Inkonzo yokurhweba ikopi. I-Algo yethu ivula ngokuzenzekelayo kwaye ivale urhwebo.

I-L2T Algo inikezela ngemiqondiso enengeniso ephezulu kunye nomngcipheko omncinci.

24/7 urhwebo cryptocurrency. Ngelixa ulalayo, siyarhweba.

Ukuseta imizuzu eli-10 kunye neenzuzo ezinkulu. Incwadi yesikhokelo ibonelelwe ngokuthenga.

79% izinga lempumelelo. Iziphumo zethu ziya kukuvuyisa.

Ukuya kuthi ga kwi-70 yorhwebo ngenyanga. Kukho ngaphezu kwe-5 izibini ezikhoyo.

Imirhumo yenyanga iqala kwi-£58.

In the first part of this series, we explained the two extremes of trader personality. In part two we will discuss the trading strategies that fit each type of trader personality. When people start trading forex, they learn how the market works and what makes it oscillate. After trading for some time, traders develop their trading skills and become more confident, in fact, they become too confident and that´s when their personality kicks in. Sooner or later your personality will affect your trading. Impulsive traders start opening too many trades and closing them short while conservative traders wait too long and miss many good opportunities.

Although the vast majority of traders are not only impulsive or reserved, we do tend to lean towards one side of the personality type spectrum. This is why it is better to discover your personality, accept it and find a trading method that suits your personality from the very beginning, rather than doing it halfway after you have gone through a painful losing streak. When forex traders apply a trading method that matches their personality, they are much more likely to succeed. So, what trading methods and strategies are best for each personality type?

4

indlela ekuhlawuliswa

Izicwangciso zokurhweba

Ulawulwa ngu

inkxaso

Min.Idiphozithi

Ukunyusa ubuninzi

wePurble yeloo

uhlelo

App yeFowuni

Min.Idiphozithi

$100

Ukusasaza min.

Ii-variables pips

Ukunyusa ubuninzi

100

wePurble yeloo

40

Izicwangciso zokurhweba

Izindlela zokuxhaswa

Ulawulwa ngu

FCA

Yintoni onokuyithengisa

Forex

Indice

izenzo

Cryptocurrencies

Iimpahla ezingekasilwa

Umyinge wokusasazeka

YeEUR / IGBP

-

YeEUR / USD

-

YeEUR / JPY

0.3

YeEUR / CHF

0.2

IGBP / USD

0.0

IGBP / JPY

0.1

IGBP / CHF

0.3

USD / JPY

0.0

USD / CHF

0.2

CHF / JPY

0.3

Imali eyongezelelweyo

Ireyithi eqhubekayo

Iintlobo

Inguquko

Ii-variables pips

ummiselo

Ewe

FCA

Hayi

CYSEC

Hayi

ASIC

Hayi

CFTC

Hayi

NFA

Hayi

BAFIN

Hayi

CMA

Hayi

I-SCB

Hayi

DFSA

Hayi

CBFSAI

Hayi

BVIFSC

Hayi

I-FSCA

Hayi

FSA

Hayi

I-FFAJ

Hayi

I-ADGM

Hayi

I-FRSA

Iipesenti ezingama-71 zeeakhawunti zotyalo mali zilahleka xa kuthengiswa iiCFD kunye nalo mboneleli.

Min.Idiphozithi

$100

Ukusasaza min.

- ipips

Ukunyusa ubuninzi

400

wePurble yeloo

50

Izicwangciso zokurhweba

Izindlela zokuxhaswa

Ulawulwa ngu

CYSECASICCBFSAIBVIFSCI-FSCAFSAI-FFAJI-ADGMI-FRSA

Yintoni onokuyithengisa

Forex

Indice

izenzo

Cryptocurrencies

Iimpahla ezingekasilwa

Njl

Umyinge wokusasazeka

YeEUR / IGBP

1

YeEUR / USD

0.9

YeEUR / JPY

1

YeEUR / CHF

1

IGBP / USD

1

IGBP / JPY

1

IGBP / CHF

1

USD / JPY

1

USD / CHF

1

CHF / JPY

1

Imali eyongezelelweyo

Ireyithi eqhubekayo

-

Inguquko

- ipips

ummiselo

Hayi

FCA

Ewe

CYSEC

Ewe

ASIC

Hayi

CFTC

Hayi

NFA

Hayi

BAFIN

Hayi

CMA

Hayi

I-SCB

Hayi

DFSA

Ewe

CBFSAI

Ewe

BVIFSC

Ewe

I-FSCA

Ewe

FSA

Ewe

I-FFAJ

Ewe

I-ADGM

Ewe

I-FRSA

Iipesenti ezingama-71 zeeakhawunti zotyalo mali zilahleka xa kuthengiswa iiCFD kunye nalo mboneleli.

