Dealing or no dealing desks – What do they mean?

Forex brokers are classified into either dealing desks (DD) or no dealing desks (NDD)

New traders have always been puzzled by the meaning of dealing desks (DD) and no dealing desks (NDD) of forex brokers, with many of them thinking that DD brokers are always trying to cheat the traders and go against their clients positions.

4

支付方式

交易平台

受到管制

支持

最低存款

最大杠杆

货币对

分类

移动应用

最低存款

$100

传播分钟。

变量点

最大杠杆

100

货币对

40

交易平台

基金模式

受到管制

FCA

你可以交易什么

外汇

指数

行动

密码货币

原料

平均点差

EUR / GBP

-

EUR / USD

-

EUR / JPY

0.3

EUR / CHF

0.2

英镑/美元

0.0

GBP / JPY

0.1

GBP / CHF

0.3

USD / JPY

0.0

USD / CHF

0.2

CHF / JPY

0.3

额外费用

连续率

变量

转变

变量点

税法法规

Yes

FCA

没有

CYSEC

没有

ASIC

没有

美国商品期货交易委员会

没有

NFA

没有

巴芬

没有

中国气象局

没有

SCB

没有

DFSA

没有

CBFSAI

没有

英属维尔京群岛金融服务中心

没有

金融服务业协会

没有

FSA

没有

FFAJ

没有

ADGM

没有

金融监管局

最低存款

$100

传播分钟。

- 点数

最大杠杆

400

货币对

50

交易平台

基金模式

受到管制

CYSECASICCBFSAI英属维尔京群岛金融服务中心金融服务业协会FSAFFAJADGM金融监管局

你可以交易什么

外汇

指数

行动

密码货币

原料

以太坊

平均点差

EUR / GBP

1

EUR / USD

0.9

EUR / JPY

1

EUR / CHF

1

英镑/美元

1

GBP / JPY

1

GBP / CHF

1

USD / JPY

1

USD / CHF

1

CHF / JPY

1

额外费用

连续率

-

转变

- 点数

税法法规

没有

FCA

Yes

CYSEC

Yes

ASIC

没有

美国商品期货交易委员会

没有

NFA

没有

巴芬

没有

中国气象局

没有

SCB

没有

DFSA

Yes

CBFSAI

Yes

英属维尔京群岛金融服务中心

Yes

金融服务业协会

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

金融监管局

最低存款

$10

传播分钟。

- 点数

最大杠杆

10

货币对

60

交易平台

基金模式

你可以交易什么

外汇

指数

密码货币

平均点差

EUR / GBP

1

EUR / USD

1

EUR / JPY

1

EUR / CHF

1

英镑/美元

1

GBP / JPY

1

GBP / CHF

1

USD / JPY

1

USD / CHF

1

CHF / JPY

1

额外费用

连续率

-

转变

- 点数

税法法规

没有

FCA

没有

CYSEC

没有

ASIC

没有

美国商品期货交易委员会

没有

NFA

没有

巴芬

没有

中国气象局

没有

SCB

没有

DFSA

没有

CBFSAI

没有

英属维尔京群岛金融服务中心

没有

金融服务业协会

没有

FSA

没有

FFAJ

没有

ADGM

没有

金融监管局

最低存款

$50

传播分钟。

- 点数

最大杠杆

500

货币对

40

交易平台

基金模式

你可以交易什么

外汇

指数

行动

原料

平均点差

EUR / GBP

-

EUR / USD

-

EUR / JPY

-

EUR / CHF

-

英镑/美元

-

GBP / JPY

-

GBP / CHF

-

USD / JPY

-

USD / CHF

-

CHF / JPY

-

额外费用

连续率

-

转变

- 点数

税法法规

没有

FCA

没有

CYSEC

没有

ASIC

没有

美国商品期货交易委员会

没有

NFA

没有

巴芬

没有

中国气象局

没有

SCB

没有

DFSA

没有

CBFSAI

没有

英属维尔京群岛金融服务中心

没有

金融服务业协会

没有

FSA

没有

FFAJ

没有

ADGM

没有

金融监管局

In reality, the decency of the broker depends on the way they operate and their individual business ethics – it has nothing to do with being a dealing or no dealing desk. After all, the differences deal in terms of execution and order handling. Some brokers even operate with both order handling types. FXCM, for example, offers no dealing desk execution for normal accounts… and dealing desk execution for mini accounts. In this article, which is divided in two parts, we will explain both types of order execution and the differences between them.

What is a dealing desk?

In the retail forex market the buy/sell orders are executed in two ways; they´re either passed to another entity – known as the liquidity provider (LP), such as banks and other large financial institutions, by the broker or are held by the brokerage itself which acts as the liquidity provider. When a broker holds the trades within and doesn´t pass them to another LP, s/he is considered a dealing desk broker. These types of brokers are called market makers (MM) as well, because they create a market. They are much smaller than the immense interbank market but the same conditions apply and the rates are almost the same.

