Buyers are opposing sellers at $7.8 zone

Uniswap Price Analysis – 20 February

If buying pressure increases around $9.5 again, it can break through resistance levels and hit the $10.2 to $12.0 levels in Uniswap market. Sellers might attempt to reevaluate the $7.8 and $6.8 levels if they can break through the $8.8 support level.

UNI/USD Market

Key Levels:

Resistance levels: $9.5, $10.2, $12.0

Support levels: $8.8, $7.8, $6.8

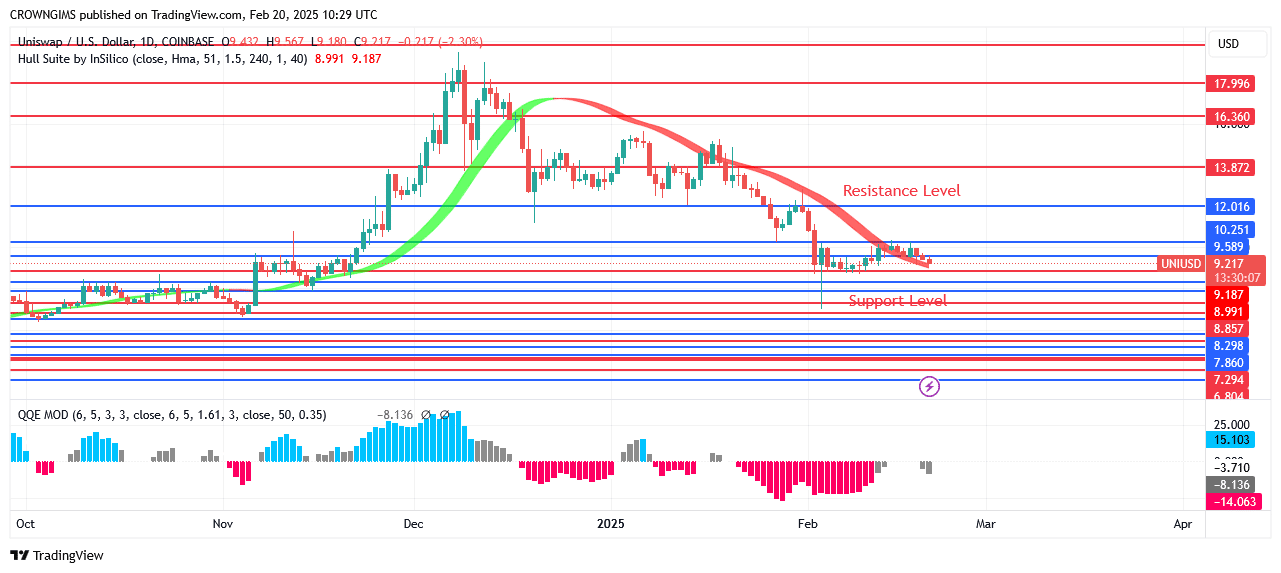

UNI/USD Long-term Trend: Bearish

The Uniswap daily chart makes the “Double Top” bearish reversal indicator quite evident. On December 8, it was forecast that the currency would surge above the $18.0 resistance level and drop to the $13.8 support level. When the price dropped below $12.0, the bears held onto their market. The price of Uniswap has decreased to roughly $9.5 in recent weeks. It subsequently began to decline and tested the support level of $8.8. On December 9, it was removed and reexamined in the $12.0 area. For the past two weeks, customers have been adhering to the prior suggestions, and the cost has decreased to roughly $8.8.

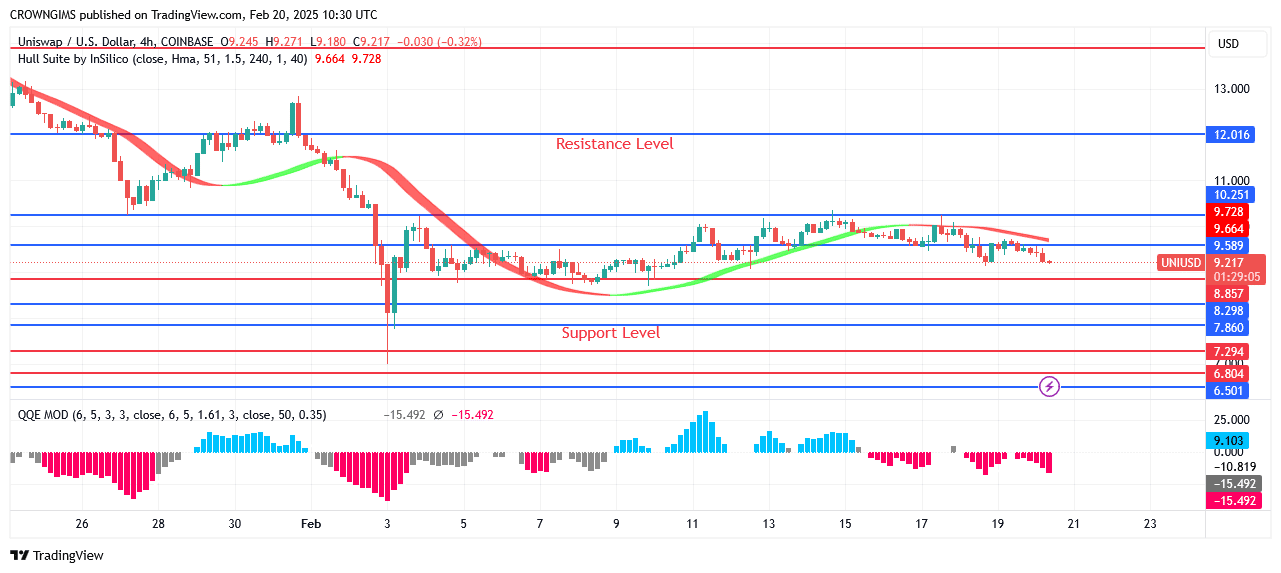

UNI/USD Medium-term Trend: Bearish

Uniswap’s 4-hour chart indicates a declining trend. As soon as the purchasers reached the $16.3 mark, price reductions started. After the big project was finished a few days ago, prices fell to $10.2. When sellers increased the pressure on their market, this is what transpired. Prices dropped to the predetermined level as selling became more apprehensive; the Uniswap followed the bears’ lead and dropped to $8.8.

Right now, the price is below the dynamic support level. At Uniswap, the market is unpredictable. A negative QQE MOD signal histogram indicates a selling position.

Start using a world-class auto trading solution

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.