Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

The AAVEUSDT market has been performing fairly well based on its price activity. Despite this, the token faced a rejection in today’s trading activity. Nevertheless, upside forces seem to maintain control of price movement in the market.

Aave Statistics:

Current AAVE Price: $149.77

AAVE Market Cap: $2,250,605,405

Aave Circulating Supply: 14,929,572

AAVE Total Supply: 16,000,000

Aave CoinMarketCap Rank: 35

Key Price Levels:

Resistance: $155.00, $160.00, $165.00

Support: $150.00, $145.00, $140.00

AAVEUSDT Price Action Stays Bullishly Biased

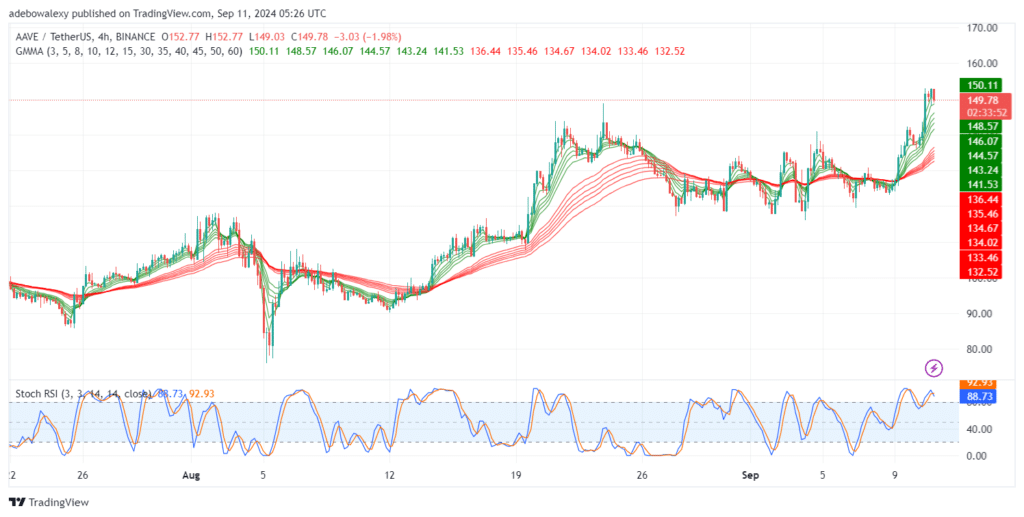

AAVEUSDT price activity has been making higher highs for about two months. Also, price volatility has been healthy enough to rapidly propel the market through more elevated price levels. The market witnessed strong bullish activity over the past two sessions, which pushed its price to a multi-month high.

At this point, the market has experienced what may be termed a minor retracement, as trading activity continues above all the Guppy Multiple Moving Average (GMMA) lines. Additionally, the Stochastic Relative Strength Index (Stochastic RSI) lines are still rising without reflecting any deflection.

Aave Bulls May Relent

Zooming in further on the AAVEUSDT market, price activity may descend lower. The last price candle placed the market below one green GMMA line. Simultaneously, the Stochastic RSI indicator lines have shown a bearish crossover in the overbought region. However, the lines of this indicator remain above the 80 mark on the Stochastic RSI indicator.

Should bearish sentiment persist, this will push the market below more GMMA lines, further strengthening the bears. However, traders may still use bullish crypto signals, as bulls have enough recovery time to regain control by staging a rebound above the $146.00 price level and refocusing the $154.00 threshold. Otherwise, the market may plunge lower.

Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.