Dịch vụ sao chép giao dịch. Algo của chúng tôi tự động mở và đóng giao dịch.

Thuật toán L2T cung cấp các tín hiệu có lợi nhuận cao với rủi ro tối thiểu.

Giao dịch tiền điện tử 24/7. Trong khi bạn ngủ, chúng tôi giao dịch.

Thiết lập 10 phút với những lợi thế đáng kể. Sách hướng dẫn được cung cấp khi mua hàng.

79% Tỷ lệ thành công. kết quả của chúng tôi sẽ kích thích bạn.

Lên đến 70 giao dịch mỗi tháng. Có hơn 5 cặp có sẵn.

Đăng ký hàng tháng bắt đầu từ £ 58.

The Central Bank (CB) of any country is the most important market participant for that country´s currency. The Central Bank officials, with their president/chairman at the top, hold the monopoly for the monetary policy of each country or economic zone. A perfect example of this being the Eurozone. They are the decisive factor for all long-term currency moves. Of course, there are other market participants in the forex market such as investors, speculators, hedge funds, second level banks etc., but they usually drive the market in the short to mid-term.

4

Phương thức thanh toán

Các sàn giao dịch

Quy định bởi

HỖ TRỢ

Tiền gửi tối thiểu

Đòn bẩy tối đa

Cặp tiền

phân loại

Điện thoại di động App

Tiền gửi tối thiểu

$100

Trải tối thiểu.

Biến pip

Đòn bẩy tối đa

100

Cặp tiền

40

Các sàn giao dịch

Phương pháp tài trợ

Quy định bởi

FCA

Những gì bạn có thể giao dịch

NGOẠI HỐI

CHỈ SỐ

Hoạt động

Tiền mã hóa

nguyên liệu thô

Spread trung bình

EUR / GBP

-

EUR / USD

-

Cặp EUR / JPY

0.3

EUR / CHF

0.2

GBP / USD

0.0

Cặp GBP / JPY

0.1

GBP / CHF

0.3

USD / JPY

0.0

USD / CHF

0.2

CHF / JPY

0.3

Phí bổ sung

tỷ lệ liên tục

Biến

Chuyển đổi

Biến pip

Quy định

Có

FCA

Không

CySEC

Không

ASIC

Không

CFTC

Không

NFA

Không

BAFIN

Không

CMA

Không

SCB

Không

DFSA

Không

CBFSAI

Không

BVIFSC

Không

FSCA

Không

FSA

Không

FFAJ

Không

ADGM

Không

FRSA

71% tài khoản nhà đầu tư bán lẻ bị mất tiền khi giao dịch CFD với nhà cung cấp này.

Tiền gửi tối thiểu

$100

Trải tối thiểu.

- pip

Đòn bẩy tối đa

400

Cặp tiền

50

Các sàn giao dịch

Phương pháp tài trợ

Quy định bởi

CySECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

Những gì bạn có thể giao dịch

NGOẠI HỐI

CHỈ SỐ

Hoạt động

Tiền mã hóa

nguyên liệu thô

quỹ đầu tư

Spread trung bình

EUR / GBP

1

EUR / USD

0.9

Cặp EUR / JPY

1

EUR / CHF

1

GBP / USD

1

Cặp GBP / JPY

1

GBP / CHF

1

USD / JPY

1

USD / CHF

1

CHF / JPY

1

Phí bổ sung

tỷ lệ liên tục

-

Chuyển đổi

- pip

Quy định

Không

FCA

Có

CySEC

Có

ASIC

Không

CFTC

Không

NFA

Không

BAFIN

Không

CMA

Không

SCB

Không

DFSA

Có

CBFSAI

Có

BVIFSC

Có

FSCA

Có

FSA

Có

FFAJ

Có

ADGM

Có

FRSA

71% tài khoản nhà đầu tư bán lẻ bị mất tiền khi giao dịch CFD với nhà cung cấp này.

Tiền gửi tối thiểu

$10

Trải tối thiểu.

- pip

Đòn bẩy tối đa

10

Cặp tiền

60

Các sàn giao dịch

Phương pháp tài trợ

Những gì bạn có thể giao dịch

NGOẠI HỐI

CHỈ SỐ

Tiền mã hóa

Spread trung bình

EUR / GBP

1

EUR / USD

1

Cặp EUR / JPY

1

EUR / CHF

1

GBP / USD

1

Cặp GBP / JPY

1

GBP / CHF

1

USD / JPY

1

USD / CHF

1

CHF / JPY

1

Phí bổ sung

tỷ lệ liên tục

-

Chuyển đổi

- pip

Quy định

Không

FCA

Không

CySEC

Không

ASIC

Không

CFTC

Không

NFA

Không

BAFIN

Không

CMA

Không

SCB

Không

DFSA

Không

CBFSAI

Không

BVIFSC

Không

FSCA

Không

FSA

Không

FFAJ

Không

ADGM

Không

FRSA

Vốn của bạn đang gặp rủi ro.

