Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

As choppy as the 1INCH/USD market seems to be, prices in this market have moved by more than 5% today. Yet the market seems highly unstable, and traders need to take extreme caution. Let’s take a closer look at price developments in this market.

1INCH Analysis Data:

1INCH Value Now: $0.490

1inch Market Cap: $480 million

1INCH Moving Supply: 834 million

1inch Total Supply: 1.5 billion

1INCH CoinMarketCap Ranking: #87

Major Price Levels:

Top: $0.490, $0.500, and $0.550

Base: $0.470, $0.440, and $0.400

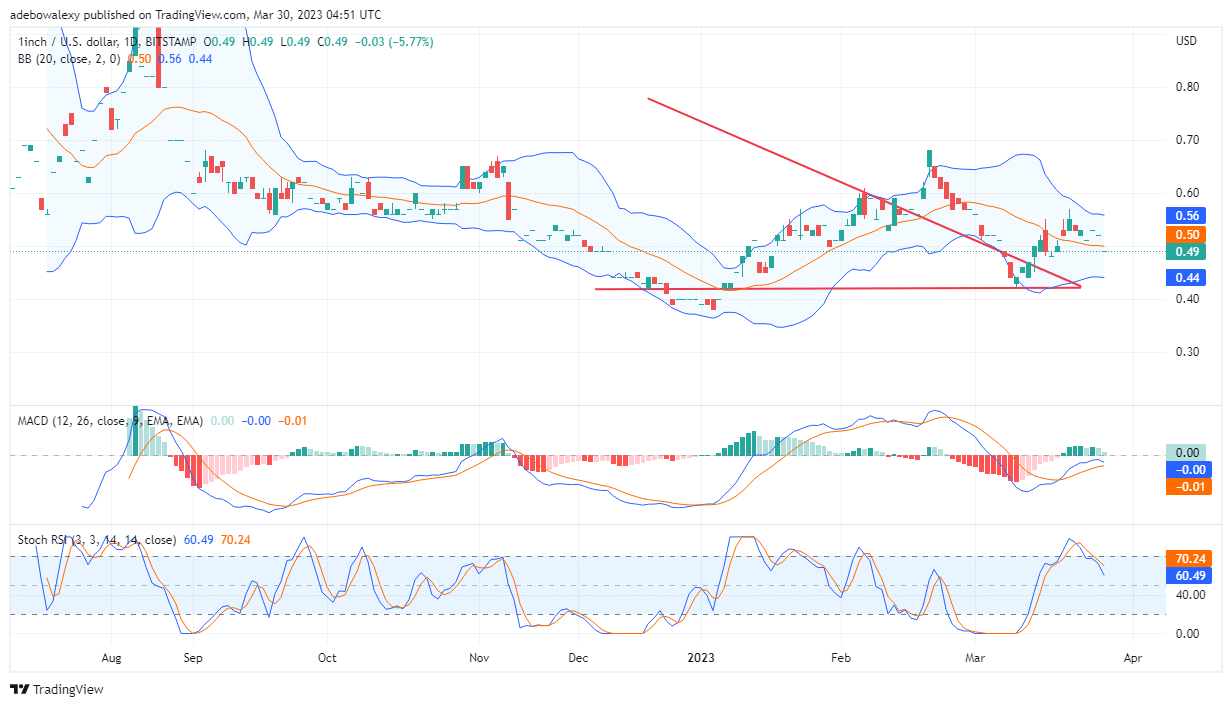

1INCH/USD Price Movements Retain Downside Propensity

The 1INCH/USDT price action on the daily chart looks very unpredictable. Despite the price movements as stated above, price action remains a bit below the middle band of the applied Bollinger Bands indicator. Also, the Relative Strength Index (RSI) lines are now plunging downward and toward the oversold area. Likewise, the Moving Average Convergence Divergence (MACD) indicator is also revealing that the headwind is strong in this market. It could be seen that the MACD curves are coming together for a crossover above the equilibrium level, which implies that it will be a bullish crossover. Therefore, the price may drop.

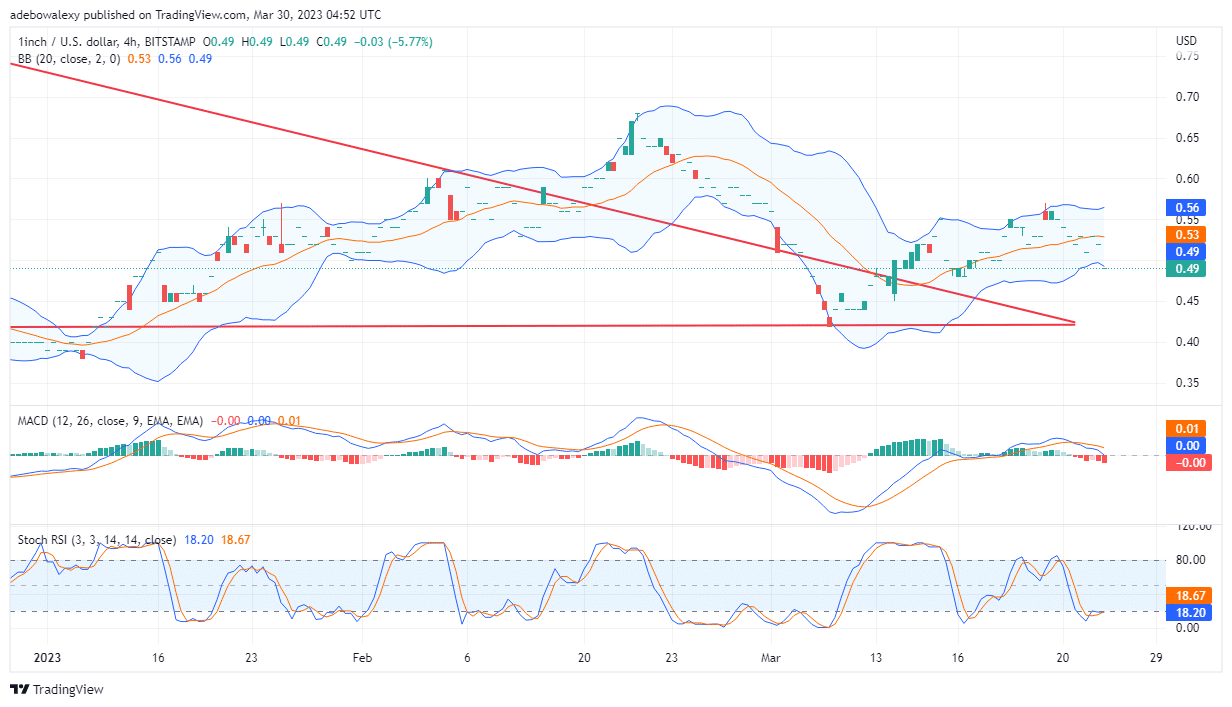

1INCH/USD Price Movements Stay Vulnerable

Even on the 4-hour market, 1INCH/USD price action remains vulnerable. The latest dash price candle can be seen appearing significantly below the previous one and under the lowest limit of the Bollinger Bands. Meanwhile, the MACD curves have fallen closer to the 0.00 level, with the leading line testing the equilibrium level. Also, the RSI curves can be seen deep in the oversold region. Additionally, it appears that these curves are about to perform a bearish crossover there as well. Consequently, it appears that the bear may gain more momentum over the bulls, and the price may fall toward $0.450.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.