Tsjinst foar kopiearjen hannel. Us Algo iepenet en slút hannels automatysk.

De L2T Algo leveret heul profitable sinjalen mei minimaal risiko.

24/7 cryptocurrency hannel. Wylst jo sliepe, hannelje wy.

10 minuten opset mei substansjele foardielen. De hânlieding wurdt foarsjoen mei de oankeap.

79% súkses rate. Us útkomsten sille jo opwekke.

Oant 70 hannelingen per moanne. D'r binne mear as 5 pearen beskikber.

Moanlikse abonneminten begjinne by £ 58.

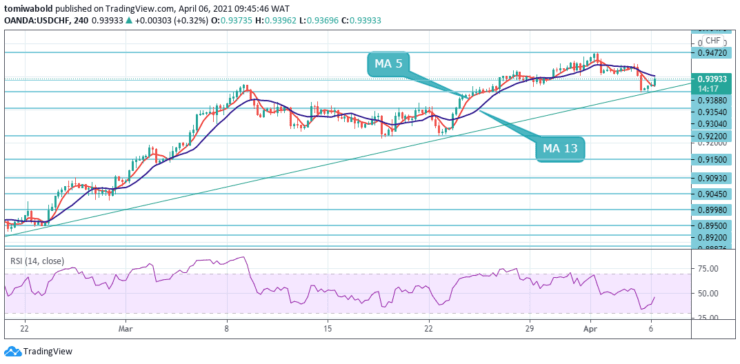

USDCHF-priisanalyse - 6 april

The USDCHF pair eases from the prior day’s high of 0.9438 while taking downside pressure to fresh lows, the selloff halts beyond the mid 0.9300 level during Tuesday’s European session. Renewed USD strength and mixed reports about US stimulus give investors a pause after sending US stocks to record highs.

Key Levels

Fersetsnivo: 0.9901, 0.9547, 0.9472

Stypjenivo's: 0.9354, 0.9304, 0.9220

USDCHF capitalized on its bounce at lows and rally to trade positively to intraday highs at 0.9388. Meanwhile, in a broader context, the fall from 1.0237 should have ended at 0.8756, which is an upbeat daily position. The current rally from 0.8756 should first reach the 0.9901 resistance.

There are no clear signs of withdrawal at this time. A break in this zone in the medium term will lead to the target at 1.0237 / 0342. Now this will remain the preferred option as long as the resistance at 0.9045 turns into support. Despite the rally, the overall daily trend remains in range after the initial bounce.

USDCHF’s plunge to fresh lows of 0.9354 level in the prior day and its rebound today suggests the uptrend may continue despite the minor correction. The intraday bias stays on the upside. And yet subsequent aim is 61.8% forecast of 0.9901 to 0.8998 from 0.9354 at 0.8756 levels.

Any such breach lower may pave the path to a long-term forecast level at 0.8639 level. On the upside, a breach of 0.9472 near-term resistance is required to indicate short-term bottoming. Yet still, the near-term trend stays in a range despite the anticipated recovery.

Noat: Learn2.Trade is gjin finansjeel adviseur. Doch jo ûndersyk foardat jo jo fûnsen ynvestearje yn alle finansjele aktiva as presinteare produkt as evenemint. Wy binne net ferantwurdlik foar jo ynvestearringsresultaten

- Broker

- Min boarchsom

- Skoare

- Besykje Broker

- Bekroand kryptovaluta-hannelsplatfoarm

- Minimale boarch fan $ 100,

- FCA & Cysec regele

- 20% wolkombonus fan maksimaal $ 10,000

- Minimale boarch $ 100

- Ferifiearje jo akkount foardat de bonus wurdt byskreaun

- Mear dan 100 ferskate finansjele produkten

- Ynvestearje fan mar $ 10

- Ynlûking fan deselde dei is mooglik

- Fûns Moneta Markets -akkount mei in minimum fan $ 250

- Meld jo oan mei it formulier om jo 50% boarchbonus op te easkjen