telegram.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.