Invester ikke, medmindre du er parat til at miste alle de penge, du investerer. Dette er en højrisikoinvestering, og det er usandsynligt, at du bliver beskyttet, hvis noget går galt. Brug 2 minutter på at lære mere

Service til kopihandel. Vores Algo åbner og lukker automatisk handler.

L2T Algo giver meget rentable signaler med minimal risiko.

24/7 handel med kryptovaluta. Mens du sover, handler vi.

10 minutters opsætning med væsentlige fordele. Manualen følger med ved købet.

79 % succesrate. Vores resultater vil begejstre dig.

Op til 70 handler om måneden. Der er mere end 5 par tilgængelige.

Månedlige abonnementer starter ved £58.

Bitcoin mining stocks have seen substantial gains in recent months, buoyed by improving macroeconomic conditions and Bitcoin’s resurgent climb, with the cryptocurrency surpassing the $48,000 mark for the first time since April 2022. Despite concerns of an impending correction, I anticipate continued upward momentum in the sector, particularly with the looming Bitcoin halving and the upcoming presidential election later this year.

Marathon Digital (NASDAQ:MARA): Leading the Bitcoin Proxy Charge

In this context, Marathon Digital emerges as the top contender among Bitcoin miners, primarily due to its substantial HODL stash, eclipsing that of its closest rivals. This positions Marathon to offer investors heightened exposure to Bitcoin’s price movements, a significant advantage during bull markets like the current one. Given Bitcoin’s potential trajectory towards new all-time highs post-halving, I maintain a buy rating on Marathon.

Firmaoversigt

Marathon stands as the world’s largest publicly traded Bitcoin miner, boasting a significant self-mining hash rate and Bitcoin reserve. The company’s strategy revolves around mining and holding Bitcoin as a long-term investment, leveraging the cryptocurrency’s potential for value appreciation amidst growing adoption and its finite supply.

Currently, Marathon conducts Bitcoin mining operations in the US, alongside joint ventures in Abu Dhabi and Paraguay. While the company hosts its mining facilities through third-party arrangements, it is actively transitioning towards assuming full operational control of its mining sites in Granbury, Texas, and Kearney, Nebraska. This strategic shift aims to enhance operational efficiency and reduce costs, particularly in anticipation of the impending Bitcoin halving.

Bitcoin Halving: A Catalyst for Price Swings

The upcoming 4th Bitcoin halving event, slated for April 19, 2024, is anticipated to trigger a reduction in block rewards from 6.25 to 3.125 Bitcoin. Historically, such supply cuts have precipitated significant price fluctuations in Bitcoin, with notable upticks observed in the years preceding and following the halving events.

Examining past halving occurrences reveals a consistent pattern of price appreciation for Bitcoin. For instance, following the first halving in November 2012, Bitcoin witnessed a substantial surge, climbing by 300% within a year. Similar bullish trends were observed in subsequent halving events, underscoring the potential for significant price appreciation in the wake of the upcoming halving.

Impact on Top Miners

While halving events traditionally bode well for Bitcoin’s price trajectory, the same cannot be said for Bitcoin miners, whose profitability hinges on various factors, including Bitcoin’s post-halving price performance. Reduced block rewards necessitate higher mining difficulty, posing challenges for miners to maintain profitability unless offset by commensurate increases in Bitcoin’s value.

Marathon’s superior hash rate positions it favorably to weather post-halving challenges, with projections indicating substantial Bitcoin production. Comparatively, Marathon’s expected production outstrips that of its peers, underscoring its dominance in the Bitcoin mining landscape.