The dealing desk brokers process the trades in two ways, either placing clients against each other or hedging the trade themselves. Putting clients’ trades against each other means that if client A wants to buy EUR/USD around 1.0900 and client B wants to sell the same pair at the same level then they are matched by the broker. The broker makes their profit by the spread – which in this case is lower than the spread offered by the no dealing desk brokers because they avoid the spread of the liquidity provider. When there are no opposite matching orders for a position, the broker matches the order themselves, hedging your position. If you want to buy EUR/USD around 1.09, the broker offers it to you at that price, which means they are buying it at the same price. There is a conflict of interest, as FXCM explains in their execution risk section, but that doesn´t mean they are cheating you. The dealing desk brokers minimize the risk by spreading it among millions of trades for all their clients. Sometimes they transfer the trades through a NDD operation as well. Dealing desk brokers usually offer fixed spreads, since they don´t pass trades to the liquidity providers. As we mentioned, the clients of these types of brokers don´t see the interbank rates and spreads, but the competition is so stiff that they get almost the same rates.

What is a no dealing desk?

直通加工

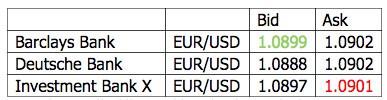

As the name implies, a no dealing desk broker does not deal with the trades. Instead, they pass the trades to the interbank market where there are many liquidity providers who are willing to buy or sell any currency pair at any time. The no dealing desk brokers process the trades through a straight through processing (STP) system which automatically passes the trades to the liquidity provider. So, they don´t match their clients orders or take the other side of the trade. Many brokers claim to be ECN providers but they are really STP brokers. STP brokers are the most common in the forex market and they act as bridges to the retail forex traders because it is very hard for individual retail traders to get through to the interbank market. They find the best bid, ask for the spread on this market and offer it to the traders adding their commission which adds an extra 0.5, 1 or 2 pips to the spread. The table below shows the rates that the STP brokers get from their liquidity providers. Then the STP system automatically places the clients’ sell trades with the best bid price offered by Barclays Bank and the buy orders with the best ask price which is offered by the Investment Bank X. As we mentioned above, these are not the rates that you see on the platform because the brokers usually add that little extra pip or a fraction of a pip as their commission.

Exemplary rates liquidity providers can give the STP brokers

电子通讯网络

Electronic communication network (ECN) brokers are very similar to STP brokers and have the same processing system, but they don´t pass the trades to the liquidity providers which have a spread between the bid and ask prices. They match all the buying and selling orders of all the participants in the interbank market. The participants might be different, from small retail traders to large hedge funds, high-frequency trading firms (HFT), banks, etc. So, all the participants buy and sell against each other and the ECN system just enables them to interact with each other. There are times when there are no spreads to the buy and sell price. If the ECN broker charges for their service on commissions per trade/size, then you might as well see the same bid/ask price. If the broker translates these commissions into spreads then you won´t see any pairs with the same bid/ask price.

有什么区别?

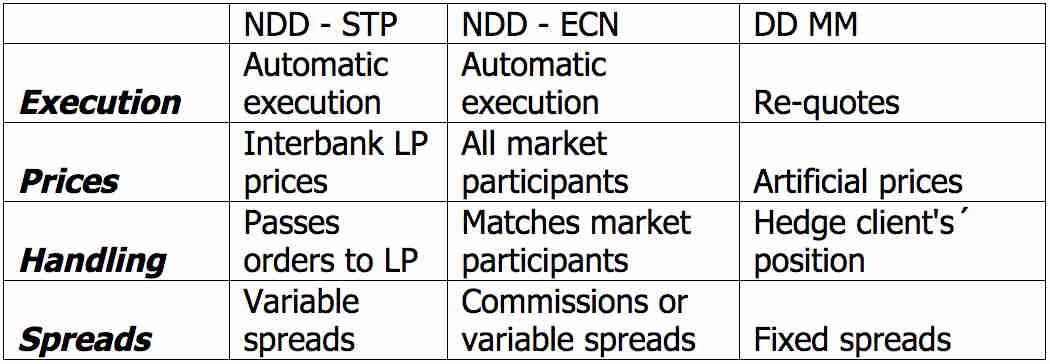

As we explained in the section above, there are differences between the different types of brokers. The table below lists all the main differences.

Differences in broker type

Above are the types of brokers classified by the order handling types and the differences between them. The no dealing desk STP brokers have variable spreads, which during volatile times might widen as much as 15-20 pips – while the dealing desk brokers offer fixed spreads, but they have the right to reject your trade as well as re-quote them. The ECN brokers and the DD market makers usually offer lower spreads because they avoid the liquidity provider (LP) spreads. The NDD brokers get prices from the LPs and market participants, but the competition forces the DD brokers to offer prices almost identical to the market. The differences don’t necessarily mean that any one type of forex broker is better or worse than the other. It all comes down to what kind of trader you are. If you are a scalper… a DD or ECN broker might be better for you. If you are a long-term trader, then you might as well choose an STP broker who has slightly higher spreads.

这也可能使您感兴趣:

- 看看我们的 外汇交易平台 评论

- 您还可以阅读更多有关如何 制定您自己的交易计划