Tsjinst foar kopiearjen hannel. Us Algo iepenet en slút hannels automatysk.

De L2T Algo leveret heul profitable sinjalen mei minimaal risiko.

24/7 cryptocurrency hannel. Wylst jo sliepe, hannelje wy.

10 minuten opset mei substansjele foardielen. De hânlieding wurdt foarsjoen mei de oankeap.

79% súkses rate. Us útkomsten sille jo opwekke.

Oant 70 hannelingen per moanne. D'r binne mear as 5 pearen beskikber.

Moanlikse abonneminten begjinne by £ 58.

The intraday rebound was triggered by the risk-averse mood sweeping across markets, which tends to bolster demand for the precious metal.

Growing concerns over the worsening state of Coronavirus numbers globally and the imposition of renewed lockdown measures across Europe and China dampened investors’ risk mood. This risk-off flight was evident in the equity markets.

Nonetheless, the bullish tone surrounding the US dollar (DXY) could cap any further gains for the dollar-denominated in the meantime. The greenback got adequate support from the prevailing rally in the US Treasury bond yields.

Meanwhile, investors have been slowly pricing-in the possibility of a more pronounced US fiscal spending in 2021, including direct stimulus payments and hefty infrastructure spending. The downbeat NFP reports on Friday further strengthened this speculation and boosted the US Treasury bond yields to a 10-month high.

That said, it is advisable to avoid taking aggressive bets at the moment and wait for a sustained directional move. The market will be dictated by the broader market risk sentiment and the USD price dynamics, considering the absence of any market-moving economic releases today.

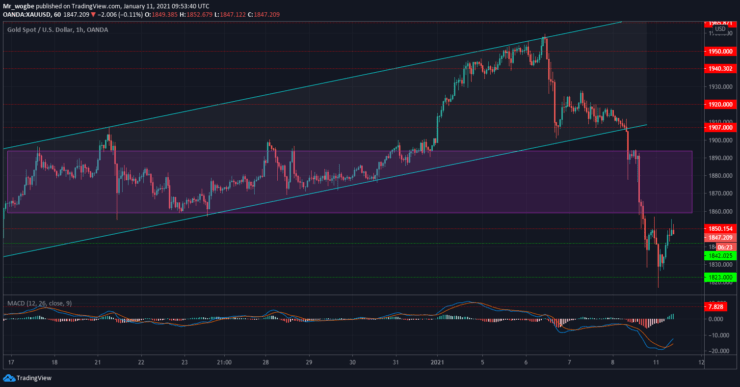

Gouden (XAU) weardefoarspelling - 11 jannewaris

XAU / USD Major Bias: Bullish

Oanbiedingsnivo's: $ 1859, $ 1880, en $ 1893

Fraachnivo's: $ 1842, $ 1823, en $ 1808

Following the devastating decline from last week, gold is now picking up the pieces and is making meaningful strides to get back into the $1859 – $1893 pivot zone and subsequently into the ascending channel.

That said, we expect the precious metal to stage a steady recovery near the $1880 in the coming hours and days.

Noat: Learn2.Trade is gjin finansjeel adviseur. Doch jo ûndersyk foardat jo jo fûnsen ynvestearje yn alle finansjele aktiva as presinteare produkt as evenemint. Wy binne net ferantwurdlik foar jo ynvestearringsresultaten.

- Broker

- Min boarchsom

- Skoare

- Besykje Broker

- Bekroand kryptovaluta-hannelsplatfoarm

- Minimale boarch fan $ 100,

- FCA & Cysec regele

- 20% wolkombonus fan maksimaal $ 10,000

- Minimale boarch $ 100

- Ferifiearje jo akkount foardat de bonus wurdt byskreaun

- Mear dan 100 ferskate finansjele produkten

- Ynvestearje fan mar $ 10

- Ynlûking fan deselde dei is mooglik

- Fûns Moneta Markets -akkount mei in minimum fan $ 250

- Meld jo oan mei it formulier om jo 50% boarchbonus op te easkjen