Online trading is more popular than ever – with nigh-on 10 million of us now investing on a daily basis. With this in mind, it makes sense that there are more brokers than ever offering their services.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

These days, the vast majority of the global populous has access to the internet, and most of us are able to trade from the palm of our hand. The problem with such a high volume of companies offering a similar service is obvious – it’s difficult to separate the wheat from the chaff.

Today we are going to review the Moneta Markets trading platform. We will cover everything from what assets Moneta Markets offers, what fees, spreads, and commissions to expect, and to how you can sign up and start trading today.

The Moneta Markets Deposit Bonus

- Minimum deposit is $200

- Opt in using the form to claim your 50% deposit bonus

- Log in to the Moneta Markets platform, and start trading!

What is Moneta Markets?

Moneta Markets was first launched in 2020 as part of Vantage International Group Limited. The broker is authorised by the Cayman Islands Monetary Authority (CIMA), so is strictly regulated as a result.

The CFD broker aims to offer clients compact all-inclusive fund management and trading solutions – under one umbrella. You are also able to trade directly from the official app – which is available for both iOS and Android.

What am I Able to Trade at Moneta Markets?

As noted above, there are over 300 forex pairs, commodities, share CFDs, and indices on offer at this brokerage firm. Within that in mind – this section of our Moneta Markets review will take a closer look at what markets you can access.

Indices

Moneta Markets offer access to 15 of the biggest indices markets in the world – from the London Stock Exchange and New York Stock Exchange, all the way to markets in Australia and Hong Kong.

- ASX S&P 200: This index is listed on the ‘Australian Securities Exchange’ and includes 200 of the biggest companies Down Under. Some of the companies include Commonwealth Bank of Australia, Auckland International Airport Ltd, Coca-Cola Amatil Ltd, OZ Minerals Ltd and more.

- FTSE 100: It’s official name is ‘The Financial Times Stock Exchange 100’ and is made up of the top 100 companies, all listed on the London Stock Exchange. To name a few companies on this index – British American Tobacco, Royal Dutch Shell, BP, GlaxoSmithKline, Unilever, Diageo, Royal Bank of Scotland Group etc.

- FRA40: Listed on the ‘Euronext Paris Exchange’ – weighting is based upon market capitalization for these 40 companies. Such stocks include Michelin, Airbus, Hermès, Carrefour, TechnipFMC, Crédit Agricole, BNP Paribas and more.

- DAX30: This blue-chip stock market index tracks 30 German companies on the ‘Frankfurt Stock Exchange’, all of which are publicly owned. Some of the companies include; Siemens, Bayer, Fresenius SE & Co, Deutsche Bank, Münchener Rückversicherungs-Gesellschaft, Delivery Hero and Henkel AG & Co.

Forex

Forex is one of the world’s most liquid markets, and so it is undoubtedly one of the most traded assets globally.

Moneta Markets offers clients over 45 forex pairs on its platform. As you likely already know the forex market is open 24 hours a day, 5 days a week – so with 45 pairs on offer you won’t be short of trading opportunities.

Moneta Markets offers clients over 45 forex pairs on its platform. As you likely already know the forex market is open 24 hours a day, 5 days a week – so with 45 pairs on offer you won’t be short of trading opportunities.

Some of the currency pairs available on this broker site include the following:

- Major FX pairs: EUR/USD, USD/JPY, GBP/USD, AUD/USD, NZD/USD

- Minor FX pairs: EUR/GBP, EUR/AUD, GBP/JPY, GBP/CAD, CHF/JPY and NZD/JPY

- Exotic FX pairs: SGD/JPY

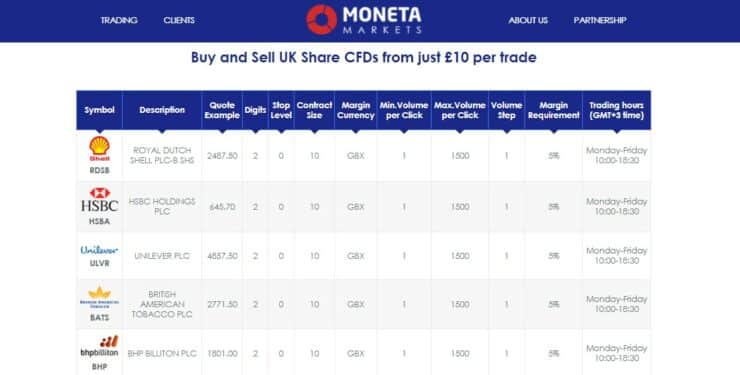

Share CFDs

There are more than 185 share CFDs on the Moneta Markets platform – giving you access to the UK, European, Hong Kong and US markets. Of course, by trading share CFDs you are able to execute buy and sell orders – without owning the underlying asset itself.