Min.Idiphozithi

$10

Ukusasaza min.

- ipips

Ukunyusa ubuninzi

10

wePurble yeloo

60

Izicwangciso zokurhweba

Izindlela zokuxhaswa

Yintoni onokuyithengisa

Forex

Indice

Cryptocurrencies

Umyinge wokusasazeka

YeEUR / IGBP

1

YeEUR / USD

1

YeEUR / JPY

1

YeEUR / CHF

1

IGBP / USD

1

IGBP / JPY

1

IGBP / CHF

1

USD / JPY

1

USD / CHF

1

CHF / JPY

1

Imali eyongezelelweyo

Ireyithi eqhubekayo

-

Inguquko

- ipips

ummiselo

Hayi

FCA

Hayi

CYSEC

Hayi

ASIC

Hayi

CFTC

Hayi

NFA

Hayi

BAFIN

Hayi

CMA

Hayi

I-SCB

Hayi

DFSA

Hayi

CBFSAI

Hayi

BVIFSC

Hayi

I-FSCA

Hayi

FSA

Hayi

I-FFAJ

Hayi

I-ADGM

Hayi

I-FRSA

Imali yakho eyinkunzi isemngciphekweni.

Min.Idiphozithi

$50

Ukusasaza min.

- ipips

Ukunyusa ubuninzi

500

wePurble yeloo

40

Izicwangciso zokurhweba

Izindlela zokuxhaswa

Yintoni onokuyithengisa

Forex

Indice

izenzo

Iimpahla ezingekasilwa

Umyinge wokusasazeka

YeEUR / IGBP

-

YeEUR / USD

-

YeEUR / JPY

-

YeEUR / CHF

-

IGBP / USD

-

IGBP / JPY

-

IGBP / CHF

-

USD / JPY

-

USD / CHF

-

CHF / JPY

-

Imali eyongezelelweyo

Ireyithi eqhubekayo

-

Inguquko

- ipips

ummiselo

Hayi

FCA

Hayi

CYSEC

Hayi

ASIC

Hayi

CFTC

Hayi

NFA

Hayi

BAFIN

Hayi

CMA

Hayi

I-SCB

Hayi

DFSA

Hayi

CBFSAI

Hayi

BVIFSC

Hayi

I-FSCA

Hayi

FSA

Hayi

I-FFAJ

Hayi

I-ADGM

Hayi

I-FRSA

Iipesenti ezingama-71 zeeakhawunti zotyalo mali zilahleka xa kuthengiswa iiCFD kunye nalo mboneleli.

In order to be successful, you must match your trading strategy to your personality

Strategies for the impulsive personality type

The impulsive type should find a trading method that gives results quickly and won’t require the traders to stay in the market too long. Impulsive traders want to get in and out of the market within a short period of time since they lack the patience to hold positions for too long. So, the best strategies for them are scalping, short-term trading, news trading and breakout trading.

- Scalping is a trading strategy for very active traders. Those that itch to trade and want to get every pip. Scalpers usually use 1-minute to 5-minute charts. They spot opportunities when the price is overbought or oversold in these timeframe charts and enter the market, hold positions for a few second or minutes and exit with a few pips profit.

For the full scalping article: Scalping – Forex Trading Strategies

- Short-term trading consists of trades that last a little longer than the scalping trades. They usually last from 10-15 minutes up to one or two hours, although during quiet times the trades might last longer. These trades usually target 20-30 pips. The timeframe charts for short-term trades are 15-minutes or up to one-hour charts. Our short-term signals can be considered short-term trading.

For more about short-term trading: Long – Short Hedging Strategy – Forex Trading Strategies

- News trading is a forex strategy that suits impulsive traders as well. The news traders enter right before the economic data release, attempting to anticipate the outcome at or before the time the data is released. During news releases, the volatility is high so the trades close pretty quickly. If you want to apply the news trading strategy you must find a broker that executes trades quickly with minimal slippage. You must also learn how to read and interpret the economic data because it can often be tricky.

