Maṣe ṣe idoko-owo ayafi ti o ba mura lati padanu gbogbo owo ti o nawo. Eyi jẹ idoko-owo ti o ni eewu ati pe o ko ṣeeṣe lati ni aabo ti nkan kan ba jẹ aṣiṣe. Gba iṣẹju 2 lati kọ ẹkọ diẹ sii

Iṣẹ fun daakọ iṣowo. Algo wa yoo ṣii laifọwọyi ati tilekun awọn iṣowo.

L2T Algo n pese awọn ifihan agbara ere pupọ pẹlu eewu kekere.

24/7 iṣowo cryptocurrency. Nigba ti o sun, a isowo.

Iṣeto iṣẹju 10 pẹlu awọn anfani nla. Iwe itọnisọna ti pese pẹlu rira.

Oṣuwọn aṣeyọri 79%. Awọn abajade wa yoo dun ọ.

Titi di awọn iṣowo 70 fun oṣu kan. Nibẹ ni o wa siwaju sii ju 5 orisii wa.

Ṣiṣe alabapin oṣooṣu bẹrẹ ni £ 58.

Did you know that Blockchain technology isn’t just reserved for virtual currencies like Ethereum and Bitcoin? On the contrary – traditional bonds can now be issued and traded as digital tokens too in the form of a financial instrument. As such, this cuts out the need to take ownership of the asset.

With this in mind, today we talk about the best tokenized bonds of 2023!

This guide will dive into how you can increase your profit-making potential through this innovative asset class – as well as other tokenized bond benefits such as leveraging your positions, utilizing fractional investments, and choosing from both long or short positions.

Currency.com - Awọn ohun -ini Tokenized Iṣowo Pẹlu Imudara ti o to 1: 500

- Ẹgbẹẹgbẹrun awọn ohun -ini tokenized ni atilẹyin - lati awọn akojopo ati Forex si crypto ati awọn iwe ifowopamosi

- Idojukọ ti o to 1: 500 - paapaa fun awọn iroyin alabara soobu

- Super kekere owo ati ju ti nran

- Ti ṣe ilana ati ailewu

Atọka akoonu

Trade the Best Tokenized Bonds: Quick Fire Guide

Before you can access tokenized bonds – you need to get the ball rolling by signing up with a trustworthy broker. If you are in a hurry, you can follow this quick-fire guide to sign up with Currency.com today.

- Step 1: Head over to Currency.com – This platform offers heaps of tokenized markets with low fees and fractionalized trades

- Step 2: Press the ‘Sign Up’ button – Now you can enter your name, address, nationality, etc to open an account.

- Step 3: Send in some documents – Upload a clear copy of your passport/driving license, and a bank statement to prove your identity. This is standard amongst regulated platforms

- Igbesẹ 4: Fi owo diẹ sii - To start trading tokenized bonds today you will need to make a deposit. Currency.com accepts crypto-assets, as well as credit/debit, and also wire transfers

- Step 5: Create a tokenized bond order – Find the bonds you are interested in and place an order to buy or sell

We’ve chosen Currency.com because this platform came out favorably when reviewing relevant providers offering access to this relatively new security token derivative.

Currency.com - Awọn ohun -ini Tokenized Iṣowo Pẹlu Imudara ti o to 1: 500

- Ẹgbẹẹgbẹrun awọn ohun -ini tokenized ni atilẹyin - lati awọn akojopo ati Forex si crypto ati awọn iwe ifowopamosi

- Idojukọ ti o to 1: 500 - paapaa fun awọn iroyin alabara soobu

- Super kekere owo ati ju ti nran

- Ti ṣe ilana ati ailewu

What are Traditional Bonds?

For those unfamiliar with this subject, it’s important to have an idea of how the underlying asset behaves before trading its tokenized counterpart.

In a nutshell, traditional bonds are a debt instrument created in order for governments or businesses to raise capital. This creates a fixed income for investors, which comes from the interest accrued over the term of the bond.

What you pay for the bonds, known as the ‘principal’, this is comparable to providing a loan to the issuer in question. When it reaches its pre-defined ‘maturity date’ you are allocated an amount that is the equivalent of the aforementioned principal – known as ‘par value’.

See a quick example to clear things up:

- You invest $1,000 in a bond

- It has an annual coupon percentage of 10%

- The maturity date is 20 years

- You will be sent $100 annually for 20 years ($1,000 x 10%)

- At the time of maturity – you receive a payment of $1,000 (the par value)

As you can see, you start receiving interest periodically, at a fixed percentage of the coupon rate – from principal to maturity. The good news is that many tokenized bonds also offer coupon payments! We talk about this later on.

What are Tokenized Bonds?

Tokenized bonds are technological innovations created to lessen the possibility of human errors, the need for multiple intermediaries, and the blow of broker costs. There are also plenty of other benefits, which we talk about throughout this guide.

Wo apẹẹrẹ ti o rọrun:

- The tokens you buy track the underlying bonds they are associated with

- Let’s say you want to invest in The Vanguard Short-Term Investment-Grade fund – priced at $10.95

- As such, The Vanguard Short-Term Investment-Grade fund àmi are also valued at $10.95

The idea is to refine data visibility, as well as improve efficiency due to the reduced need for admin and as we said – fewer costs. The concept has been around for a few years but is still very much new, in comparison to say conventional stocks and bonds.

How do Tokenized Bonds Work?

Many reputable platforms are now opting to create and launch their own tokenized bonds.

See below a simple explanation of how this works:

- The information of the provider you purchase tokenized bonds from will appear as a digital record on the blockchain.

- Smart contracts will code the terms of the bonds onto the blockchain.

- You, as a trader, then buy or sell the digital tokens that represent the asset in question.

- The tokenized asset will track the yield of the underlying bonds.

- These smart contracts enable you to trade, invest, and receive coupon payments, where applicable

What happens next is that you try to predict which way the markets might go. The goal is that you exit the tokenized bonds trade with more money than when you entered. We talk about how to research to make gains later.

See another example below. This time, you will notice that this works in virtually the same way as traditional bonds:

- Let’s say you are trading tokenized government bonds

- Each bond is valued at $1,000

- You buy 3, so you have invested $3,000

- The coupon rate on offer is 3%

- As such, you will be paid $90 annually until the bond reaches maturity

- When this date is reached – you will also receive your initial investment of $3,000

As we mentioned earlier – the maturity of a tokenized bonds simply means the date the contract expires and the position is closed. What if you can’t or don’t want to hold on to your tokenized bonds for decades? You can place an order to trade your tokens in the open marketplace – whenever you like.

What Types of Tokenized Bonds are there?

Most assets that you can trade or invest in can be tokenized. As such, we are now going to run through some of the most common – to give you an idea of what to expect.

Some of the main types of tokenized bonds are as follows:

- Awọn iwe ifowopamosi ijọba: When the government has obligations to fulfill or just needs funding in general – a bond is issued as a form of debt security. Because the government issuing the bonds also backs them, many people consider this to be a minimal risk investment. This is on the proviso that the issuer is behind a strong economy – such as the US, UK, Europe, or Japan.

- Agency Bonds: Think along the lines of a government department or enterprise (not the treasury). This is sometimes referred to as an ‘agency debt’. This type of underlying asset is ko ẹri by a government but will be backed.

- Corporate Bonds: Rather than going to a bank to get a loan – many operations obtain debt financing via bond markets. This is largely due to more favorable interest fees.

- Zero-Coupon Bonds: As you likely figured, this type of bond doesn’t include annual or quarterly coupon payments or interest. This type is sometimes referred to as ‘deep discount bonds’. This is because there is usually a price reduction, to make up for the lack of regular payouts. We found that this can be up to 20% in some cases. When the maturity date comes around – you still receive your initial investment back.