Tiền gửi tối thiểu

$50

Trải tối thiểu.

- pip

Đòn bẩy tối đa

500

Cặp tiền

40

Các sàn giao dịch

Phương pháp tài trợ

Những gì bạn có thể giao dịch

NGOẠI HỐI

CHỈ SỐ

Hoạt động

nguyên liệu thô

Spread trung bình

EUR / GBP

-

EUR / USD

-

Cặp EUR / JPY

-

EUR / CHF

-

GBP / USD

-

Cặp GBP / JPY

-

GBP / CHF

-

USD / JPY

-

USD / CHF

-

CHF / JPY

-

Phí bổ sung

tỷ lệ liên tục

-

Chuyển đổi

- pip

Quy định

Không

FCA

Không

CySEC

Không

ASIC

Không

CFTC

Không

NFA

Không

BAFIN

Không

CMA

Không

SCB

Không

DFSA

Không

CBFSAI

Không

BVIFSC

Không

FSCA

Không

FSA

Không

FFAJ

Không

ADGM

Không

FRSA

71% tài khoản nhà đầu tư bán lẻ bị mất tiền khi giao dịch CFD với nhà cung cấp này.

The Central Bank can print any amount of money and induct it into the market (which will devalue the currency) or retrieve any amount of money from the market which will appreciate the currency. Therefore, as forex traders we must know the actual monetary policy of the major Central Banks and the possible future changes in the policy – then, naturally, how to trade it. Here we will explain how you can trade based on the actions of the CB. The actions might be an interest rate cut, a rate hike, a Quantitative Easing program, a tapper, a market intervention (where the CB buys or sells a currency), a peg enforcement or removal, etc.

Trading the Central Bank’s actions can be a very profitable strategy

Trading the expectations

There are always expectations in forex. These might be inducted into the market by economists, financial media, investors, speculators and, of course, by the CB officials themselves. We should know how to trade the expectations, because often they are even more important than the event itself. Sometimes, the market expectations drive the price of a currency up or down and by the time the event happens it has already been priced in. The price action after the event is only minimal compared to the price action before the event.

The perfect example of this is the appreciation of the US Dollar since the summer of 2014. The US economy has been recovering pretty well after the 2008 financial crisis, notably in both 2013 and 2014. So, obviously the forex market participants expect the FED to hike the interest rates next Thursday, which is almost guaranteed. Everyone has been entering long on the Buck since, buying it for a year and a half. Right now, the Dollar is near its highest level in more than a decade against the basket of currencies. That means that the market has already priced-in the rate hike by the FED. This expected move has meant about a 30-35 cent appreciation of the USD in a little more than a year. Yes, that´s around 3,000-3,500 pips.

Imagine you bought 10 lots USD/CAD last summer and had the patience and the guts to hold the position till now. Your account would have been $300,000 greater by now. We might see another 2-4 cent appreciation of the USD when the FED hikes the rates next Thursday, but that´s inconsequential in light of this gigantic move driven by the expectations.

Once the volatility is over after the hike, the market will build new expectations. The FED finally hiked the rates, now what? The market will have no more expectations for another hike soon, so they get off their USD long positions and reverse the uptrend, suffering some losses. This sentiment will last until the market starts to build expectations again for another rate hike.

So when you hear innocent comments from CB members about tightening the monetary policy, you had better buy because something big is coming and you don´t want to miss the move. Sometimes the opinion is formed by a single bomb dropping, like the one the ECB president Draghi delivered in May 2014. Out of the blue, he announced that the ECB will start a large QE program to pump Euros into the market. Since that announcement, the Euro lost about 25 cents against most majors until the program was launched in January 2015.

Trading the knee-jerk reaction

After the expectation of the event, which is usually the most important part and the biggest market mover, there´s a knee-jerk reaction in the first few minutes. This reaction might take the price from 40-50 pips to a few cents. This is not the main move of the event but it is pretty simple to trade if you could open very quickly. Some brokers don´t allow news trading and some freeze the trading platform, but you can trade the CB announcements with most brokers. But, the execution must be quick so that the slippage isn’t large, since this is common during volatile times. Trading the reaction is pretty simple, you go with the direction of the monetary policy.

