What are interest rates?

How often have you heard the term interest rates? Thousands of times I bet, depending on how long you have been in this business. Our team has mentioned it many times in our daily updates and weekly analysis and have several articles about the central banks, who affect these rates. We have a forex strategy as well about interest rates. But, let’s take a deeper look into the interest rates, what they are, and how they affect the forex market.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Normally, when ordinary people hear about interest rates, they instinctively think about the annual percentage of the mortgage or loan that they pay the bank in return for using the bank’s money to finance the purchase of their home – and that’s correct. An interest rate is basically the annual percentage that you have to pay back to the lender for the money you have borrowed.

Let´s say, you took a $100,000 mortgage to buy a house. Interest rates are calculated and expressed annually, so with a 4% interest rate, you´d pay $4,000 a year to the lender in addition to the principal, which is the $100,000 mortgage. If you had a 20-year mortgage then you´d pay an additional $80,000 to the bank.

But that’s not exactly what the forex jargon refers to when we mention interest rates. They are calculated in the same way but, the interest rate in forex is the rate that the second-level banks would pay a central bank to use its money. The central banks lend money to the second-level banks and for this, they have to pay interest. This is the interest rate that we refer to in forex.

Who controls the interest rates and why they move?

However, there’s another interest rate in forex. Besides borrowing money, the second-level banks and other depository institutions place their extra cash at the central bank as the safest place to keep it. For this, they receive interest in return. In this article, we will focus on the former rate, known as the main interest rate

If you want to trade the interest rates you have to understand them

Since the central bank decides to move the rates up or down, it is the central bank that sets the rates. But, it doesn’t act as a solid body. The central banks are made up of several members, all of whom vote to hike or cut the interest rates at every official meeting. The number of members depends on the bank; the Bank of England (BOE) has nine members, the Federal Reserve (FED) 12 members and the European Central Bank (ECB) consists of 25 board members. The economy has also taken high priority in the last decades when it comes to the monetary policy of the central banks.

How the interest rates affect fx trading

We are in the forex business and we are all interested in why and how the central bank’s actions affect the forex market. But it’s not that difficult to understand. The lower the interest rate, the less willing the second-level banks are to keep money deposited at the central bank, therefore, the more money in circulation. We know that money is a commodity just like any other, so the more goods around, the cheaper they become.

Let’s see an example, the Japanese economy has been in a recession for a long time, so the Bank of Japan (BOJ) cut the interest rate twice in the past 5 years making them negative, which means that if the second level banks keep the money deposited at the BOJ they will have to pay interest to the BOJ. The large local and international banks obviously don’t want to pay 0.10% interest so they would rather withdraw the Yen deposited at the BOJ than throwing it away on the economy. This benefits the Japanese economy, which we’re yet to see, but weakens the currency because there is a lot more Yen in circulation. As you can see from the chart below USD/YEN has surged both times when there was a meaningful rate cut.

Now, there are three periods of price reaction when the interest rates are slashed:

- Before the cut due to market anticipation

- In the first few hours right after the cut

- During the weeks/months after the cut as in the case below

It all depends on how the rate cut/hike is priced in and how the forex market is positioned. If the market has been warned by the central bank that a rate cut/hike is coming, then the market has anticipated it there are no surprises. Surprises lead to immediate emotional reactions, worth hundreds of pips in the first few minutes/hours and followed by an even bigger move in the days/weeks or even months that follow, depending on how the big the rate cut/hike. It requires the right experience to interpret the right reaction of an interest rate cut/hike, but you can follow our daily market updates to learn how the market reacts on a daily basis.

USD/JPY has moved up more than 50 cents after the BOJ intervention

Examples of market reaction to interest rate changes

Usually, the price of the related currency goes in the same direction as the interest rate decision, meaning that when the rates are cut the currency depreciates, and when the rates are hiked that currency appreciates. But there are times when the price and the rate decision move in opposite directions, so let’s take a look at both scenarios using two recent examples.

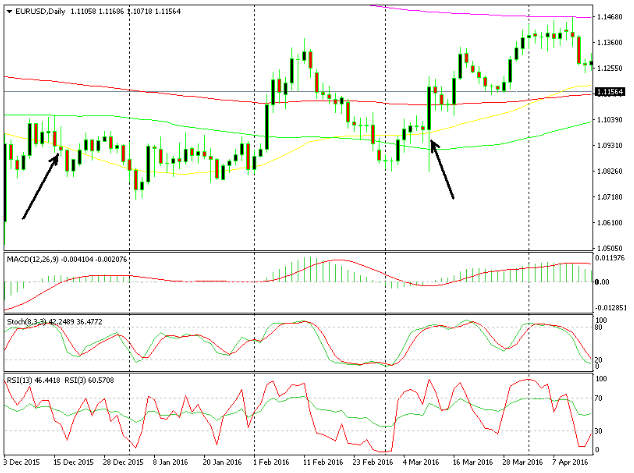

First, let´s have a look at EUR/USD when the FED hiked the interest rates from 0.25% to 0.50% in December 2015. Before the announcement, EUR/USD was moving up but once the announcement of the rate hike was made, the price started sliding, meaning that the USD was getting stronger – two days later this pair found itself 200 pips lower. It was a widely expected move from the FED and, thus, it wasn´t a big surprise. Since the move wasn´t very violent, the EUR/USD pair kept trading near the lows between 1.08 and 1.10 for several weeks.

EUR/USD moved 200 pips lower when the FED hiked the rates but shot up 300 pips higher when the ECB cut them

In the second example, (the second arrow on the right side of the chart), the ECB cut the financing interest rates from 0.05% to 0% and the deposit rates from -0.20% to -0.30%. The Euro initially lost 200 pips which seemed to be the right reaction. Then it reversed and closed the day about 450 pips higher. What the heck happened? After the ECB cut both the interest rates and added extra QE, the market came to the conclusion that the ECB was out of armor and that these actions would help the Eurozone economy – a positive for the Euro in the long term, and thus, investors were quick to re-position themselves.

This, in fact, turned out to be mainly negative for the USD because what started as strengthening EUR/USD turned into broad USD selling because the USD lost several hundred pips against all other pairs that day. So, if you see an interest rate decision on the calendar and want to trade it, evaluate all the factors. Is it priced in, is it a surprise, how big will the cut/hike be?

As you can see, the interest rates really affect the forex market. Sometimes the effect is smaller because the market expects the hike or cut in the rates, and sometimes the move from a central bank comes as a surprise, which will have a bigger impact. Often, the price of the related currency goes in the same direction with the interest rates but not always, so you must be careful to read the price action and analyze many other factors.