- Awọn iwe adehun ti ilu: Sometimes referred to as a muni bond, this type is created by local governments to fund large-scale projects such as road infrastructure, schools, seaports, repairs, bridges, airports – and more.

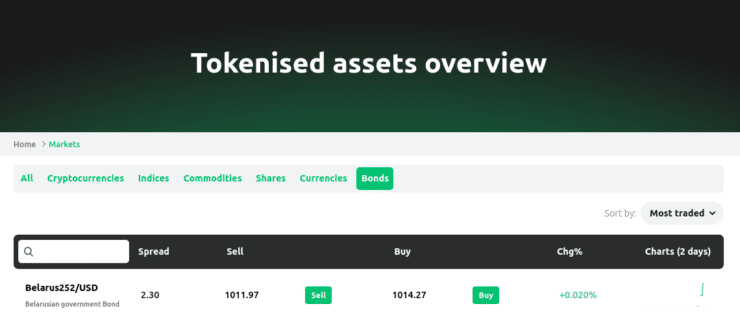

Top-rated provider Currency.com was one of the first platforms in the world to offer a tokenized government bond – from Belarus to be specific. As of 2023, we can now access many bonds from the comfort of our home in tokenized form.

Each share of the bond will usually be represented by one token. However, as we talk about shortly, you can also fractionalize – which makes bonds even more accessible to a wider scope of investors.

How to Make Money From Tokenized Bonds

It goes without saying that the main reason people invest in and trade the financial markets is to try and make some money. In the case of tokenized bonds, there are various ways to do this.

Tokenized Bonds: Coupon Payments

Coupon payments are like a form of regular income for bond investors. Unlike dividends offered by shares, coupon payments are offered at a fixed rate of interest.

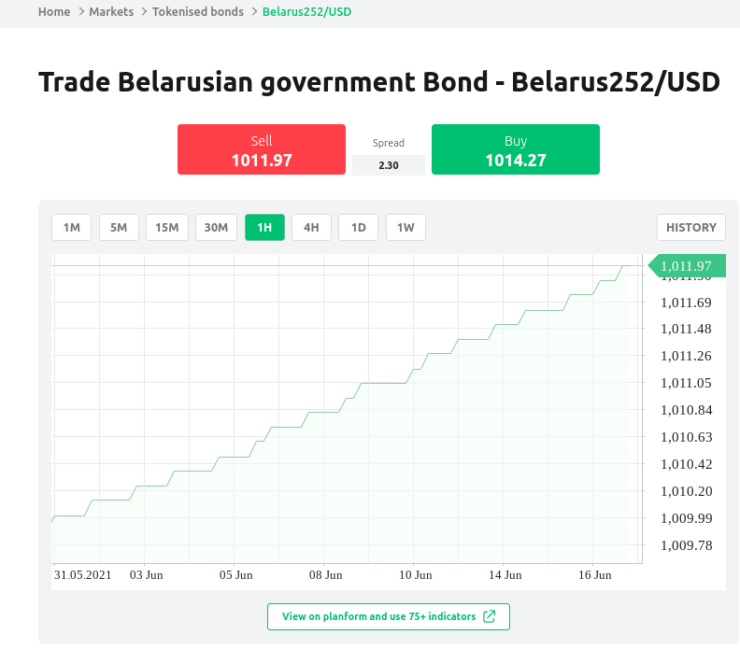

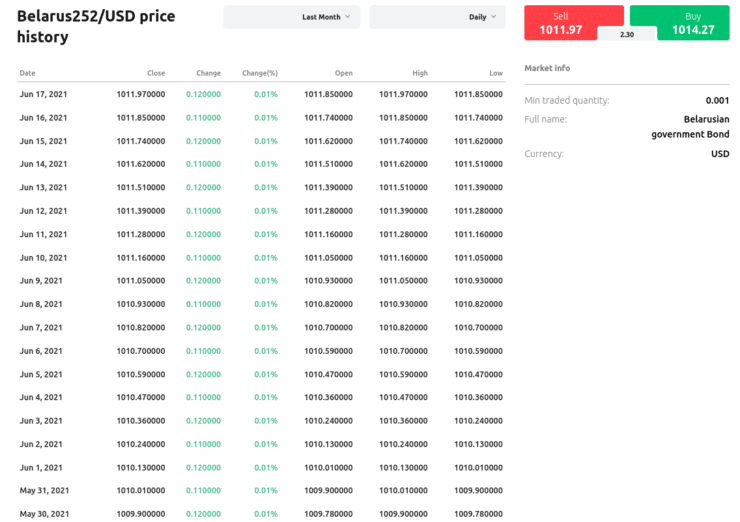

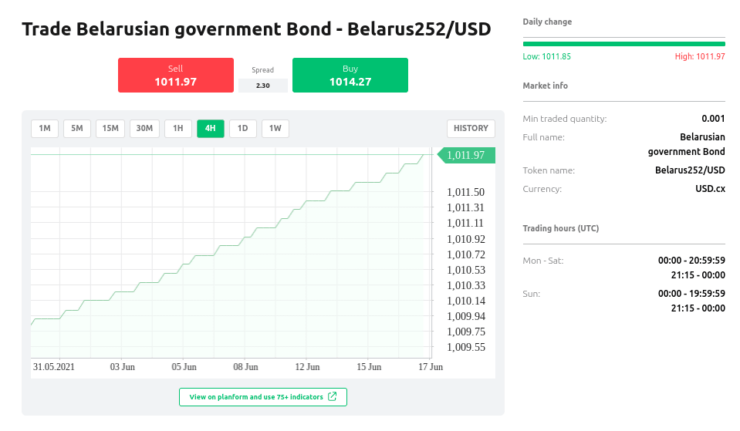

- Let’s say you invest $2,022.54 is tokenized Republic of Belarus government bonds

- Each bond is currently valued at $1,011.27 – so you have purchased two instruments

- The yield to maturity is 4%, and the platform makes payments every 6 months

- This means that you will receive a coupon payment of $80.90 per year until the maturity date ($2,022.54 x 4%)

- When cashing out your position on this date – you will also be allocated the $2,022.54 principal you originally paid

As we said, the money you put into a tokenized bond is essentially like a loan to the platform. As such, you will be paid a type of interest referred to as coupon payments until the end of the agreed period. Remember, you can of course close your position before you reach maturity if you wish.

Tokenized Bonds: Capitalize on Price Fluctuations

Whilst bonds are notoriously less volatile than stocks – you can still try to capitalize on price shifts. This is attainable thanks to the fact tokenized bonds allow you to speculate in either direction – rise or fall.

When trading traditional bonds, you will only make gains from the coupon payments received, or by cashing out before maturity and selling for a ‘premium rate’.

Tokenized Bonds: Long and Short Examples

When dealing with tokenized bonds – you can try to profit from their predicted fall in value by short-selling your tokens, or go long with a buy order.

Below you will see an example of a ‘long’ position on tokenized bonds:

- Let’s say you are interested in tokenized US treasuries

- You think that the bond is undervalued, and thus – its price will dide

- Bi eleyi, o gbe kan ra order at your chosen platform

- The tokenized US treasuries increases in value by 3%

- O owo jade pẹlu kan ta order – pleased with your 3% gains

Alternatively, let’s see a ‘short’ position on tokenized bonds:

- Let’s say you are trading a tokenized treasury bond and feel like its value will decline

- In this scenario – you must place a ta ibere

- Let’s now say that the tokenized bond falls in value by 12%

- You will make a profit of 12% by cashing out your position

Importantly, if you enter a tokenized bonds trade with short sell order – you will need to place a buy order to cash this position out and exit the market.

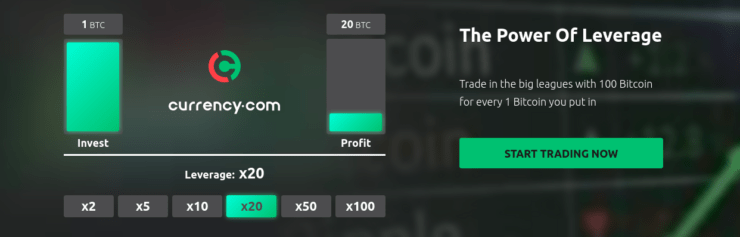

Tokenized Bonds: Add Leverage

Some platforms will allow you to leverage your tokenized bonds positions – just as you can with CFDs. For anyone in the dark – this is a way to increase your purchasing power and hopefully your profits too.

Either way, to further explain, see an example below:

- Let’s say you want to trade tokenized Piemonte bonds

- Next, you place a $100 buy order

- You apply leverage of 1:10 to this trade

- Piemonte bonds increase in value by 16%

- Pleased with your gains, you decide to cash out before the maturity date

- Your profit from this tokenized bond position without leverage would have amounted to $16

- But, by applying leverage of 1:10 – your profit is multiplied to $160

Please be careful when applying leverage, especially if you are a beginner. If you are right, great – but if you are wrong – your losses from this position will be magnified tenfold.

Tokenized Bonds Main Advantages

There are plenty of advantages when it comes to trading tokenized bonds. See some of the most noteworthy below.

Trade Fractionalized Bonds

There was a time when bonds were only really a viable option for people with a huge bank balance. This type of investment is no longer reserved for the wealthy. These days, platforms such as Currency.com enable investors to buy and sell fractional bonds in the form of a token.

As you can imagine, with digital tokens and fractional investment opportunities, buying bonds no longer requires a deposit of thousands of dollars.

In other words, being able to invest smaller sections of this asset class means that you can dip your toes into the world of debt instruments – without paying a higher price unit usually associated with bonds and stocks. Currency.com accepts as little as $10 to get started.

Marry Cryptocurrencies and Bonds

As we have mentioned, tokenized assets allow you to enter the world of trading and investing – using cryptocurrencies. Large institutional investors have been paying more attention to digital assets for a while now. Crucially, it’s never been easier to merge the world of financial securities and crypto-assets.

For instance, over at Currency.com, you can deposit and invest using Bitcoin or Ethereum, without the need to first exchange your digital assets into fiat funds. You can also cash out your tokenized bond investments and withdraw your gains as digital currency!

Create a Diverse Portfolio

We don’t just create a diverse portfolio to add variety and interest, it’s also important to avoid too much exposure to one market and its characteristics. Sure, you could stick with bonds, but why not try something different like tokenized owo or Awọn eru oja tita?

Creating a diverse portfolio is an advantage when trading or investing in tokenized bonds – because yields can be affected by opposing markets, inflation, and many other outside influences.

To give you an example of the correlation between tokenized markets:

- Precious commodity goolu and markets like real estate have long been used as the go-to hedge against inflation.

- When markets are bearish – stocks tend to shift in the opposite direction to US treasury bonds

This is why people pay attention to the positive and negative correlation between assets. If the latter is the case – you know that if one is on the rise, the chances are its counterpart will be falling. This is precisely why when awọn mọlẹbi tokenized fall – bond tokens typically rise

Finding the Best Tokenized Bonds Provider 2023

You won’t be able to access tokenized bonds without first creating an account with an online platform capable of offering this type of instrument.

See below some of the things we look for in a tokenized bonds provider in 2023:

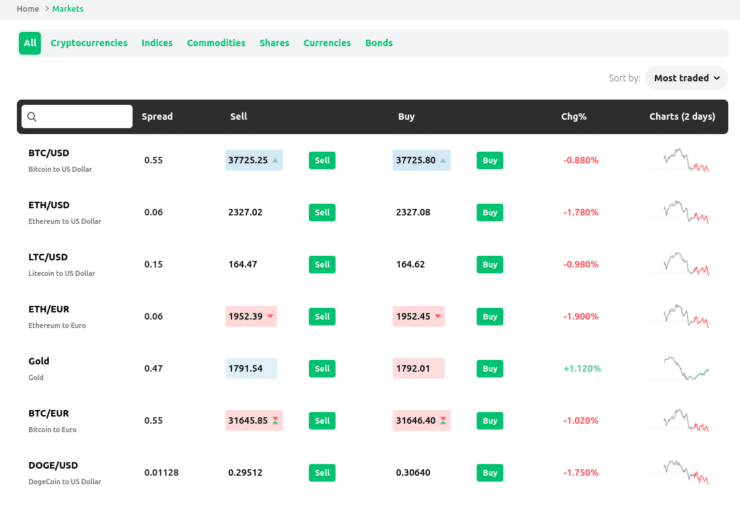

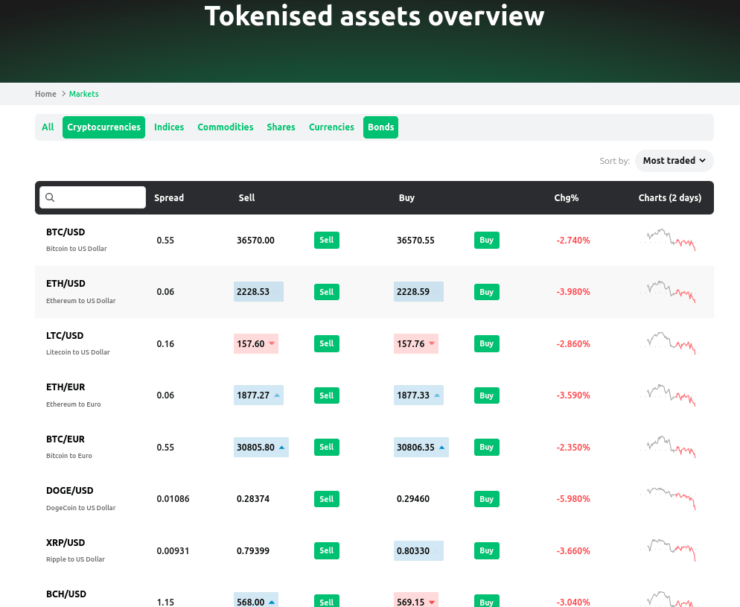

- A wide variety of tokenized assets: It’s important to have options available for diversification purposes, and it’s better to have this at your fingertips under one account. Also look for tokenized forex, crypto, indices, shares, and commodities. Currency.com offers over 2,000 assets.

- Awọn idiyele ti o tọ: Some platforms charge through the nose in trading fees – what might seem like a small amount but will soon eat away at your trading balance. You will also find that some providers charge wide spreads – another cost that is bad for your gains. Always check the fees and charges section before joining.

- Regulation and AML compliance: Regulated tokenized bond providers offer client fund segregation and follow anti-money laundering rules, keep your data private, and ensure secure payments.

- Choice of deposit methods: It’s always better to have a few different options for making a deposit. Ideally, you should be looking for a provider that accepts digital currencies as well as standard fiat methods like bank transfers. The latter is usually fee-free but takes the longest to clear.

Finding the best tokenized platform isn’t an easy feat. Fortunately, we’ve saved you some legwork by reviewing the top provider in this space- Currency.com.

Best Tokenized Bonds Provider 2023

See below a comprehensive review of the best tokenized bonds provider of 2023.

Currency.com – Best All-Round Tokenized Bonds Broker

At the forefront of the fusion of blockchain tech and digital currencies with traditional financial markets is Currency.com. This platform provides access to over 2,000 different tokenized markets which includes indices, currencies, shares, cryptocurrencies, commodities, and of course bonds. Furthermore, you can get started at this platform with a deposit of just $10.

The tokenized government bond of the Republic of Belarus #252 offers a yield to maturity of 4.2% per year, and further bond tokens are included as time passes. Coupon payments are distributed on a semi-annual basis. Each token here is valued at $1,000 - which is the price of the underlying bond. This is in line with the par value of the underlying bond in question. As you likely know, the value of the respective instrument decides the price of a tokenized asset.

This also means that the spread will fluctuate along with supply and demand. With that said, we checked out the gap between the buy and sell price and found it to be a very competitive 0.2%. Currency.com enables fractional purchases, so you don' have to invest in the full token value. Interest coupon payments will also be paid on tokenized bonds - in proportion to the amount you buy.

At the point of maturity - you will be allocated the principal amount. The commission fee is just 0.5% to trade tokenized bonds, and the spread is low across the majority of the assets available. We found a free simulator account whereby you can buy, sell, and strategize using paper funds. To give you an idea, you will be given the equivalent of 375,000 USD, 315,000 EUR, 270,000 GBP, or 500,000 AUD (in demo funds).

Notably, if you decide to invest in a whole bond token, you can contact this provider to transfer the relevant tangible bonds - whenever you see fit. If you would rather start with the free demo account on offer, you won't need to make a deposit right away. When you do, accepted payment types include Bitcoin, Ethereum, Mastercard, Visa, and others. Finally, Currency.com is a high leverage broker - offering limits of up to 1:500 on some of its tokenizes markets.

- Ẹgbẹẹgbẹrun awọn ọja tokenized lati ṣe idoko-owo sinu

- Agbara ti o to 1: 500

- Very competitive 0.05% exchange fee

- 3.5% idiyele lori kirẹditi ati awọn idogo kaadi debiti

How to Invest in the Best Tokenized Bonds: Step-by-Step Guide

To invest in the best tokenized bonds you will need a top-rated platform, preferably with low spreads and a variety of deposit options. As you can see from the above review, Currency.com ticks plenty of boxes.

As such, next we offer a simple six-step run-through of how you can register and access tokenized bonds today!

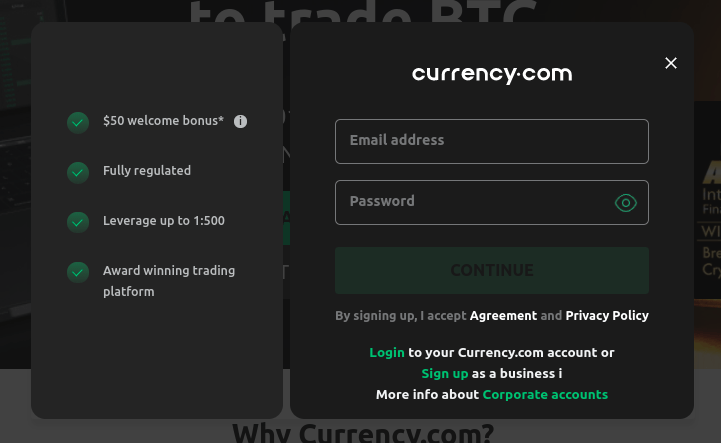

Step 1: Join Best Tokenized Bonds Provider Currency.com

Head over to the site and hit ‘Sign Up’. Next, you will see the below form appear.

Go through the steps to complete all the information requested and confirm to move to the next stage of registration.

Currency.com - Awọn ohun -ini Tokenized Iṣowo Pẹlu Imudara ti o to 1: 500

- Ẹgbẹẹgbẹrun awọn ohun -ini tokenized ni atilẹyin - lati awọn akojopo ati Forex si crypto ati awọn iwe ifowopamosi

- Idojukọ ti o to 1: 500 - paapaa fun awọn iroyin alabara soobu

- Super kekere owo ati ju ti nran

- Ti ṣe ilana ati ailewu

Step 2: Upload ID Documents

You will be asked to upload some documentation at this stage, which is standard in the regulated brokerage arena. Curency.com will accept your passport or a driving license.