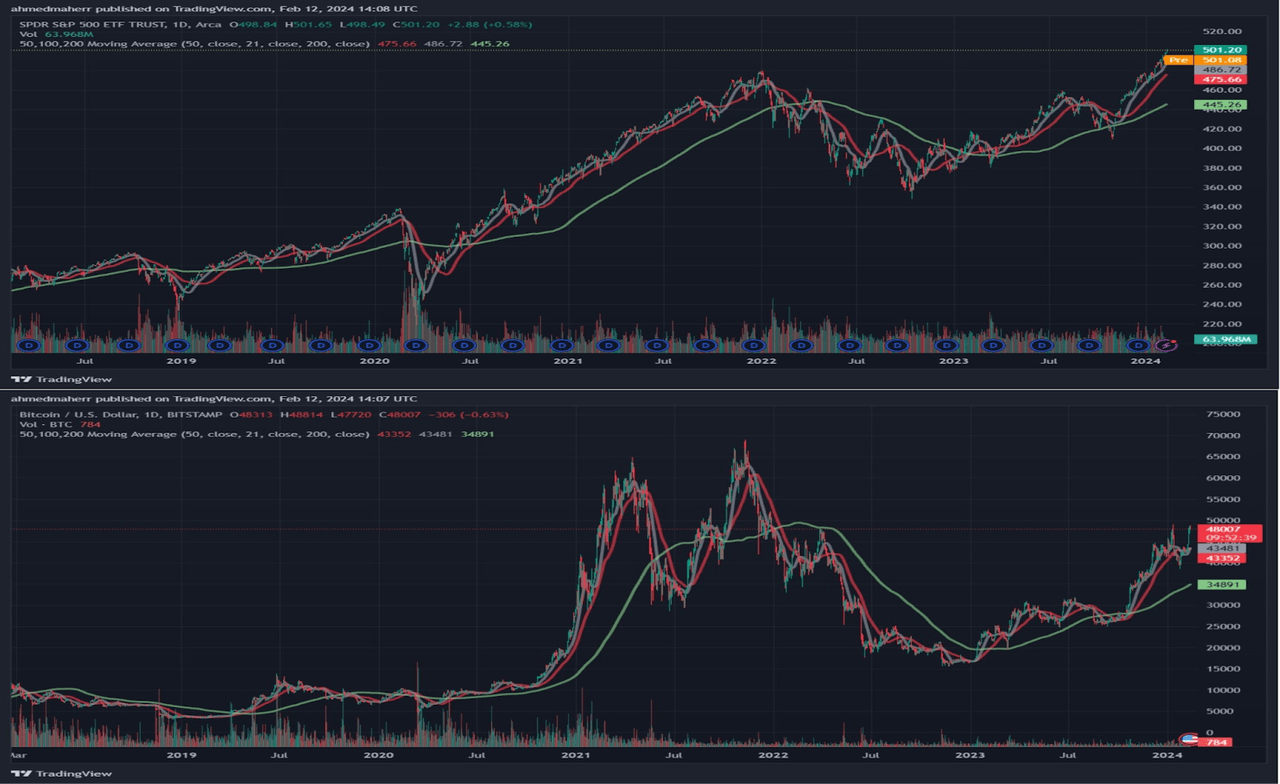

Bitcoin Price Correlation with the Stock Market

Bitcoin’s price trajectory has exhibited a correlation with the broader stock market, particularly evident since the surge in interest from retail and institutional investors in 2017. This correlation underscores the bullish outlook for Bitcoin miners like Marathon, especially against the backdrop of sustained bullish momentum in indices like the S&P 500.

Presidential Election Impact

The forthcoming presidential election represents an additional catalyst for Bitcoin’s price trajectory, historically associated with positive gains for the S&P 500. Given Bitcoin’s parallel performance with the stock market, the election year could herald further gains for the cryptocurrency, bolstering the case for investment in Bitcoin miners.

Bitcoin Miners as Leveraged Proxies

Bitcoin miners, including Marathon, have proven to be leveraged proxies for Bitcoin, consistently outperforming the cryptocurrency during major market catalysts. Notably, Marathon’s robust performance vis-a-vis Bitcoin underscores its appeal as an investment option, offering higher returns and lower risk exposure.

The Strategic Advantages of Marathon

Marathon’s competitive edge lies in its significant HODL stash, industry-leading hash rate, and robust cash position. These factors position Marathon to capitalize on Bitcoin’s upward trajectory post-halving, while also affording the company greater flexibility to explore growth opportunities.

Traditional valuation metrics like P/S or P/E ratios may not effectively capture the value proposition of Bitcoin miners. Instead, the price-to-hash ratio emerges as a more relevant metric, with Marathon exhibiting favorable ratios compared to its peers, further bolstering its investment appeal.

Konklusion

While risks such as dilution and Bitcoin’s price volatility persist, Marathon’s strategic advantages and bullish market outlook position it as a compelling investment opportunity. Accordingly, I maintain a buy rating on Marathon, anticipating significant upside potential amidst favorable market conditions.

In summary, Marathon Digital emerges as the premier Bitcoin miner poised to capitalize on the forthcoming halving and election dynamics, offering investors a lucrative avenue to participate in Bitcoin’s bullish trajectory.

Bemærk: learn2.trade er ikke finansiel rådgiver. Lav din research, før du investerer dine midler i ethvert finansielt aktiv, præsenteret produkt eller begivenhed. Vi er ikke ansvarlige for dine investeringsresultater.

- Broker

- Min Deposit

- Score

- Besøg mægler

- Prisvindende Cryptocurrency-handelsplatform

- $ 100 minimum indbetaling,

- FCA & Cysec reguleret

- 20% velkomstbonus på op til $ 10,000

- Minimum depositum $ 100

- Bekræft din konto, før bonusen krediteres

- Over 100 forskellige finansielle produkter

- Invester fra så lidt som $ 10

- Udtrækning samme dag er mulig

- Fund Moneta Markets -konto med et minimum på $ 250

- Tilmeld dig ved hjælp af formularen for at kræve din 50% bonus