USDWTI Price Analysis – January 16

WTI (oil futures) is changing intraday while trading moderately from Europe into the American trading session, recently meeting fresh supplies after the International Energy Agency (IEA) released a bearish monthly report on the oil market thrashing investors’ bias.

Key Levels

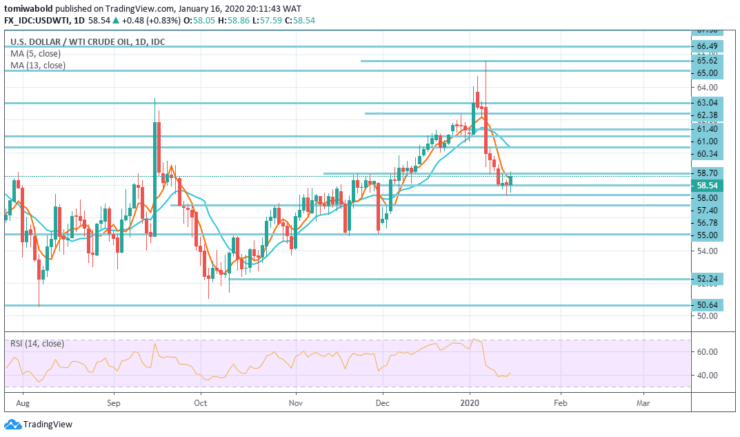

Resistance Levels: $ 63.04, $ 60.34, $ 58.70

Support Levels: $ 57.40, $ 56.78, $ 55.00

USDWTI Long term Trend: Ranging

The recent data released had a muted impact on WTI oil, but the decline in WTI from the level of 65.62 continues and still reaches the low at 57.40 level.

The trend remains unchanged and the plunge is viewed as part of the sideways trading, which began from the level at 66.49. As long as the resistance level of 60.34 holds, we anticipate a further plunge to the support level of 50.64.

USDWTI Short term Trend: Bearish

In the short term, WTI crude oil rebounded on Thursday after an unsuccessful attempt to clear the horizontal support zone on the level at $ 57.40. The initial reversal signal is generated on the 4-hour time frame after the price action of the last two days ended with a successive advance.

The new preliminary test of the initial resistance level at $ 58.70, while the lowest requirement for confirming the reversal is expansion through horizontal barriers on the level at $ 60.34 and ( both psychological zone at $ 65.62 / $ 57.40). The failure to break may signal a prolonged consolidation and may remain vulnerable to a downward movement, while a break beneath may lead to a negative signal.

Instrument: USDWTI

Order: Buy

Entry price: $ 58.00

Stop: $ 57.40

Target: $ 61.40

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.