Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

From one bullish session to another, the Akash Network market continues to record upside progress. As of the time of writing, the token has achieved a price growth of 5.09%. This performance underscores sustained bullish sentiment, and given the current technical posture of the market, it appears that further progress could be recorded in the sessions ahead.

AKT Market Statistics

Current Price: $1.4021

Market Capitalization: $349.18M

Circulating Supply: 248.28M

Total Supply: 248.28M

CoinMarketCap Rank: 154

Key Price Levels

Resistance: $1.500, $1.750, $2.000

Support: $1.250, $1.000, $0.7500

Akash Network Heads Toward $1.600

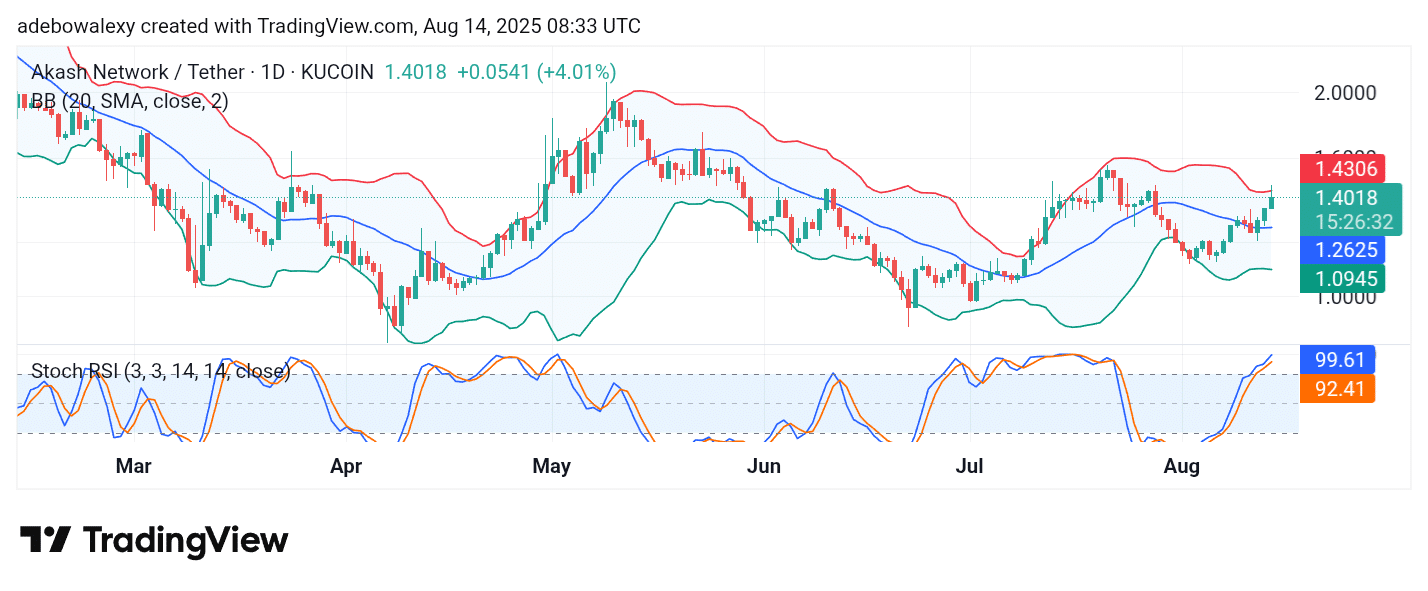

Examining the daily chart, the AKT token has maintained a clear bullish trajectory since the previous session. In the ongoing session, price action tested the uppermost band of the Bollinger Bands (BB) indicator, signaling strong upward pressure. The corresponding price candle features an upper shadow, revealing that intraday pullbacks have occurred during the trading session.

Meanwhile, the Stochastic Relative Strength Index (SRSI) lines have advanced firmly into the overbought region, with their terminals retaining a straight upward slope. This technical posture hints at the likelihood of continued upward movement, as strong buying momentum remains present despite minor retracements.

The Nature of AKT Pullback Sees Expression

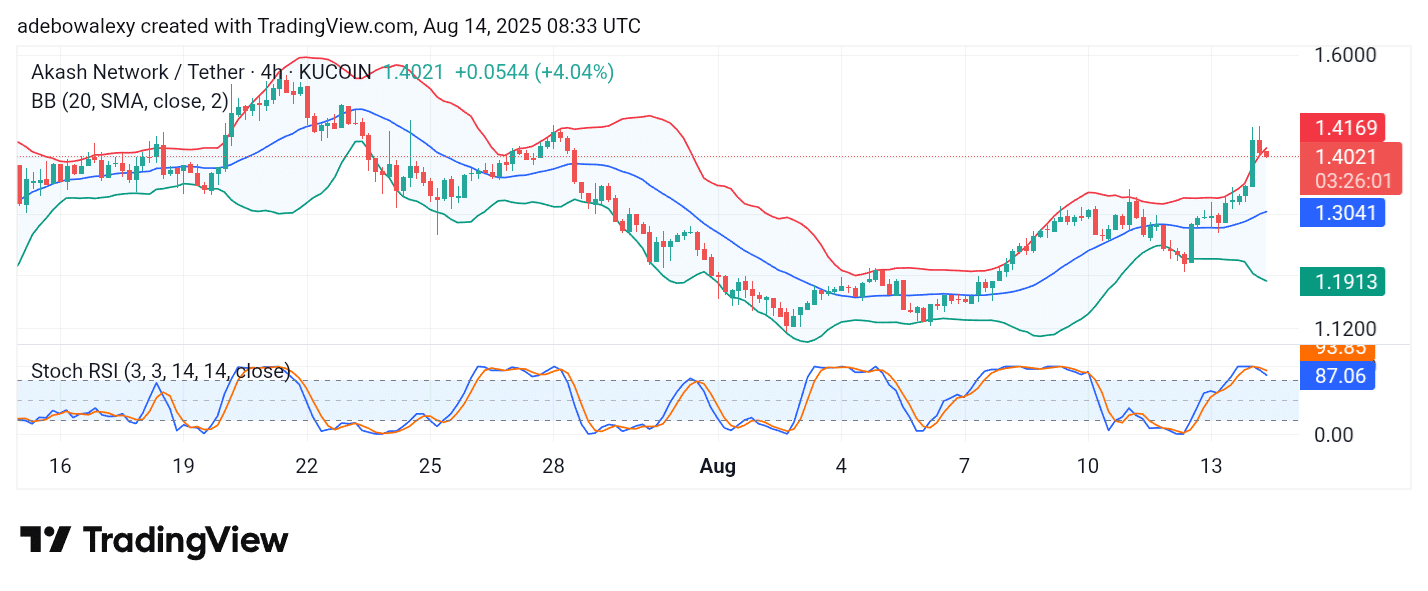

Shifting focus to the 4-hour chart, price action shows a modest retreat toward the uppermost band of the BB indicator. The past two sessions saw notable gains, driving price action beyond the BB’s upper band. However, the last two candles on this chart are bearish, initiating a short-term correction. Even so, price remains closely aligned with the upper band, indicating that bullish sentiment has not been significantly weakened.

Simultaneously, the SRSI lines have begun to turn downward, moving toward the 80 threshold. This development suggests some cooling of momentum, possibly reflecting short-term profit-taking after recent gains. Nevertheless, the market remains elevated above significant support levels, and as such, there is still a strong prospect for price to challenge the $1.600 resistance level in the near term, provided bullish forces regain dominance quickly.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.