Service pikeun dagang salinan. Algo kami otomatis muka sareng nutup perdagangan.

The L2T Algo nyadiakeun sinyal kacida nguntungkeun kalayan resiko minimal.

24/7 dagang cryptocurrency. Bari saré, urang dagang.

Setup 10 menit kalayan kauntungan anu ageung. Manual disadiakeun kalawan beuli.

79% Laju kasuksésan. Hasil kami bakal ngagumbirakeun anjeun.

Nepi ka 70 dagang per bulan. Aya leuwih ti 5 pasang sadia.

Langganan bulanan dimimitian dina £ 58.

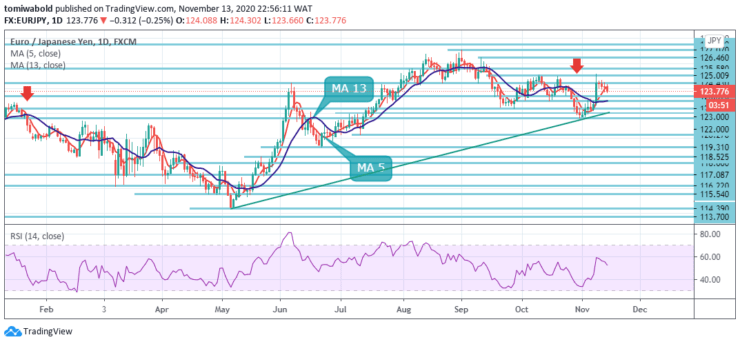

Analisis Harga EURJPY - 13 November

The common European currency has declined by 0.54% versus the Japanese Yen from the prior session to sub 124.00 level while exiting the week in a bearish zone. The currency pair breached the moving average of 5 to trade lower. The upside potential against the JPY could be limited due to a combination of factors such as ECB fiscal policy.

Tingkat konci

Tingkat Résistansi: 127.07, 125.58, 124.43,

Tingkat Dukungan: 123.37, 121.61, 119.31

EURJPY initially traded higher on Friday, but after it reached resistance around 124.30 and pulled back, bears appeared as traders turned their attention to levels below 124.00. To begin exploring the bearish scenario, it is necessary to establish a decisive fall below 123.37. The pair may continue to decline with a potential target for bearish traders around 123.00.

Dina kontéks anu langkung lega, kamekaran ti 114.39 ditingali salaku fase jangka pertengahan pertumbuhan dina tren konsolidasi jangka panjang. Keuntungan salajengna diantisipasi salami tingkat dukungan 119.31 diayakeun. Nanging, breakout padet 119.31 bakal ngabuktoskeun yén rally ti 114.39 parantos réngsé sareng parantos nganteurkeun low ieu deui.

EURJPY intraday bias stays optimistic as consolidation from 125.00 is still ongoing. Continuous advance is anticipated until minor support level 123.00 is breached. The correction from the level of 127.07 could have ended with three cycles down to the level of 121.61.

A breach of the minor resistance zone at 125.00 should lead to a retest of the 127.07 upper level. On the other hand, a breach of the minor support level at 123.00 would extend the correction with another fall to 121.61.

Catetan: Diajar2. Trade sanés panaséhat kauangan. Ngalaksanakeun panilitian anjeun sateuacan investasi dana anjeun dina aset kauangan atanapi produk atanapi acara anu disajikeun. Kami henteu tanggel waler pikeun hasil investasi anjeun

- calo

- mnt deposit

- Asup

- Didatangan Broker

- Platform dagang Cryptocurrency anu unggul

- Deposit minimum $ 100,

- FCA & Cysec diatur

- 20% wilujeng sumping bonus dugi ka $ 10,000

- deposit minimum $ 100

- Verifikasi akun anjeun sateuacan bonus kiridit

- Langkung 100 produk kauangan anu béda

- Investasi tina sakedik $ 10

- Ditarikna dinten anu sami tiasa

- Waragad Perdagangan Terendah

- 50% Wilujeng sumping Bonus

- Pangrojong 24 Jam anu meunang

- Rekening Pasar Moneta Fund kalayan sahanteuna $ 250

- Milih nganggo formulir pikeun ngaku 50% bonus deposit anjeun