Layanan kanggo dagang salinan. Algo kita kanthi otomatis mbukak lan nutup perdagangan.

L2T Algo nyedhiyakake sinyal sing duwe bathi kanthi resiko minimal.

24/7 dagang cryptocurrency. Nalika sampeyan turu, kita dagang.

10 menit persiyapan karo kaluwihan substansial. Manual diwenehake karo tuku.

79% tingkat sukses. Asil kita bakal excite sampeyan.

Nganti 70 dagang saben wulan. Ana luwih saka 5 pasangan kasedhiya.

Langganan saben wulan diwiwiti ing £58.

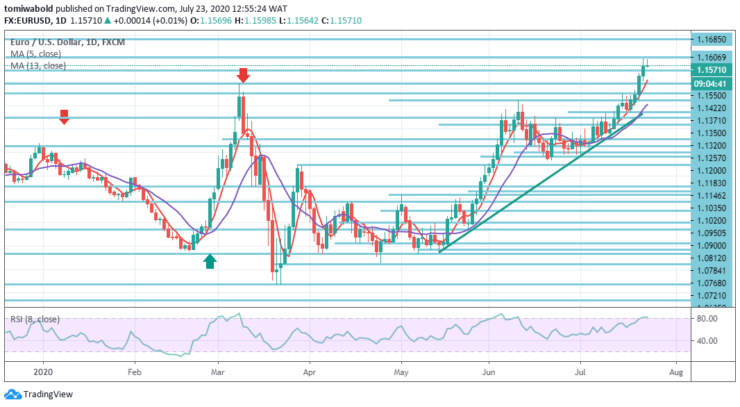

Analisis rega EURUSD - 23 Juli

EURUSD’s upward traction stopped from its rise to a level of 1.1600 as the technical view of the pair indicates a correction. The Euro’s advance edges lower on Thursday in early European trading, as increasing U.S./China tensions affect risk sentiment. China is set to respond in retaliation to the US shutting of its Houston embassy.

Tingkat Key

Resistance Levels: 1.1750, 1.1685, 1.1606

Dhukungan tingkat: 1.1550, 1.1422, 1.1350

During Thursday’s European trading hours EURUSD traded close to 1.1598 level, confronting rejection at 1.1602 level. The pullback may be pushed farther down to levels beneath 1.1550, as the relative strength index (RSI) on the daily chart indicates an overbought condition.

The trend according to the daily chart may stay bullish as long as the pair holds beyond the ascending trendline and both MAs beyond the 1.1400 marks. A required downside correction of EURUSD is anticipated, as the pair has grounds to correct downwards.

At this point, the intraday bias in EURUSD stays on the upside. Present 1.0635 level rally may attempt a 100 percent projection of 1.0784 to 1.1422 levels from 1.1183 next to 1.1750 level. If the predicted resistance persists, a reversal to the south is probable to appear.

On the downside, a support level breach of 1.1400 is required to indicate short-term tops. Anything else, the forecast in the event of a fall must stay bullish. So for now, note that the pair may gain support from the 5 moving average and the 1.1550 horizontal support level.

Catetan: Learn2.trade dudu penasihat finansial. Riset sadurunge nggawe dana ing aset finansial utawa produk utawa acara sing ditampilake. Kita ora tanggung jawab kanggo asil investasi sampeyan

- broker

- Simpenan Min

- Score

- Dolan maring Broker

- Platform dagang Cryptocurrency sing menang

- Setoran minimal $ 100,

- FCA & Cysec diatur

- Bonus sambutan 20% nganti $ 10,000

- Simpenan minimal $ 100

- Verifikasi akun sampeyan sadurunge bonus dikreditake

- Luwih saka 100 produk finansial sing beda

- Nandur modal saka $ 10

- Penarik dina padha bisa ditindakake

- Akun Pasar Moneta Fund kanthi minimal $ 250

- Pilih nggunakake formulir kanggo njaluk 50% bonus deposit sampeyan