Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

USDCHF Price Analysis – June 19

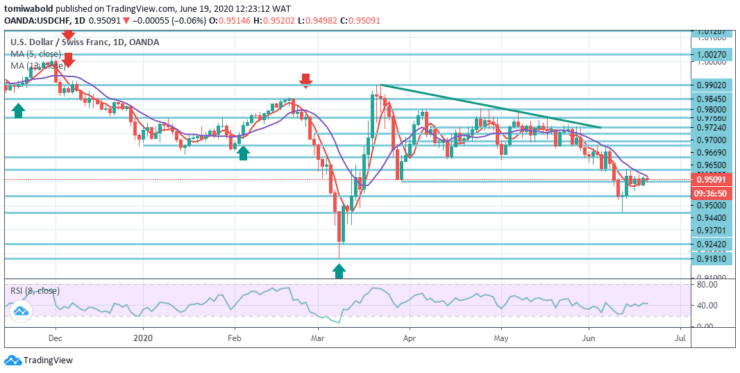

USDCHF price bounces back to about 0.9510 level while hitting intraday low at 0.9498 level, only down 0.05 percent on a day, as at early Friday. The pair’s latest decline from the moving average 5 may be traced from an initial pullback. The focus will be on coronavirus statistics.

Key Levels

Resistance Levels: 1.0027, 0.9766, 0.9550

Support Levels: 0.9440, 0.9370, 0.9181

USDCHF is now consolidating within the region of 0.9440-0.9550 over the past week, but in the wider context, the fall from level 1.0231 is seen as the third step of the trend from level 1.0342. Having reached 0.9242 main support (low) level, it should have ended at 0.9181 level.

Despite the moving averages relieving downward momentum in the bearish region and the straight RSI resisting to return to its 20 oversold marks, a 0.9902-level breach may expand the rebound from 0.9181 to 1.0027-level resistance. Simply put, medium to long-term trade in ranges is inclined to maintain for some longer between 0.9181/1.0231 levels.

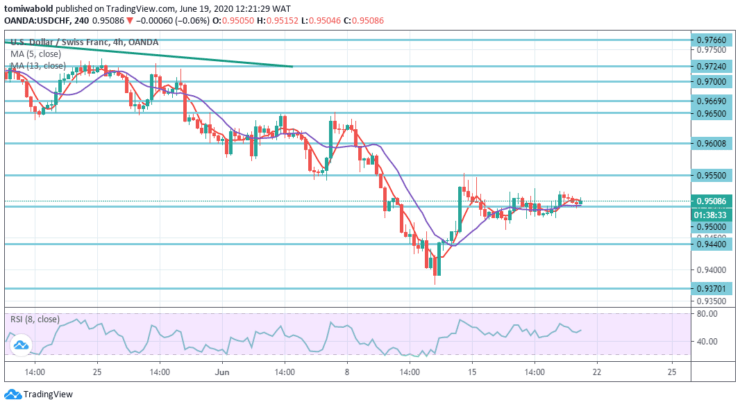

The recent sideways trading by the pair may be linked from a short-term plunge in the four-hour chart in its pullback. The USDCHF intraday bias stays neutral, and the trend stays intact. On the positive side, the 0.9550 level break may continue the rebound from a short term bottoming level of 0.9370.

The continuous trading beyond moving average 13 (now at 0.9500 level) sets the stage back to resistance of 0.9902 level. On the drawback, however, the 0.9370-level breach may then restart the decline from 0.9902 level.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus