Iṣẹ fun daakọ iṣowo. Algo wa yoo ṣii laifọwọyi ati tilekun awọn iṣowo.

L2T Algo n pese awọn ifihan agbara ere pupọ pẹlu eewu kekere.

24/7 iṣowo cryptocurrency. Nigba ti o sun, a isowo.

Iṣeto iṣẹju 10 pẹlu awọn anfani nla. Iwe itọnisọna ti pese pẹlu rira.

Oṣuwọn aṣeyọri 79%. Awọn abajade wa yoo dun ọ.

Titi di awọn iṣowo 70 fun oṣu kan. Nibẹ ni o wa siwaju sii ju 5 orisii wa.

Ṣiṣe alabapin oṣooṣu bẹrẹ ni £ 58.

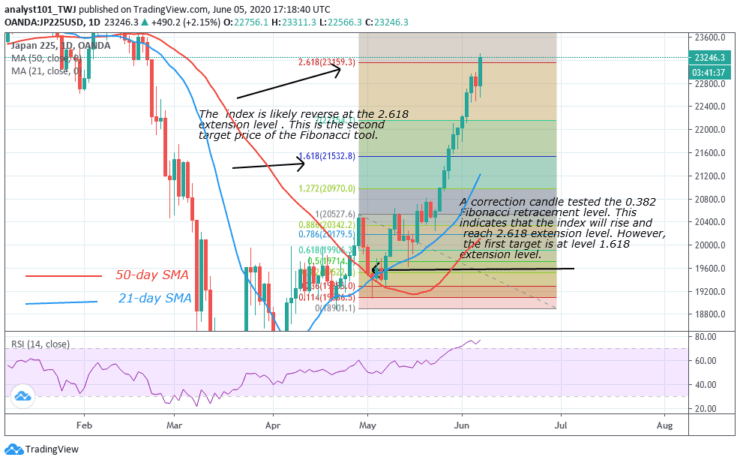

Awọn agbegbe Idaabobo Bọtini: 23200, 23600, 24000

Awọn agbegbe Atilẹyin Bọtini: 20800, 20400, 20000

Japan 225 (JP225USD) Aṣa igba pipẹ: Bullish

Japan 225 is in an uptrend. A correction candle tested the 0.382 Fibonacci retracement level. This indicates that the index will rise and reach 2.618 extension level. However, the first target price of the index is at level 1.618 extension level. The index is likely to reverse at the 2.618 extension level. This is the second target price of the Fibonacci tool. The RSI is confirming that the index is in the overbought region. The market may take a downward move.

Awọn Ifihan Atọka Ojoojumọ Kika:

Japan 225 has risen to level 76 of the Relative Strength Index. It is in the overbought region. Sellers are likely to emerge to push prices down. The 21-day SMA and 50-day SMA are sloping upward indicating the uptrend.

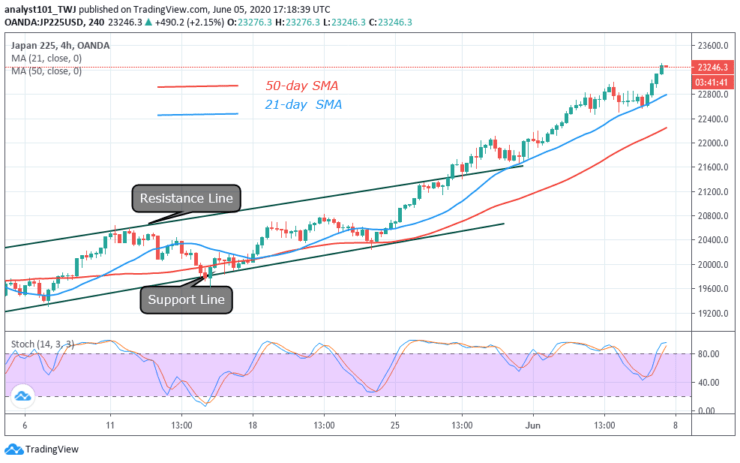

Japan 225 (JP225USD) Aṣa-igba alabọde: Bullish

On the 4- hour chart, the index is in an ascending channel. The price has risen and reached a high of level 23266 at the time of writing. The index will rise and reverse in the overbought region.

Awọn afihan Awọn apẹrẹ Awọn apẹrẹ 4-wakati kika

Japan 225 is now above 80% range of the daily stochastic. The market has reached the overbought region. It is likely to take a downward move. The 21-day SMA and the 50-day SMA are sloping upwardly indicating the upward move.

Gbogbogbo Outlook fun Japan 225 (JP225USD)

Japan 225 is in a strong bullish move. The index has recovered from the bear market. All the indicators are showing an overbought region of the index. Sellers are supposed to emerge in the overbought region.

akiyesi: Kọ ẹkọ 2. Iṣowo kii ṣe onimọran owo. Ṣe iwadi rẹ ṣaaju idoko-owo awọn owo-inọn rẹ ni dukia inawo eyikeyi tabi ọja ti a gbekalẹ tabi iṣẹlẹ. A ko ṣe iduro fun awọn abajade idoko-owo rẹ

- alagbata

- Idogo min

- O wole

- Ṣabẹwo si Broker

- Syeed iṣowo Cryptocurrency ti o gba ẹbun

- $ 100 idogo to kere ju,

- FCA & Cysec ṣe ilana

- 20% kaabo ajeseku ti to $ 10,000

- Idogo ti o kere ju $ 100

- Daju iroyin rẹ ṣaaju ki o to ka ajeseku

- Lori awọn ọja inawo oriṣiriṣi 100

- Ṣe idoko-owo lati diẹ bi $ 10

- Yiyọ ọjọ kanna ṣee ṣe

- Iṣiro Awọn ọja Iṣowo Moneta pẹlu o kere ju $ 250

- Jade ni lilo fọọmu lati beere fun idogo idogo 50% rẹ