Tsjinst foar kopiearjen hannel. Us Algo iepenet en slút hannels automatysk.

De L2T Algo leveret heul profitable sinjalen mei minimaal risiko.

24/7 cryptocurrency hannel. Wylst jo sliepe, hannelje wy.

10 minuten opset mei substansjele foardielen. De hânlieding wurdt foarsjoen mei de oankeap.

79% súkses rate. Us útkomsten sille jo opwekke.

Oant 70 hannelingen per moanne. D'r binne mear as 5 pearen beskikber.

Moanlikse abonneminten begjinne by £ 58.

EURUSD Priisanalyse - 16 maart

Since trending as high as the 1.1236 level earlier in the day, at the time of writing, EURUSD has now come under some selling pressure and drops the price down to the 1.1172 level. In the second time this month, the US Federal Reserve is cutting the benchmark rate down to 0 percent -0.25 percent. The meeting where the regulator took the rate decision was again unscheduled, as this week’s scheduled meeting is set for earlier.

Key Levels

Fersetsnivo: 1.1500, 1.1350, 1.1250

Stypjenivo's: 1.1055, 1.0950, 1.0779

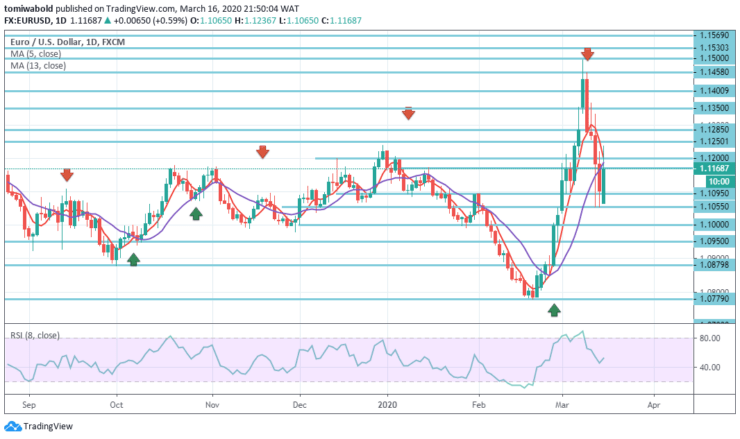

EURUSD Lange termyn Trend: fariearjend

In the larger structure, a rebound from 1.0779 low level faced heavy rejection from a 38.2 percent retraction of 1.1500 to 1.0779 at 1.1458 levels, as well as the 5 and 13 moving averages. Development argues that price behavior from the level at long-term trends of 1.0779 is just a corrective downward trend from the level at 1.1500 (high).

Further decline is in favor of retesting the level of 1.0700 (low). Sustained break of 1.1458 level, however, may increase the possibility of a long-term bullish reversal and target a 61.8 percent retraction at 1.1569 level.

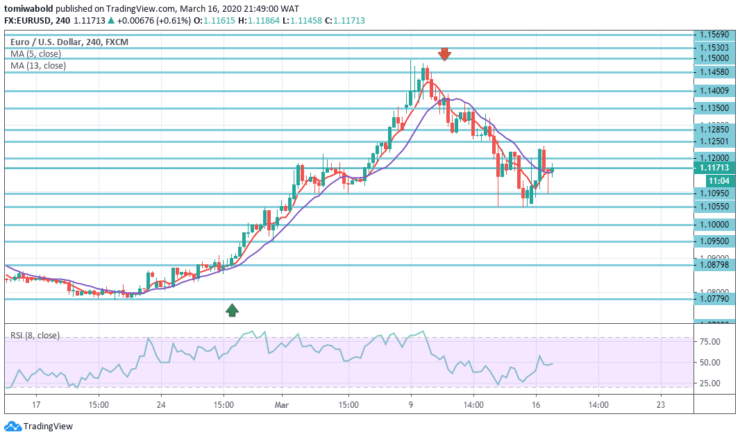

EURUSD Koarte termyn Trend: Bullish

The intraday bias is initially altered neutrally with a 4 hour RSI signal line cross over past 50. At the downside, the case of a rebound from 1.0779 level has completed at 1.1500 level may be reaffirmed below 1.1055 level.

Intraday bias can be back to the downside for 1.0779 level retesting. However, on the upside over the 1.1250 minor resistance level towards the 1.1500 resistance level will again alter bias to the upside.

Ynstrumint: EURUSD

Oarder: keapje

Yntreepriis: 1.1095

Stopje: 1.1000

Doel: 1.1285

Noat: Learn2Trade.com is gjin finansjeel adviseur. Doch jo ûndersyk foardat jo jo fûnsen ynvestearje yn alle finansjele aktiva as presinteare produkt as evenemint. Wy binne net ferantwurdlik foar jo ynvestearringsresultaten

- Broker

- Min boarchsom

- Skoare

- Besykje Broker

- Bekroand kryptovaluta-hannelsplatfoarm

- Minimale boarch fan $ 100,

- FCA & Cysec regele

- 20% wolkombonus fan maksimaal $ 10,000

- Minimale boarch $ 100

- Ferifiearje jo akkount foardat de bonus wurdt byskreaun

- Mear dan 100 ferskate finansjele produkten

- Ynvestearje fan mar $ 10

- Ynlûking fan deselde dei is mooglik

- Fûns Moneta Markets -akkount mei in minimum fan $ 250

- Meld jo oan mei it formulier om jo 50% boarchbonus op te easkjen