AUDUSD Price Analysis – June 4

The AUDUSD pair stayed on the guard during Thursday’s European session and was last seen trading close to the lower range of its daily trading, just below the 0.6938 marks. Fears over a yet more confrontation in US-China conflicts have kept a shield on the latest positivity about the coronavirus pandemic’s global economic recovery.

Key Levels

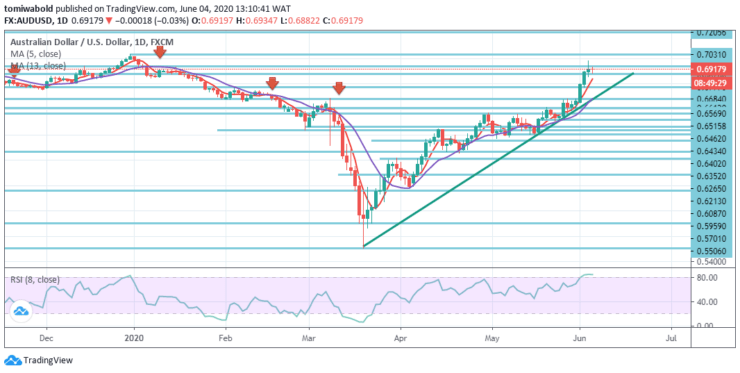

Resistance Levels: 0.7205, 0.7031, 0.6938

Support Levels: 0.6770, 0.6402, 0.5906

The RSI, as seen on the daily, is in the overbought zone and suggests a possible short-term downside correction. In the situation the pair moves higher, the bulls are likely to beat the prior height of 0.7031 level, recorded as a barrier last year-end. A higher break may take a breath within level 0.7205.

Conversely, a downward shift may further push the market to the 0.6800 handles before the actual 0.6777 support level, so sellers can put more emphasis on overbought RSI conditions to revisit the late-January lows close to 6684 levels.

Overall, after the significant rebound off the 171⁄2-year low level of 0.5506 on March 19 as seen on the daily, AUDUSD has been in a bullish mood. The short-term bias is positive and any rising push beyond yesterday’s high may first change the bearish mode to be neutral in the medium to long term.

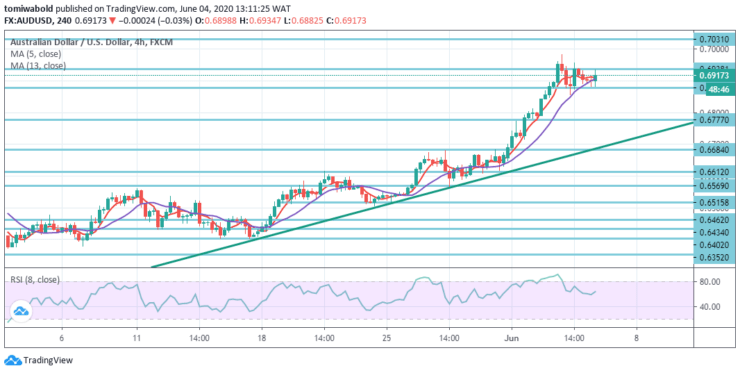

The exchange rate is currently trading at 0.6878 level near a support level established by a horizontal line. If the level of support continues to hold, bullish traders within this session may try to force the price higher. Nevertheless, if the currency exchange rate breaches the horizontal support line, this week a fall toward the level of 0.6770 may be anticipated.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.