S&P 500 Price Analysis – July 28

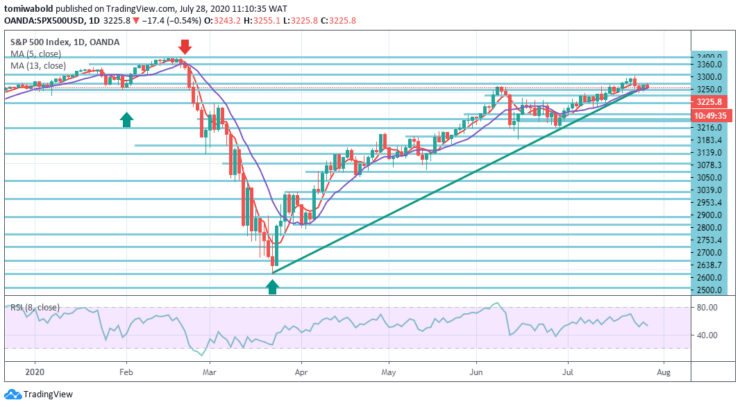

S&P 500 Futures rise 0.35 percent during early Tuesday picking up bids close to 3249 levels. After once again faced rejection at 3250 levels, the S&P 500 has reached a consolidation trading period beyond 3200 levels, anticipating fresh support from US stimulus negotiations, optimism on global stocks, and the Fed decision.

Key Levels

Resistance Levels: 3400, 3360, 3300

Support levels: 3216, 3183, 3139

The S&P 500 faced opposition at level 3250 and further out is the next weekly hurdle restricting upside around level 3300. The bulls are prone to incur a few minor hurdles on the upside path. Potent support may threaten the interaction of the bears at 3216 levels.

To the drawback, the support cluster is positioned around 3216 levels, high from the previous month’s convergence. Upon a breach beneath the latter, the support may be tested at level 3186, which is the confluence of the moving average of 13 and ascending trendline support.

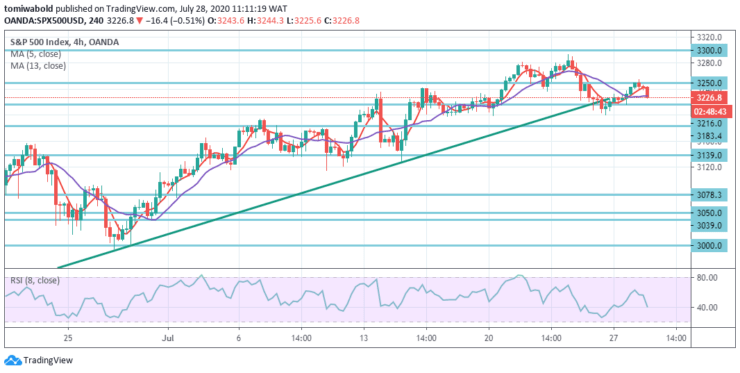

The technical analysis context of the S&P 500 index lies currently in a very fascinating zone on the 4-hour time frame. It would be bullish to breach back beyond 3250 levels but a breach at the 3300 levels at the horizontal resistance line would hold the uptrend stable.

Taking a look at the indicators in the prior session, as they took a bullish shift forward. The relative strength edged beyond 50, though decreasing. Both the moving average 5 and 13 have turned to the positive side and maybe near a crossover past the 3250 levels.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.