When trading in CFDs you are simply trying to forecast whether or not the relevant shares are going to fall or rise.

If you are interested in share CFDs but haven’t a clue where to begin, not to worry. We have listed some of the most liquid companies (globally) – all of which you can find on the Moneta Markets website.

- UK share CFDs: £10+ per trade: Shell, Unilever, British American Tobacco, HSBC, GSK, AstraZeneca, Vodaphone, Lloyds Bank, RBS, BT, Tesco, and more.

- US share CFDs: $6+ per trade: Amazon, Microsoft, Facebook, Walmart, the Home Depot, Cisco, Toyota, Coca Cola, Mastercard, Walt Disney, Netflix, McDonald’s, Starbucks, Tesla, etc.

- Aussie share CFDs: $5+ per trade: Crown Resorts Limited, Afterpay Touch, Stockland, Origin Energy, SYD Airport, Aristocrat leisure

- European share CFDs: €10+ per trade: Renault, L’oreal, Heineken N.V, Philips N.V, E.ON, Siemens AG, Banco Comercial, Ibersol Group, Allianz etc.

- Hong Kong share CFDs: HK $50+ per trade: China Unicom, Sinopec Corp, CSPC Pharma, Prada, Techtronic Ind, WH Group, etc

Cryptocurrencies

Our Moneta Markets review found that there are 6 cryptocurrencies available on the platform. All crypto assets come with variable spreads due to ever-changing conditions in the market.

Commodities

Moneta Markets offer 15 of the most popular commodity markets available. No matter what you want to trade, you will likely find a market that interests you.

- CFD energies include: crude oil, gasoline

- CFD precious metals include: forex gold USD, forex silver USD, forex gold AUD, forex silver AUD, and copper

Moneta Markets Fees

There isn’t an awful lot of information available on the Moneta Markets platform when it comes to fees. However, we have included our findings below for your consideration.

Spreads and Commissions

As with all broker platforms, the spread depends entirely on the asset and the market conditions. Consequently, spreads will always fluctuate throughout the trading day.

When it comes to major FX pairs at Moneta Markets such as GBP/USD and EUR/USD – the spreads are largely competitive. In terms of major indices like FTSE 100 and SP500, this is also the case.

Trading Platform Compatibility

The first thing to mention about trading platform compatibility is Moneta Markets isn’t supported by hugely popular third-party platform MetaTrader4. However, the company has created its own app called ‘AppTrader’ – which we will review in more detail below

Moneta Markets AppTrader

The Moneta Market’s ‘AppTrader’ application is suitable for Android devices as well as iOS. The app works well on both mobile phones and tablets. Using the app, clients are able to access over 300 tradable instruments.

We have listed the best features of this app below.

- 45 built-in technical indicators

- 6 different types of chart

- 9 different timeframes

- Heaps of chart drawing tools such as Fibonacci levels, and trendlines.

- Risk management

- Take profit and stop-loss orders illustrated in Dollar, price and pips

Crucially, not only is the app handy for researching the financial markets on the move, but you can also place trades and view your current orders.

Educational Content and Trading Tools

When it comes to educational content, Moneta Markets really comes through. A perfect example of this is the in-platform feature ‘Moneta TV’ – which regularly provides financial news updates.

Please find below a list of Moneta Market’s platform features:

- Deposit Bonus

- Forex Sentiment

- Economic Calendar

- Platform Videos

- Webtv

- Moneta Tv

- Daily Technical Analysis

- Trading Tools

- Calculators

- Market Masters

- Duplitrade

- Daily Market Update

Moneta Markets Leverage

When it comes to leverage, much like spreads, it is dependent on the asset being traded. To give you an indication of what to expect from this broker’s leverage limits, we have listed the various markets below.

In terms of commodities, leverage limits stand at:

- 1:20 – CFD natural gas, CFD heating oil, copper,

- 1:33 – cotton, sugar, orange juice

- 1:50 – forex gold AUD, cocoa, coffee,

- 1:100 – CFD gas oil, CFD oil, forex gold and silver USD, forex silver AUD

When it comes to indices, your leverage will be capped at the following:

- 1:100 leverage examples – ASX S&P 200, FTSE 100, Dow Jones 30, Nasdaq 100 Index, Nikkei 225

- 1:200 leverage examples – China A50 Index, USD Index, US SMALL CAP 2000, Hang Seng Index, Euro Stoxx 50 Index

Our Moneta Markets review found that there are 2 fixed leverage amounts on offer, with regards to the 6 cryptocurrencies available.

- Fixed leverage 1:2 – XRP/USD, ETH/USD, DSH/USD, BCH/USD

- Fixed leverage 1:5 – BTC/USD

With that said – the stand out leverage offering at Moneta Markets is that you can trade forex pairs at up to 1:500. This is huge, as a $100 stake would permit a maximum trade value of $50,000.

