The MetaTrader4 and MetaTrader5 have great features such as the default templates, automated trading, the multiple account option and many more. We have gone over these in our previous articles about the main MT4 features and these are the reasons that most traders use the MT4 and almost all brokers offer it to their clients for free. Besides those features, there are some really good tools as well, such as the Fibonacci retracement levels and the lines which include the horizontal line, vertical line and trend line. In this article we´ll take a look at these tools and explain how they work and how to use them in everyday trading.

The Fibonacci indicator is one of the great MT4 tools

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Fibonacci Indicator

The Fibonacci indicator (aka Fib or Fibo in the forex jargon) is at the top of the platform on the indicators tab and has a little ‘F’ on it. It is based on the Fibonacci sequence theory that starts with 0 and 1. The following numbers are a sum of the last two numbers, so it continues with 1, 2, 3, 5, 8, 13, 21, 34 and so on. The MT4 has made it simple so you don’t have to do any calculations – you just need to know to use it. When there is an uptrend in a forex pair but the price makes a retrace down, such as in the chart below, you think that the retrace is over and you apply the Fibonacci indicator. The high in USD/JPY so far has been 125.84 from June 2015. After some consolidation, the market finally decided that the time for a retrace had come and during this retrace the price declined to 111. Since the price tried twice to break below that level (and failed), we can consider it as the bottom. You can now click on the Fibonacci button on the MT4, click again in the chart at the highest price (which is 125.84) and drag your cursor down to the bottom. Six yellow lines will appear; the value of the bottom one is 0, the value of the second line is 23.6, the value of the third line is 38.2, the fourth one in the middle of the range is 50, the fifth line is 61.8 and the top line is 100. If you want, you can add another line at 76.4. The numbers are percentages and represent the golden ratio numbers of the Fibonacci sequence. You can use these numbers to define the risk. As you can see, the two arrows show that the price has reversed once when it reached 23.6% of the big decline from 125.84 to 111 and it is having difficulty breaking above that level again. If your opinion is that the four-year uptrend will resume, you can play on this by opening small trades when the price hits these levels and sell this pair for 70-100 pips when the price gets rejected by the fibs. There have been two such opportunities when the price was rejected by the 23.6% Fibonacci level. But the ultimate trade if the uptrend resumes is to buy when the pair breaks these levels and ride the trade to the top.

The 23.6 Fibonacci level has rejected the price twice

Vertical, Horizontal and Trend Lines

As we said above, there are three types of lines in the MT4 platform: the vertical, the horizontal and the trend lines. They´re found in the same section as the Fibonacci indicator in the MT4 and you can easily place them on the chart by clicking on the button, then clicking on the chart. You can then change the place on the chart by double-clicking on it and moving one of the squares with the mouse. In the case of the trend line, you can change the direction by clicking one of the side squares and dragging it up or down after you have double-clicked on the trend line. The horizontal and vertical lines are red by default while the trend line is blue, but you can change the colors according to your preference by double-clicking on the line and then right-clicking, selecting ‘properties’ and then choosing your preferred color. The vertical lines are mainly used as reminders; you can place them on the chart a few days or a few hours into the future (depending on the timeframe) whenever there is an economic event, so you don´t miss out.

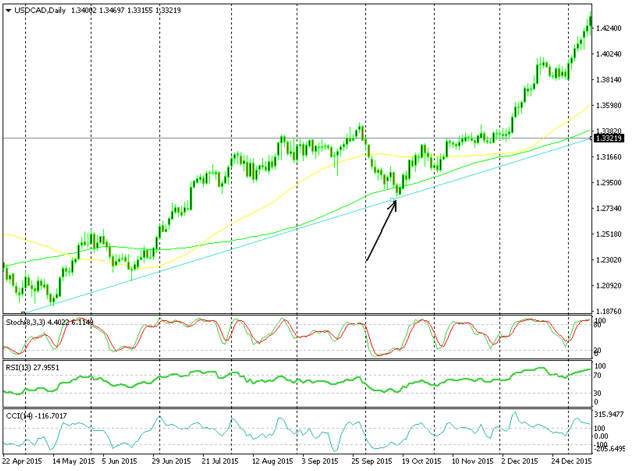

The horizontal lines and the trend lines are used more like indicators or trading strategies in themselves. As you can see in the USD/CAD daily chart below, we have placed a trend line connecting the first two low points dating back in May and June 2015. In October, this pair made a 600 pip retracement but the retracement ended once the price touched the trend line. That was a good time to open a buy position in this pair, since the 100 MA was around that level too and makes it an even stronger support level. As we know, the pair moved up nearly 20 cents (2,000 pips) in the next few months.

If you´d have bought at the trend line you would have made 2,000 pips

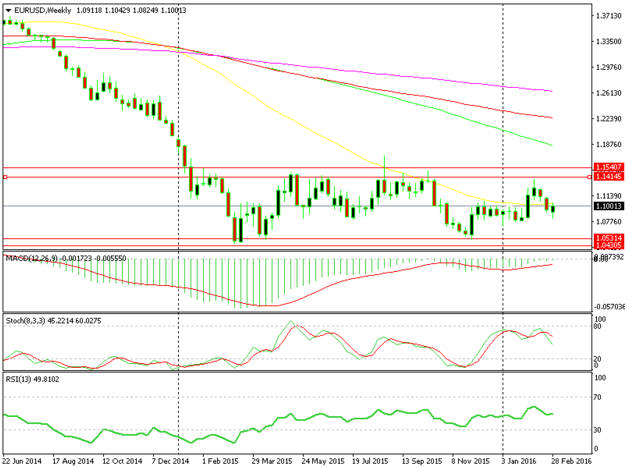

It´s the same with the horizontal lines… but often they work even better than the trend lines! That´s because they´re easier to visualize so a lot of people see the support/resistance levels – and we know that the more people use an indicator and trade based on it, the better it works. First of all, we know that the price doesn´t always respect indicators to the pip, so we must be a little flexible when using any forex indicator and provide a few pips room either way. That´s why I have used two horizontal lines both on the top and on the bottom of the 1,000 pip range in the EUR/USD chart below. As you can see on the weekly chart, the price has had three attempts at the bottom band and numerous attempts at the upper band between the two horizontal lines on the top during the course of a year – and this is why we can say that the top line is stronger.

The horizontal lines offered countless trading opportunities during last year

The tools which the MT4 offers are quite easy to use and you can build great forex strategies with them. In fact, we have forex strategies based on these tools. You can find the Fibonacci forex strategy, the trend line forex strategy, and the horizontal levels forex strategy. They´re not difficult to understand and are very effective – so give them a look!

- See more forex trader platforms