Layanan kanggo dagang salinan. Algo kita kanthi otomatis mbukak lan nutup perdagangan.

L2T Algo nyedhiyakake sinyal sing duwe bathi kanthi resiko minimal.

24/7 dagang cryptocurrency. Nalika sampeyan turu, kita dagang.

10 menit persiyapan karo kaluwihan substansial. Manual diwenehake karo tuku.

79% tingkat sukses. Asil kita bakal excite sampeyan.

Nganti 70 dagang saben wulan. Ana luwih saka 5 pasangan kasedhiya.

Langganan saben wulan diwiwiti ing £58.

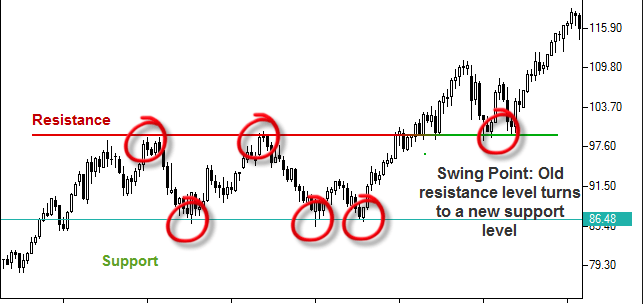

Horizontal Levels is one of the simplest yet incredibly useful ideas in Forex trading. Horizontal levels are fundamental in most Forex trading strategies and aid us in analyzing charts. However, they can also be used on their own as a strategy rather than just a tool for other strategies. By watching the most obvious price changes and drawing their horizontal levels we can make successful trades. In fully understanding the horizontal levels of more complex charts we can spot trends that we would have otherwise missed.

4

cara pembayaran

Platform dagang

Diatur dening

dhukungan

Deposit Min

Leverage maks

Pasangan Currency

klasifikasi

App Mobile

Deposit Min

$100

Nyebar min.

Variabel pips

Leverage maks

100

Pasangan Currency

40

Platform dagang

Metode Pendanaan

Diatur dening

FCA

Apa sampeyan bisa dagang

forex

Indeks

tumindak

Pranala dhumateng kaca punika

raw Materials

Rata-rata nyebar

EUR / GBP

-

EUR / USD

-

EUR / JPY

0.3

EUR / CHF

0.2

GBP / USD

0.0

GBP / JPY

0.1

GBP / CHF

0.3

USD / JPY

0.0

USD / CHF

0.2

CHF / JPY

0.3

Fee Tambahan

Rate terus menerus

Variabel

Konversi

Variabel pips

angger-angger

Ya

FCA

Ora Ana

CYSEC

Ora Ana

ASIC

Ora Ana

CFTC

Ora Ana

NFA

Ora Ana

BAFIN

Ora Ana

CMA

Ora Ana

SCB

Ora Ana

DFSA

Ora Ana

CBFSAI

Ora Ana

BVIFSC

Ora Ana

FSCA

Ora Ana

FSA

Ora Ana

FFAJ

Ora Ana

ADGM

Ora Ana

FRSA

71% akun investor ritel kelangan dhuwit nalika dagang CFD karo panyedhiya iki.

Deposit Min

$100

Nyebar min.

- pitik

Leverage maks

400

Pasangan Currency

50

Platform dagang

Metode Pendanaan

Diatur dening

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

Apa sampeyan bisa dagang

forex

Indeks

tumindak

Pranala dhumateng kaca punika

raw Materials

Etfs

Rata-rata nyebar

EUR / GBP

1

EUR / USD

0.9

EUR / JPY

1

EUR / CHF

1

GBP / USD

1

GBP / JPY

1

GBP / CHF

1

USD / JPY

1

USD / CHF

1

CHF / JPY

1

Fee Tambahan

Rate terus menerus

-

Konversi

- pitik

angger-angger

Ora Ana

FCA

Ya

CYSEC

Ya

ASIC

Ora Ana

CFTC

Ora Ana

NFA

Ora Ana

BAFIN

Ora Ana

CMA

Ora Ana

SCB

Ora Ana

DFSA

Ya

CBFSAI

Ya

BVIFSC

Ya

FSCA

Ya

FSA

Ya

FFAJ

Ya

ADGM

Ya

FRSA

71% akun investor ritel kelangan dhuwit nalika dagang CFD karo panyedhiya iki.

Deposit Min

$10

Nyebar min.