To learn more about trading the news: Trading the News – Forex Trading Strategies

For more about volatility trading: How To Turn Volatility In Your Favor – Forex Trading Strategies

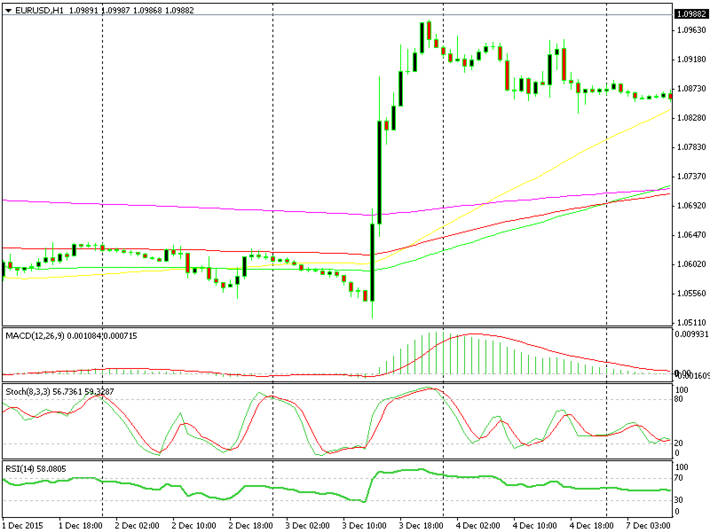

The Euro declined after the rate cut but it later reversed

Trading the event

You can make a quick profit of 50 – 200 pips trading this reaction, but that´s not the real trade of the event. The CB monetary policy changes have a longer term impact which accounts for much more than the move of the initial reaction. When the ECB started their QE program in January, the Euro lost about two cents that day but the real trade was in the longer term. The Euro lost about 10 cents in the next two months.

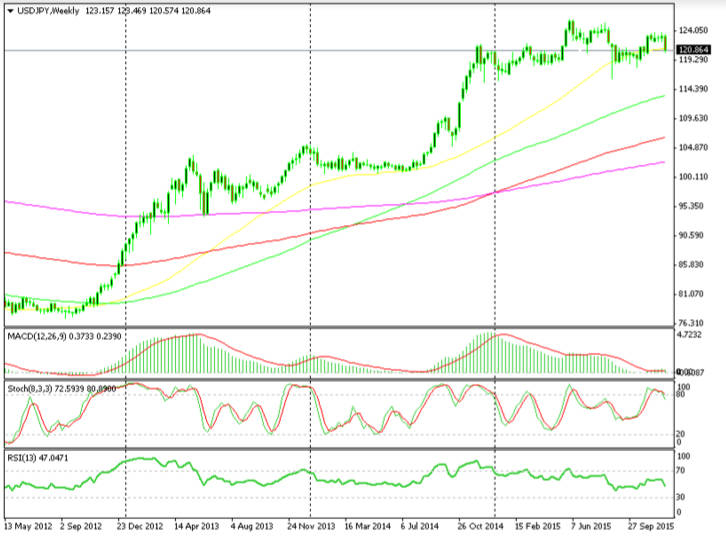

The same thing happened with the Japanese YEN. The BOJ announced a similar program late in 2012 and USD/JPY gained more than 200 pips that day. Many traders got out with a nice profit, but missed the real trade. Since then, this pair has gained a massive 50 cents. Those traders who have been patient profited a lot from this long-term move. If you went long USD/JPY at that time with 10 lots, you would have about $500,000 in your account.

You don´t necessarily have to hold the position the entire move. You should know that when a CB announces an important monetary policy change, such as the QE program, the move may last for years, and you can buy on every retrace (just pick the right direction). But trading the main event is not always that easy. The catch here is that a longer term impact or the long-term direction might not be in line with the CB action.

Over the last two weeks, we have had two perfect examples of this. The ECB delivered a 10 bps deposit rate cut as we mentioned above and six months of additional QE. Normally, you would think that the Euro would drop. It did fall about 100 pips after the first reaction but it reversed immediately and gained about 500 pips since. That´s because the market participants expected much more and were disappointed.

So, for the main event, you should compare the size of the monetary policy change with the market expectations. If the expectations are lower than the action announced by the CB, the impact is amplified and the resulting moves are huge. Such was the 35 cent decline in EUR/USD from the QE announcement in May 2015 by the ECB. If the expectations are higher than the change announced, the main trade usually goes in the opposite direction than the CB action, such as the 500 pip gain in EUR/USD that we mentioned above.

USD/JPY gained 200 pips in the 1 st day of QE announcement in 2012 and the trend continued for another 50 cents

So, trading the Central Banks is a profitable, but not always an easy strategy. The expectations and the initial reactions are easier to trade, but you still have to get the direction right and execute the trades quickly. The main trade is a bit harder; you must read the monetary policy change correctly and compare it to the market expectation. Sometimes the market takes the price in the same direction as the CB monetary policy change and sometimes in the opposite direction. In the next article we will explain how to trade the CB rhetoric.