Iṣẹ fun daakọ iṣowo. Algo wa yoo ṣii laifọwọyi ati tilekun awọn iṣowo.

L2T Algo n pese awọn ifihan agbara ere pupọ pẹlu eewu kekere.

24/7 iṣowo cryptocurrency. Nigba ti o sun, a isowo.

Iṣeto iṣẹju 10 pẹlu awọn anfani nla. Iwe itọnisọna ti pese pẹlu rira.

Oṣuwọn aṣeyọri 79%. Awọn abajade wa yoo dun ọ.

Titi di awọn iṣowo 70 fun oṣu kan. Nibẹ ni o wa siwaju sii ju 5 orisii wa.

Ṣiṣe alabapin oṣooṣu bẹrẹ ni £ 58.

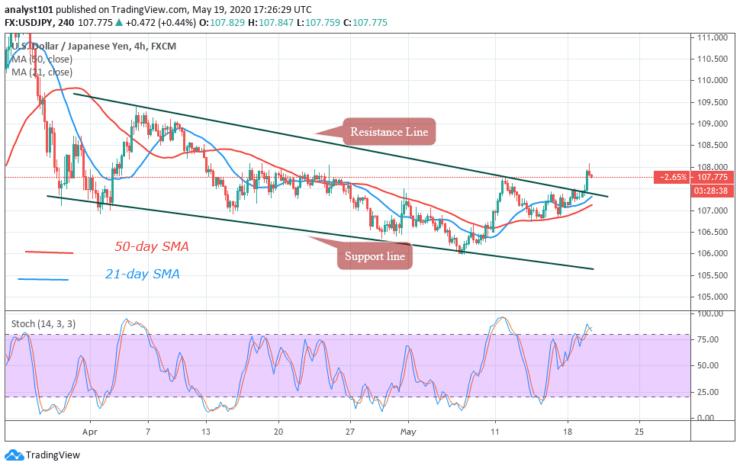

Awọn ipele Resistance Key: 111.000, 112.000, 113.000

Awọn ipele Atilẹyin bọtini: 104.000, 103.000, 102.000

USD / JPY Iye Aṣa-igba pipẹ: Aye

The USD/JPY pair is trading in a sideways trend. The price is fluctuating between levels 108.000 and 110.000. Today, the Yen is testing the lower price range to break above it. The index will be in the range-bound zone if price breaks above level 108.000. Otherwise, the market will continue its sideways move below level 108.000.

Awọn Ifihan Atọka Ojoojumọ Kika:

The 21-day SMA and 50-day SMA are sloping horizontally indicating the sideways move. The Yen is currently at level 55 of the daily Relative Strength Index. The Japanese Yen is still in the uptrend zone and above the centerline 50. The market is rising to break above the lower price range.

USD / JPY Aṣoju-igba Aṣa: Bullish

On the 4-hour chart, the pair is in a descending channel. Today, price is rising after breaking the resistance line. As price breaks the resistance and closes above it, it indicates a change in trend. It is currently approaching level108.000. The upward move is being resisted at level 108.000. The price may fall and resume the upward move.

Awọn afihan Awọn apẹrẹ Awọn apẹrẹ 4-wakati kika

The pair is above 80% range of the daily stochastic. The stochastic bands are making U-turn downward indicating that sellers may emerge. The SMAs are also sloping upward indicating the upward move.

Gbogbogbo Outlook fun USD / JPY

The USD/JPY pair is making an upward move. The Yen is currently facing resistance at level 108.000. A break above level 108.000 will accelerate the upward move to level 109.000.

akiyesi: Kọ ẹkọ 2. Iṣowo kii ṣe onimọran owo. Ṣe iwadi rẹ ṣaaju idoko-owo awọn owo-inọn rẹ ni dukia inawo eyikeyi tabi ọja ti a gbekalẹ tabi iṣẹlẹ. A ko ṣe iduro fun awọn abajade idoko-owo rẹ

- alagbata

- Idogo min

- O wole

- Ṣabẹwo si Broker

- Syeed iṣowo Cryptocurrency ti o gba ẹbun

- $ 100 idogo to kere ju,

- FCA & Cysec ṣe ilana

- 20% kaabo ajeseku ti to $ 10,000

- Idogo ti o kere ju $ 100

- Daju iroyin rẹ ṣaaju ki o to ka ajeseku

- Lori awọn ọja inawo oriṣiriṣi 100

- Ṣe idoko-owo lati diẹ bi $ 10

- Yiyọ ọjọ kanna ṣee ṣe

- Iṣiro Awọn ọja Iṣowo Moneta pẹlu o kere ju $ 250

- Jade ni lilo fọọmu lati beere fun idogo idogo 50% rẹ