Meanwhile, the yellow metal appears to have snapped its three-day losing consecutive streak and stalled the recent drastic corrective slide from its recent all-time high of $2,075 set on the 7th of August.

The US dollar, however, has lost its bullish traction in the meantime, which appears to be one of the major factors aiding the dollar-denominated commodity’s recovery from the aggressive correction. Despite the renewed optimism over a US economic recovery, the political stalemate over the next round of fiscal stimulus packages has capped the early USD strength.

In other news, the global risk sentiment remained strongly supported by the recent development surrounding a potential vaccine for the highly infectious Coronavirus disease. This could cause investors to tone down their bullishness and remain on the sidelines, which will invariably cap further gains for the yellow metal in the near-term.

Moving on, market participants will be looking at the US economic docket today—which features the Consumer Inflation data for July—for clues. This data release is expected to pump-in a little volatility in the gold market during the North American session.

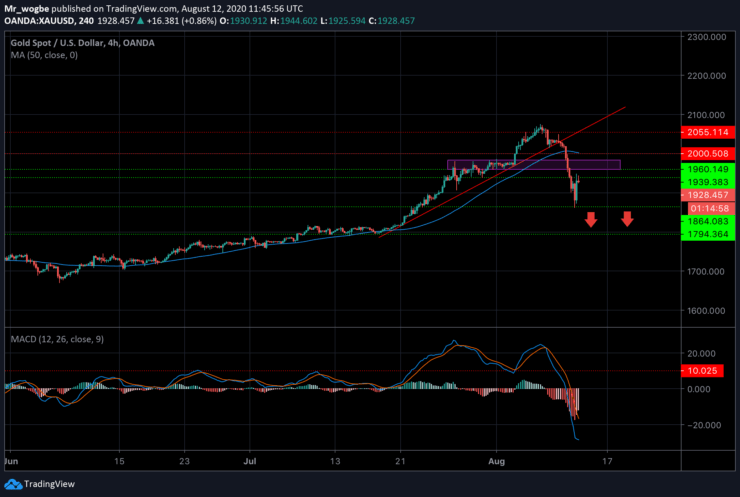

Gold (XAU) Value Forecast — August 12

XAU/USD Major Bias: Sideways

Supply Levels: $1,960, $1,983, and $2,000

Demand Levels: $1,900, $1,864, and $1,840

Gold has now spiraled into an aggressive correction mode. However, it appears to have found some support at the $1,864 mark and has entered a consolidation phase. It remains unclear if this consolidation will hold and the worse of the correction is over.

Meanwhile, the $1,983-60 region will serve as a strong technical determinant of what gold will likely do next. That said, further correction is not off the table and we could see the $1,864 support again.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.