Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

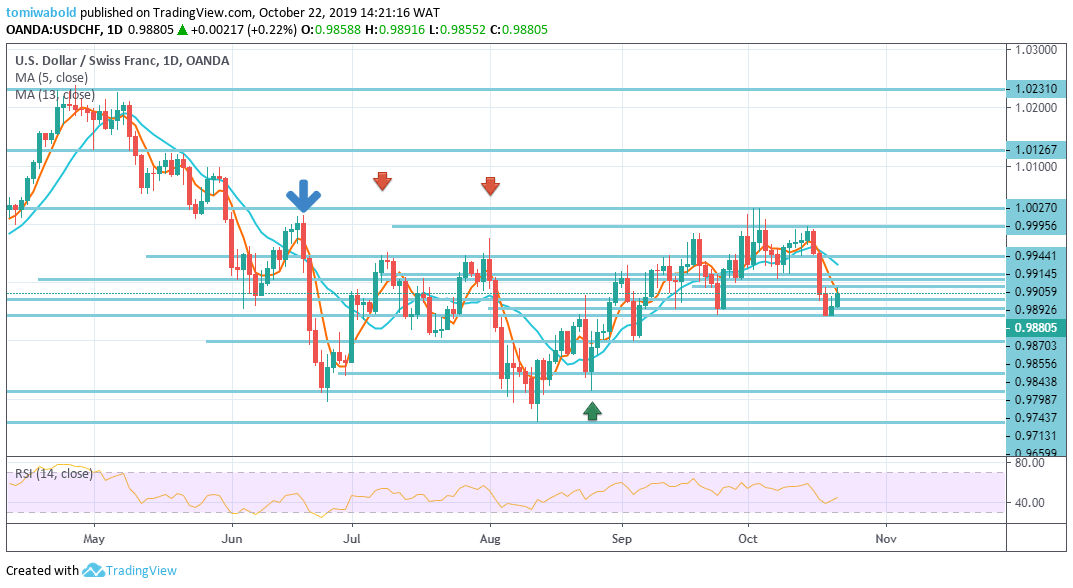

USDCHF Price Analysis – October 22

In the prior session, the USDCHF currency pair attempted to breach the short-term horizontal zone on the level at 0.9843. During today’s morning, the pair is testing the upper horizontal level formed above the MA 5 and 13 on the level at 0.9892.

Key Levels

Resistance Levels: 1.0126, 1.0027, 0.9905

Support Levels: 0.9843, 0.9798, 0.9659

USDCHF Long term Trend: Bearish

As displayed on the daily, If the given minor support level holds, the currency pair may likely attempt to exceed the psychological level at 0.9892 resistance. However, on the other hand, the US Dollar could consolidate against the Swissy in the nearest future.

Meanwhile, take note that the exchange rate is pressured by the moving average 5 and therefore, if the given support level does not hold, some downside potential may prevail following its longterm downtrend.

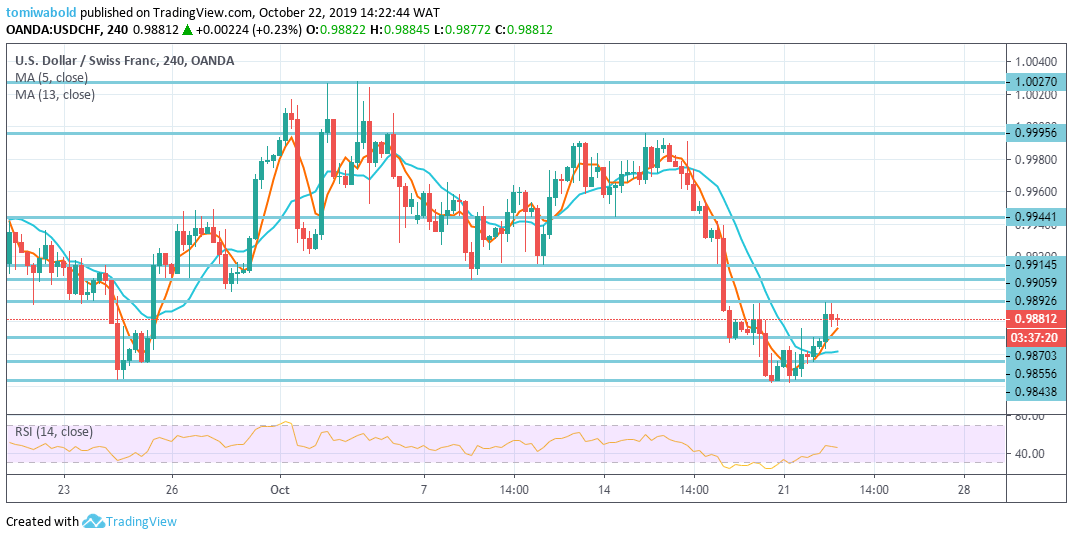

USDCHF Short term Trend: Ranging

Since the prior session, on the flip side of the 4-hour time frame, no change in USDCHF’s outlook. As it’s intraday bias remains on the upside zone in the near term with a focus on 0.9905 resistance.

However, this trend to the upside may be limited to the psychological level at 0.9892 resistance and a deeper fall may be seen to the level at 0.9843 support and below. On the upside, above the level at 0.9905 minor resistance will turn the focus back to the level at 1.0027 instead.

Instrument: USDCHF

Order: Sell

Entry price: 0.9905

Stop: 0.9944

Target: 0.9843

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus