Service pikeun dagang salinan. Algo kami otomatis muka sareng nutup perdagangan.

The L2T Algo nyadiakeun sinyal kacida nguntungkeun kalayan resiko minimal.

24/7 dagang cryptocurrency. Bari saré, urang dagang.

Setup 10 menit kalayan kauntungan anu ageung. Manual disadiakeun kalawan beuli.

79% Laju kasuksésan. Hasil kami bakal ngagumbirakeun anjeun.

Nepi ka 70 dagang per bulan. Aya leuwih ti 5 pasang sadia.

Langganan bulanan dimimitian dina £ 58.

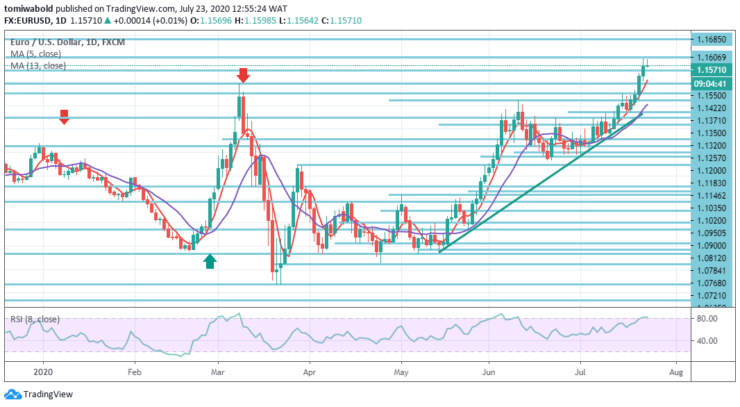

Analisis Harga EURUSD - 23 Juli

EURUSD’s upward traction stopped from its rise to a level of 1.1600 as the technical view of the pair indicates a correction. The Euro’s advance edges lower on Thursday in early European trading, as increasing U.S./China tensions affect risk sentiment. China is set to respond in retaliation to the US shutting of its Houston embassy.

Tahap konci

Tingkat Résistansi: 1.1750, 1.1685, 1.1606

Tingkat Dukungan: 1.1550, 1.1422, 1.1350

During Thursday’s European trading hours EURUSD traded close to 1.1598 level, confronting rejection at 1.1602 level. The pullback may be pushed farther down to levels beneath 1.1550, as the relative strength index (RSI) on the daily chart indicates an overbought condition.

The trend according to the daily chart may stay bullish as long as the pair holds beyond the ascending trendline and both MAs beyond the 1.1400 marks. A required downside correction of EURUSD is anticipated, as the pair has grounds to correct downwards.

At this point, the intraday bias in EURUSD stays on the upside. Present 1.0635 level rally may attempt a 100 percent projection of 1.0784 to 1.1422 levels from 1.1183 next to 1.1750 level. If the predicted resistance persists, a reversal to the south is probable to appear.

On the downside, a support level breach of 1.1400 is required to indicate short-term tops. Anything else, the forecast in the event of a fall must stay bullish. So for now, note that the pair may gain support from the 5 moving average and the 1.1550 horizontal support level.

Catetan: Learn2.trade sanés panaséhat kauangan. Ngalaksanakeun panilitian anjeun sateuacan investasi dana anjeun dina aset kauangan atanapi produk atanapi acara anu disajikeun. Kami henteu tanggel waler pikeun hasil investasi anjeun

- calo

- mnt deposit

- Asup

- Didatangan Broker

- Platform dagang Cryptocurrency anu unggul

- Deposit minimum $ 100,

- FCA & Cysec diatur

- 20% wilujeng sumping bonus dugi ka $ 10,000

- deposit minimum $ 100

- Verifikasi akun anjeun sateuacan bonus kiridit

- Langkung 100 produk kauangan anu béda

- Investasi tina sakedik $ 10

- Ditarikna dinten anu sami tiasa

- Waragad Perdagangan Terendah

- 50% Wilujeng sumping Bonus

- Pangrojong 24 Jam anu meunang

- Rekening Pasar Moneta Fund kalayan sahanteuna $ 250

- Milih nganggo formulir pikeun ngaku 50% bonus deposit anjeun