For your proof of address – a tax letter, bank statement, or utility bill will do fine.

Igbesẹ 3: Idogo Diẹ ninu Awọn Owo

Currency.com accepts many different methods of payment – so select your preferred deposit option.

This includes Bitcoin, Ethereum, MasterCard, Visa, bank wire and more.

Step 4: Select Tokenized Bonds

If you have an idea of what you would like to trade, use the search box to see whether it is available.

Step 5: Place an Order on Tokenized Bonds

As you can see, here we chose to trade the tokenized Belarusian government bond.

As we mentioned, you can go long or short on tokenized bonds. As such, you need to click the green ‘buy’ button if you believe the value will increase.

Step 6: Cash Out Tokenized Bonds

When you think the time is right to cash out, log into your Currency.com account and find the relevant tokenized bonds in your portfolio.

If you happened to enter the position with a sell order – you will action a buy to close it. As such, if you began with a buy order – you will need to create a sell to exit.

ti o dara ju Tokenized Bonds 2023: Full Conclusion

Digitalized assets are taking the world by storm! Tokenized securities are set to revolutionize the way we can use our digital currencies, as well as the wider exposure to otherwise expensive or cumbersome markets.

For instance, when it comes to tokenized bonds – the traditional method would be out of reach for most of us – as a single instrument could cost thousands of dollars. These days you can trade tokens that merely track the real-world price of the asset.

This means you can short sell, add leverage and diversify by adding smaller investments and subsequently – build your portfolio in a risk-averse way. We found the best place to find tokenized assets is regulated platform Currency.com. There are 2,000+ markets to choose from and the provider offers competitive spreads across the board.

Currency.com - Awọn ohun -ini Tokenized Iṣowo Pẹlu Imudara ti o to 1: 500

- Ẹgbẹẹgbẹrun awọn ohun -ini tokenized ni atilẹyin - lati awọn akojopo ati Forex si crypto ati awọn iwe ifowopamosi

- Idojukọ ti o to 1: 500 - paapaa fun awọn iroyin alabara soobu

- Super kekere owo ati ju ti nran

- Ti ṣe ilana ati ailewu

FAQs

What are tokenized bonds?

Tokenized bonds are a form of digital security designed to represent the price of the underlying real-world asset. As such, Instead of purchasing traditional bonds, which can require a minimum outlay in the thousands of dollars, you will trade tokens associated with them. This means you can access fractional investments, leverage, and short-selling facilities. Some platforms, such as Currency.com - allow you to earn coupon payments - much like you would with conventional bonds.

Can I buy tokenized bonds using cryptocurrencies?

Yes. For instance, Currency.com welcome Bitcoin and Ethereum deposits and investments - as well as the standard fiat options of bank wire transfers and credit and debit cards.

What is the best tokenized bonds provider 2023?

This guide found that the best tokenized bonds provider of 2023 is Currency.com. There are more than 2,000 tokenized markets on offer with competitive spreads and low trading fees. The platform also enables cryptocurrency deposits from just $10 using Bitcoin and Ethereum and facilitates fractional investments.

What other tokenized markets can I invest in?

Tokenization is quickly gaining popularity. As such, you can invest in a plethora of markets in token form. This includes cryptocurrencies, shares, indices, commodities, and bonds. All the aforementioned assets are available at Currency.com with small investment minimums.

What is the minimum amount needed to access tokenized bonds?

Top-rated platform Currency.com not only accepts payment methods such as Bitcoin, Mastercard, Ethereum and Visa - but you only need a minimum deposit of $10 to get start trading tokenized bonds!