In this light, it seemed as if investors had gotten at ease in taking the risk, thereby undermining the safe-haven currencies, Japanese Yen and Swiss dollar.

For more than five weeks, the positivity loomed around the US dollar and it rose up against a basket of currencies.

Events took a turn when the US revealed that it wasn’t removing certain tariffs, thereby spurring up uncertainty as investors weren’t sure when the preliminary phase deal will be signed.

Investors Seek Solace in Safe-Haven Currencies

Investors were therefore prompted to take solace in safe-haven currency, Japanese yen as it rose up as against the previous week of 108.785 versus the dollar.

The yen also seemed to have been propped up by the unrest in Hongkong and also unfavorable economic stats from the Eurozone and China.

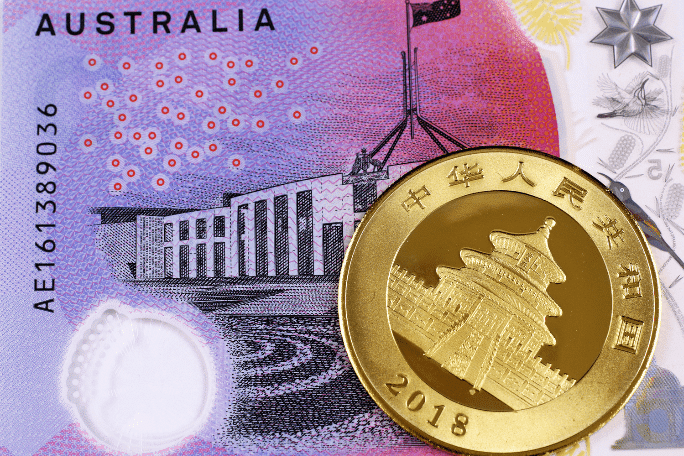

Last week, economic stats released saw China record a lower industrial production, lower GDP figures for Japan and Germany while Australia’s employment figures slipped by close to 19,000 as against an increase forecasted, being the largest drop recorded since 2016. Bearish sentiments also forced the Australian government bond yield spanning over ten years to record a week low.

Aussie closed the previous week down at 0 .6821 versus the dollar, standing at a negative of 0.56%. The speculation that the reserve bank of Australia might embark on an interest rate reduction due to the employment stats also undermined the AUD.

On the other end, NZD experienced a bounce as the reserve bank of new Zealand held steady its interest rate at a percent. Analysts had forecasted a reduction in the OCR (official cash rate).

The NZD closed the previous week at 0.6402 versus the dollar with a market gain of 1.19%. RBNZ’s stance came as a surprise to investors as the apex bank now presented an attractive growth outlook. Speculations are high for a likely interest rate cut in February or May. The RBNZ also mentioned that it may pump more liquidity into the economy if necessary.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.