- pitik

Leverage maks

10

Pasangan Currency

60

Platform dagang

Metode Pendanaan

Apa sampeyan bisa dagang

forex

Indeks

Pranala dhumateng kaca punika

Rata-rata nyebar

EUR / GBP

1

EUR / USD

1

EUR / JPY

1

EUR / CHF

1

GBP / USD

1

GBP / JPY

1

GBP / CHF

1

USD / JPY

1

USD / CHF

1

CHF / JPY

1

Fee Tambahan

Rate terus menerus

-

Konversi

- pitik

angger-angger

Ora Ana

FCA

Ora Ana

CYSEC

Ora Ana

ASIC

Ora Ana

CFTC

Ora Ana

NFA

Ora Ana

BAFIN

Ora Ana

CMA

Ora Ana

SCB

Ora Ana

DFSA

Ora Ana

CBFSAI

Ora Ana

BVIFSC

Ora Ana

FSCA

Ora Ana

FSA

Ora Ana

FFAJ

Ora Ana

ADGM

Ora Ana

FRSA

Ibukutha sampeyan duwe risiko.

Deposit Min

$50

Nyebar min.

- pitik

Leverage maks

500

Pasangan Currency

40

Platform dagang

Metode Pendanaan

Apa sampeyan bisa dagang

forex

Indeks

tumindak

raw Materials

Rata-rata nyebar

EUR / GBP

-

EUR / USD

-

EUR / JPY

-

EUR / CHF

-

GBP / USD

-

GBP / JPY

-

GBP / CHF

-

USD / JPY

-

USD / CHF

-

CHF / JPY

-

Fee Tambahan

Rate terus menerus

-

Konversi

- pitik

angger-angger

Ora Ana

FCA

Ora Ana

CYSEC

Ora Ana

ASIC

Ora Ana

CFTC

Ora Ana

NFA

Ora Ana

BAFIN

Ora Ana

CMA

Ora Ana

SCB

Ora Ana

DFSA

Ora Ana

CBFSAI

Ora Ana

BVIFSC

Ora Ana

FSCA

Ora Ana

FSA

Ora Ana

FFAJ

Ora Ana

ADGM

Ora Ana

FRSA

71% akun investor ritel kelangan dhuwit nalika dagang CFD karo panyedhiya iki.

The importance of horizontal levels

Most traders consider horizontal levels to be just as important as price action, which is the core to Forex trading. Analyzing the combination of the price change and the horizontal levels can allow us to understand the trend and predict where the market will go next. Although horizontal levels is a very basic Forex trading strategy, many famous and experienced traders such as Jesse Livermore, Warren Buffett, and George Soros have confirmed that they use it as a basis to many of their strategies.

To learn more about How to read and trade the price action – Forex Trading Strategies

Horizontal levels help us spot key areas on a chart where a change in trend is likely to occur. This can help us when deciding where to place a stop, or when we want to enter a trade but don’t know the right time to do so. Precise timing can be crucial in many Forex trading strategies and a careful analysis of the horizontal levels can help us find the correct timing and place a good trade. Keep in mind that horizontal levels may be the foundation for many strategies but on its own, it is usually not enough and must be used in combination with other forex trading strategies.

Horizontal Levels and ‘Swing Points’

The best way to use horizontal levels to our advantage is by analyzing the swing points. Swing points are points where the trend changes, and by marking horizontal levels at these points we can find prices where there is likely to be a change in trend. The illustration below clearly shows how we can use horizontal levels to our advantage.

Notice how the swing points have the tendency to repeat themselves. Support levels can turn into resistance levels and vice versa. By marking the horizontal levels on the chart we can predict when the next swing point will occur and enter/exit a trade at the perfect time. The blue circles on the chart are the points that we should have been able to notice in advanced. These are the most obvious entry points, and by noticing them we would have given an edge to any strategy that we chose to use.

Horizontal Levels and Ranging Markets

Horizontal levels are also very useful in range-bound markets. Range-bound markets are markets where the price has very clear upper and lower boundaries that the price doesn’t cross. By watching the price as it approaches one of the boundaries we can predict with great accuracy where the price will trend next. As always, the price can be unpredictable and might break the boundary just as we decide to enter a trade, but overall this strategy is very reliable and safe. The illustration below shows an example of a range-bound market.

Notice how the price jumps back and forth between two very obvious boundaries. By marking these boundaries as our horizontal levels we can use them to our advantage. Wait for the price to approach one of the boundaries to make a move. As we know that the price is not likely to cross the horizontal level at the boundary, we can enter a trade, expecting the trend to switch, and the price to go back away from the horizontal level.

If the price was approaching the upper boundary, expect the trend to be bearish and the price to go down and if the price was approaching the lower boundary expect a bullish trend and an up-going price change. Risk and reward levels are also very easy to choose in this kind of market. The risk level should be just above or below the boundary that you entered the trade from and the reward level should be at the opposite boundary of the range-bound market.

It is important to remember that these are only three Forex trading strategies which are based on technical analysis of the charts. There are dozens of unique strategies out there. Some are long term and some are short term. Some forex trading strategies involve great risk while others are almost risk-free. Some strategies are based on a deep understanding of current economic events while others are based on a technical analysis of the market and trends. The list is endless and diverse.