Ọrụ maka ịzụ ahịa nnomi. Algo anyị na-emepe ma mechie azụmaahịa na-akpaghị aka.

L2T Algo na-enye akara ngosi bara uru nke ukwuu na obere ihe egwu.

24/7 ahia cryptocurrency. Mgbe ị na-ehi ụra, anyị na-azụ ahịa.

Nhazi nkeji 10 nwere nnukwu uru. Enyere akwụkwọ ntuziaka na ịzụrụ.

Ọnụego ịga nke ọma 79%. Nsonaazụ anyị ga-atọ gị ụtọ.

Ruo azụmaahịa 70 kwa ọnwa. Enwere ihe karịrị ụzọ abụọ ise dị.

Ndebanye aha kwa ọnwa na-amalite na £58.

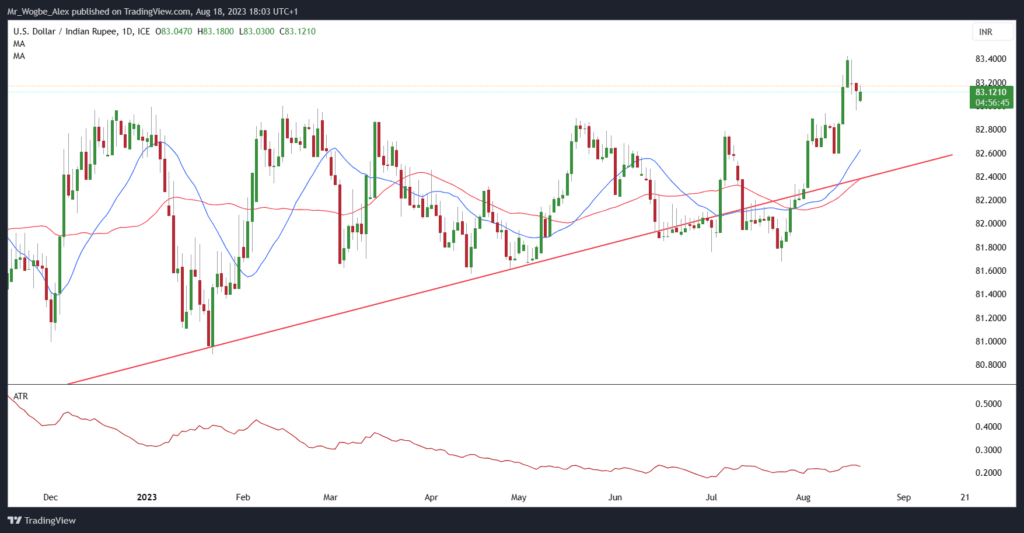

The Indian rupee concluded the week on a positive note, bolstered by the retreat in U.S. Treasury yields and a slight easing in the dollar’s strength. This respite follows a period of concern earlier in the week when fears of prolonged elevated U.S. interest rates had driven the rupee perilously close to an all-time low.

Closing around 83.12 against the U.S. dollar, the rupee recorded a modest 0.02% gain for the day. However, over the course of the week, the currency saw a marginal decline of 0.34%.

According to Reuters analysts, factors such as equity outflows and persistently high crude oil prices have acted as brakes on the rupee’s potential for further appreciation, citing a foreign exchange trader at a state-run bank. This expert views the rupee’s recent movement as primarily reflective of dollar strength rather than inherent INR weakness.

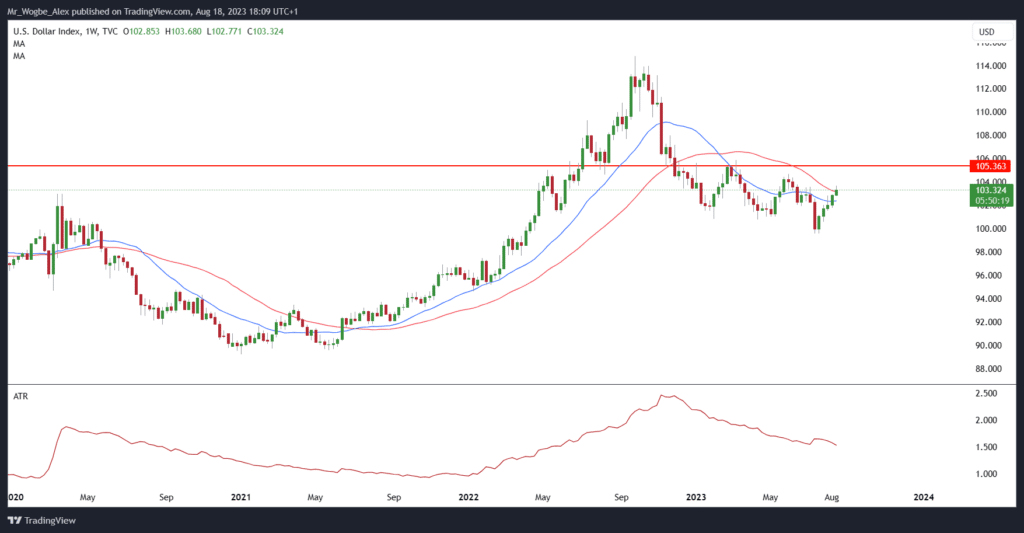

The dollar index displayed strength on Friday, indicating a possible fifth consecutive week of gains for the greenback. The surge can be attributed to the demand for safe-haven assets, a reaction to the anticipation of sustained U.S. treasury yields amidst ongoing concerns about China’s economic stability.

Dollar to Keep the Upper Hand Against the Rupee: IDFC Bank

IDFC Bank, in a recent note, pointed out the likelihood of continued upward pressure on the USD/INR exchange rate in the short term. The bank underscored the impact of rising U.S. Treasury yields on the dollar’s standing and highlighted that the potential announcement of heightened stimulus measures by China might further elevate crude oil prices, contributing to the dollar’s strength.

As the week drew to a close, Mandar Pitale, the head of treasury at SBM Bank India, projected a confined trading range for the rupee in the upcoming week, fluctuating between 82.75 and 83.25. Nevertheless, Pitale cautioned that extensive regulatory interventions could propel the rupee beyond these boundaries, leading to unforeseen strengthening.

Ị nwere ike ịzụta Lucky Block ebe a. Zụrụ LBLOCK

- Broker

- Min ego

- Akara

- Nleta Broker

- Onyinye-emeri Cryptocurrency trading n'elu ikpo okwu

- $ 100 nkwụnye ego kacha nta,

- FCA & Cysec chịkwara

- 20% nabata ego nke ihe ruru $ 10,000

- Obere nkwụnye ego $ 100

- Nyochaa akaụntụ gị tupu daashi na-otoro

- N'ime 100 ngwaahịa ego dị iche iche

- Tinye ego na $ 10

- Withdrawalwepu otu ụbọchị ga-ekwe omume

- Ahịa Moneta Ahịa nwere akaụntụ opekata mpe $ 250

- Banye iji mpempe akwụkwọ iji kwuo ego nkwụnye ego 50% gị