Au'aunaga mo kopi fefa'ataua'iga. Ole matou Algo e otometi lava ona tatala ma tapunia fefaʻatauaiga.

O le L2T Algo o lo'o tu'uina atu fa'ailoga sili ona aoga ma fa'aletonu la'ititi.

24/7 cryptocurrency fefaʻatauaʻiga. A o e momoe, matou te fefaatauai.

10 minute seti faʻatasi ai ma faʻamanuiaga tele. O loʻo tuʻuina atu le tusi lesona ma le faʻatau.

79% Fa'amanuiaina fua faatatau. O a matou taunuuga o le a faʻafiafiaina oe.

E oʻo atu i le 70 fefaʻatauaʻiga i le masina. E silia ma le 5 paipa o lo'o avanoa.

E amata totogi masina ile £58.

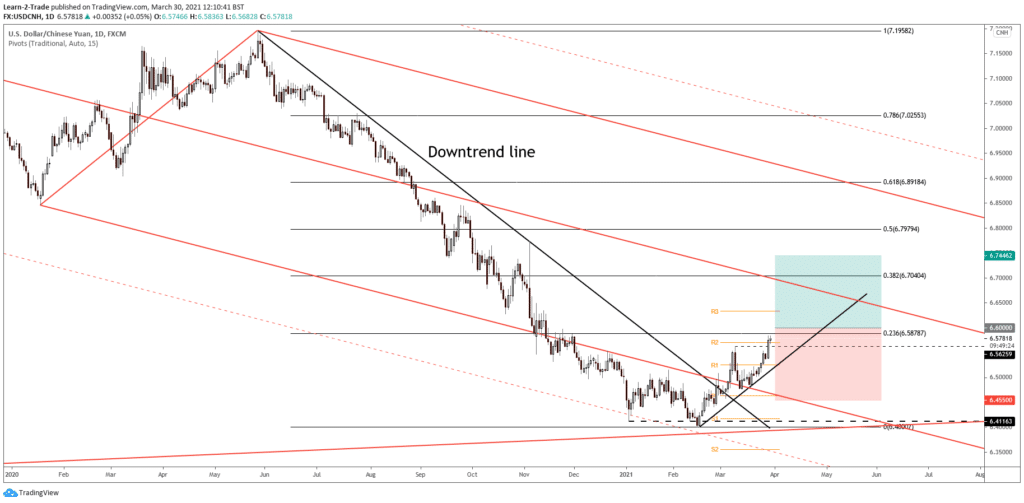

USD/CNH registered a new higher yesterday by closing at 6.5746 above 6.5625 former high. Technically, the pair tries to develop a new uptrend, a bullish reversal after breaking above the major downtrend line.

The currency pair may resume its upside movement, the uptrend, if the US economic data continues to come in line with expectations or better during the week. Today, the US Consumer Confidence could boost the greenback if the indicator jumps from 91.3 to 96.9 points as expected.

USD/CNH Daily Chart Analysis!

USD/CNH jumped above the R2 (6.5708) static resistance and now is struggling to confirm this breakout. Stabilizing above 6.5625 and beyond the R2 could indicate more gains ahead.

Jumping and consolidating above the 23.6% retracement level is seen as a long opportunity. A valid breakout above this level could announce a bullish momentum towards the 38.2% retracement level, or higher if the US Dollar Index continues to increase.

iʻuga

The bullish bias remains intact as long as the pair stands above the black uptrend line. Consolidating here above the R2 (6.5708) or above the 23.6% could offer us a long opportunity.

- posi

- Min Teugatupe

- togi

- Asiasia le Faletupe

- Taui manumalo Cryptocurrency platform

- $ 100 totogi maualalo,

- FCA & Cysec faʻatonutonu

- 20% faʻafeiloaʻiga ponesi e oʻo atu i le $ 10,000

- Tupe maualalo $ 100

- Faʻamaonia lau teuga tupe muamua o le ponesi

- Sili atu 100 eseʻese oloa tautupe

- Inivesi mai sina $ 10

- E mafai ona toʻesea le aso e tasi

- Le tau maualalo o tau o fefaatauaiga

- 50% ponesi Faafeiloaiga

- Faʻailoga-manumalo 24 Itula Lagolago

- Tupe Moneta Markets teutupe ma le maualalo o le $ 250

- Filifili i le faʻaaogaina o le fomu e tapa ai lau 50% tupe teu