Deposits and Withdrawals

In terms of deposits, our Moneta Markets review found that there are a variety of different currencies accepted.

Accepted currencies on this broker site are:

- USD

- EUR

- GBP

- AUD

- NZD

- SGD

- JPY

- CAD

Next, we are going to delve into deposit and withdrawal options available.

Deposits

Below we have listed all available deposit options, alongside Moneta Markets processing times for each method.

- Visa – instant

- Mastercard – instant

- Wire transfer – 2-5 working days

- FasaPay – instant (AUD only)

- JCB (JPY only)

- Bitcoin – 1 business day

- Sticpay – instant

You will not be charged a fee for using any of the above payment methods when making your first deposit. The platform states that clients are not permitted to deposit more than $1,000 AUD (or the equivalent).

When it comes to making a deposit into your account thereafter the limit is place is $10,000 AUD (or the equivalent)

Withdrawals

Withdrawals will be processed by this broker within 1 to 3 business days, depending on the method used.

It is important to note that the site says that all withdrawal requests are carried out using a bank wire. As such, you will not be permitted to use credit or debit card options.

Any requests for withdrawals will be processed by the trading platform between Monday and Friday between the hours of 9 am and 7 pm – always GMT+10. The minimum withdrawal value allowed is 20 of your currency, for example, £20, $20 etc.

Moneta Markets Customer Support

At this point in our Moneta Markets review, we are going to take a look at the customer support on offer from this broker.

The platform claims that it offers ‘award-winning customer service’. The customer support on offer from what we found is at varied. For example, you will find not only a telephone number for UK customers but also an international telephone number.

Most of us these days prefer the option of live chat, so we were pleased to see that this is available. If you prefer email you can message the team at support@monetamarkets.com.

Importantly, customer support is available 24 hours a day, and 5 days a week.

Moneta Markets Account Types

Our Moneta Markets review found that there are only 2 account types available from the broker. The first is a standard account, with a minimum deposit of $200.

The second is a swap-free account. For those unaware, this is sometimes also called an Islamic trading account. The reason for this is that followers of the Islamic faith are prohibited from giving or receiving interest (riba) of any kind. For this reason swap fees, or overnight financing, is waived on this type of account.

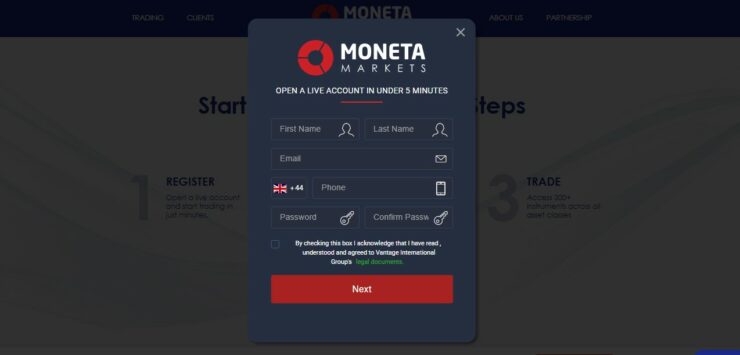

How to open a Trading Account With Moneta Markets

By this point in our Moneta Markets review, you might be considering signing up to the broker in question. Should this be the case we have put together a simple 3 step sign up guide to get you off on the right foot.

Step 1: Sign Up

To get the ball rolling you need to head over to the Moneta Markets website and hit the green ‘sign up’ button at the top right-hand side of the main page.

Step 2: Deposit Into Your Moneta Markets Account

It only takes a matter of minutes to sign up with this broker. Now you can go ahead and fund your new account using one of the accepted payment methods listed above.

As we mentioned, you are able to deposit into your account using the app if you wish.

Step 3: Start Trading

Finally, you can begin to trade in the live markets of your choosing. If you don’t feel ready to take the plunge and trade using real money, we highly recommend using the free demo account.

Demo accounts are a great way to get a feel for the trading platform, as well as try out different strategy ideas.

Conclusion

To sum up our findings in this Moneta Markets review – the platform is easy to navigate, but not as informative as we would like. For instance, we couldn’t find much information on spreads.

However, if you are interested in signing up to Moneta Markets, a good way to gauge this yourself would be to take advantage of the broker’s free demo account. By trading for free in an environment which mirrors real market conditions you will soon inform yourself.

The good news is that from what we’ve found, you are able to sign up to a free demo account in under a minute – and without needing to make a deposit first. The broker offers over 300 tradable instruments, all of which can be traded via the native ‘MobileTrader’ app, as well as on the Moneta Markets WebTrader platform.

The Moneta Markets Deposit Bonus

- Minimum deposit is $200

- Opt in using the form to claim your 50% deposit bonus

- Log in to the Moneta Markets platform, and start trading!