The differences between MT4 and MT5

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

The MetaTrader5 MT5 platform is the successor of the MT4 platform. It was developed and introduced in 2010 by the MetaQuotes Corporation, the same company that introduced the vastly popular MT4. As if the MT4 wasn´t feasible and handy enough to use, the company decided to take the older MT4 forex platform to the next level, and the MT5 trading platform was born. A large part of the trading community was already used to the MT4, so when the MT5 was introduced, it came as a bit of a surprise. According to them, the MT4 already had everything needed to analyze the markets and trade. Because of that, the MT5 was adopted slowly by traders. We now know that the MT4 and MT5 are not the same; the MT5 offers additional and more advanced indicators and features. So, in this article, we´ll talk about the new features and indicators that MT5 offers to traders in addition to the MT4.

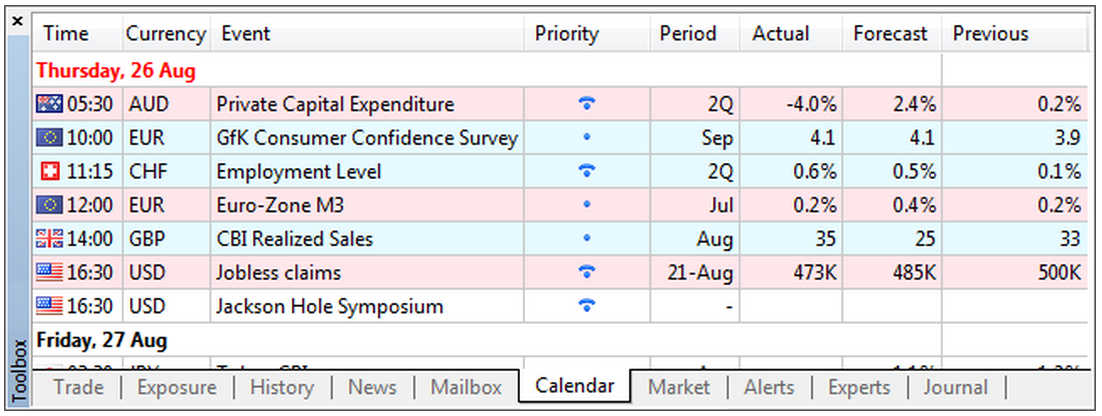

Calendar – The economic calendar is a new feature which was added to the MT5 trading platform. It is a weekly calendar with the important news and data releases which might affect the forex market. I know there are many sites out there that provide the economic calendar to the traders, but I prefer to have the news right at my platform when important news releases and the market becomes very volatile. This way I can actually see the numbers and the charts in real-time, instead of switching back and forth between the web calendar page and the platform. The calendar feature is placed in the toolbox section at the bottom of the platform between ‘mailbox’ and ‘market’. As you can see from the picture it is visually friendly and very easy to understand. On the far left, there is the scheduled time of the release and the flag of the respective country. As you move to the right, you can see the affected currency, the name of the event and its importance. According to the historical market reaction, the importance of the release is separated into three categories which are distinguished by their signs; the small blue dots equals low priority release; the small blue dot and blue curve equals medium priority and dot with two curves = high priority. The period column shows the time span during which the data has been accumulated and calculated. The last three columns show the actual, forecasted and the previous reading. The column becomes red if the actual data is worse than the forecast and blue if it is better. On top of that, you can place the economic events on the charts as well. You can drag and drop one event, all events for a currency and/or drag all the events at once… and it will appear on the affected currencies.

Two new ‘pending order’ types – Apart from the instant market execution, the MT4 platform offered four pending order types; buy limit, sell limit, buy stop and sell stop. The MT5 forex platform added two new pending order types this time around; buy stop limit and sell stop limit. It sounds complicated, but it´s quite simple. With the MT4 trading platform, it’s very hard to get filled on a trade with stop and limit orders. For example, if the market opens with a gap, but with a new bus stop limit and sell stop limit on pending orders of the MT5, you can hardly miss a pending trade. Basically, a stop limit pending order gives your trade some breathing space regarding the entry price. This can be useful when the forex market opens with a gap over the weekend, but its main use is in the stock market, which closes every day and where gaps are very common. So, let´s explain these order types. With a buy stop order, your trade opens when the price reaches the exact level you have placed as the entry level. For instance, if you placed a buy stop order before going to bed on Sunday 2nd of October in EUR/USD at 1.1205, your order wouldn´t have been filled because the market opened 17 pips above the closing price at 1.1219. With a buy stop limit order you place the entry buy stop price at 1.1205 and the buy limit order at 1.1220. That means that the trade will be triggered if the price opens or trades between this levels but not if the price opens above 1.1220.

MQL5 – MQL5 is the built-in programming language of MT5 forex platform, same as the MQL4 is the programming language of the MT4. But what´s different in this language? MQL4 was already quite advanced and user-friendly, but the MQL5 took programming to another level. Having more advanced features and continuously evolving, the MT5 offers more options for developing advanced strategies, indicators, and automated trading programs. The tech geeks in particular love this platform. For example the new function “OrderSendAsync()” allows you to create high-speed trading programs and robots. Another breakthrough is the ‘Depth of Market’ information handling, but this is a separate feature of the MT5 and we will cover it separately in the following articles about the MT5 platform. Having said all this, the MQL5 is easier to use by the inexperienced traders. The MQL4 mode of strict compiling has a higher standard of coding, thus minimizing the errors when you are programming a strategy or indicator. In the MQL5 this is a default option which cannot be changed, making it simpler for the new users. The new event types of the MQL5 have made it easier to test and improve the trading robots in the MT5 strategy testers (TesterPass, TesterInit, and TesterDeinit). The debugging capabilities have also been enhanced in the MQL5, so it makes much safer to buy and import trading software.

MQL5 offers more advanced tools and features for building your own robot.

Many think to this day that the MT5 is exactly the same as the MT4. It looks the same and has a lot of similarities which gives you the identical impression, but if you look closely and use it for some time you´ll see that there are many differences. As we explained in this article the MQL4 programming language is more advanced and safer from viruses, there is an economic calendar included and the two new pending order types making it nearly impossible to miss a trade when you place a pending order. There are newer and different features and indicators, such as depth of market, aggregation of positions more graphical objects and timeframes, more inbuilt indicators etc. We will explain all these differences on the following MT5 articles.

- Check out our Forex Trading Platforms reviews

- You can also read more about how to create your own trading plan