To learn more about trading the news: Trading the News – Forex Trading Strategies

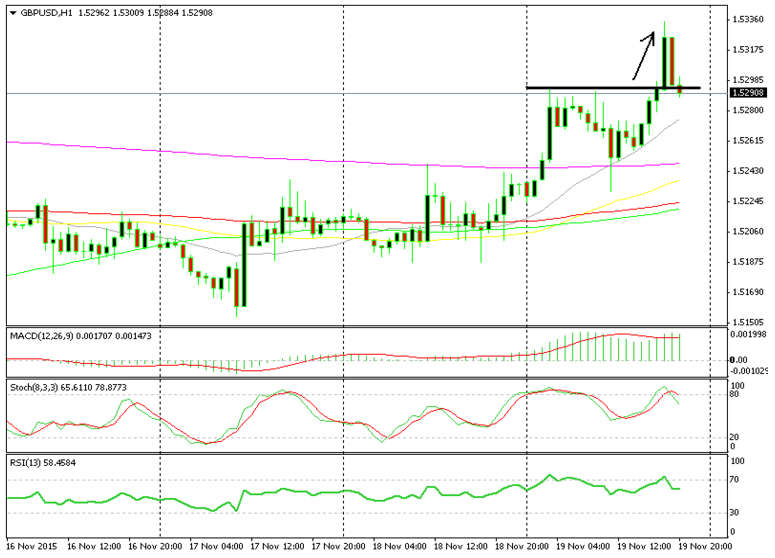

- The breakout strategy is another forex strategy for impulsive traders. As you can see in the chart below, the price has slumped about 50 pips in a matter of minutes after breaking the 1.53 resistance level in GBP/USD. When you apply the breakout trading strategy, you enter after the price breaks the resistance and close the trade a few minutes later with a nice profit.

The price jumps 50 pips after the breakout occurs

Strategies for the patient personality types

If you are a conservative trader, then the bigger timeframe charts are the best way to trade. Some trading strategies for the conservative trader types are: trend-following, moving average strategy and hedging trading strategy.

- When you apply the trend-following trading strategy, you identify trends. For example, you follow an uptrend or a downtrend in the one-hour, four-hour or daily chart, draw a trend line which touches the tops or the bottoms of the retraces, then wait until the price comes back to the trend line. It is better to wait for a confirmation, when the price retraces to the trend line, so you get better odds for the trade going your way. The confirmation might be a doji, a pin or a hammer candle in the hourly or four-hour chart.

For the full trend-trading article: Trend Trading – Forex Trading Strategies

- The hedging trading strategy is a bit more complex than the trend-following trading strategy. For the hedging trading strategy, you buy and sell two correlated currencies, such as NZD and AUD, against another currency. It is a fundamental trading strategy but you can use the charts as well to get better entries and exits. You evaluate which of the two countries (Australia and New Zealand) is doing better economically and buy that currency against the USD, the Yen or the Euro and sell the other. Let´s say you buy NZD/USD, which the Kiwi is linked to, beis going up and you sell AUD/USD because the Chinese economy, which the Aussie is linked to, is having troubles. If the USD declines it means that both pairs will go up, but NZD/USD (which you bought) will gain more than AUD/USD (which you sold) because of the specifics regarding Kiwi and Aussie. So, your profit from the NZD/USD buy trade will be bigger than the losses from your AUD/USD sell trade.

To learn all about the hedging strategy: Hedging – Forex Trading Strategies

- Another trading strategy for patient traders is the moving average forex trading strategy. It is similar to the trend trading strategy. However, instead of the trend line you use moving averages. Many people use moving averages on their charts, therefore they have higher odds of acting as support/resistance since many traders open a position when the price reaches a certain moving average. Below is the four-hour EUR/USD chart. As you can see, during the downtrend the price makes a retrace up the 50 MA in yellow and then resumes the downtrend again. This has happened four times during the past five weeks, which means that the sellers pile up when the price reaches the 20 MA. The patient type traders can use a trading strategy which consists of selling this pair when the price gets close to the 50 MA and close about a week later with hundreds pips of profit. Another trading strategy is to sell EUR/USD when the price and the 50 MA meet for the first time, and then add to that position on every other encounter, keeping all the trades open as the price moves down.

For more about the moving average strategy: Trading Moving Averages – Forex Trading Strategies

The price has reversed each time after reaching the 50 MA

There are many trading strategies, so whatever personality type you have and whatever type of trader you are, there are sure to be many strategies which can fit your profile. You can check out the strategies that we have on our forex strategies section on our FXML site for more strategy ideas.