Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

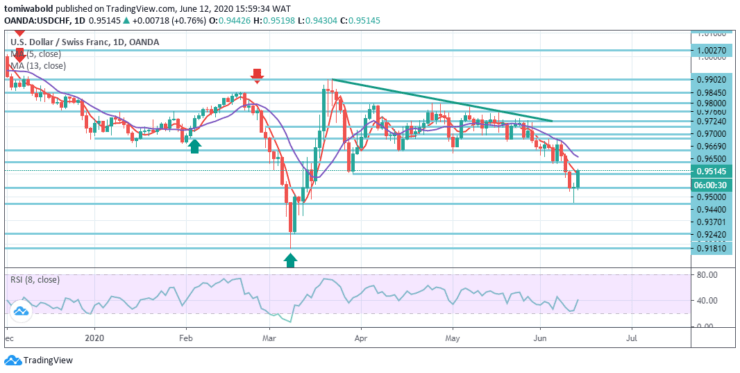

USDCHF Price Analysis – June 12

The USDCHF pair ripped out of its daily consolidated range and in the last hour leaped to new session highs, all over the region of 0.9475. The bullish market mood has eroded the Swiss franc safe-haven and has been seen as one of the big drivers that give certain strength to the USDCHF pair.

Key levels

Resistance Levels: 1.0027, 0.9766, 0.9500

Support Levels: 0.9440, 0.9370, 0.9181

USDCHF downside reversal can be verified if the follow-through is favorable, the pair is likely to end up above Thursday’s 0.9460 level high on Friday. Similarly, if Thursday’s low of 0.9376 level is breached, the bias may turn negative again. That may yield a sell-off to the level of 0.9182 (low on March 9).

USDCHF is on the upward trend today and is currently getting near the horizontal pressure resistance selling zone, indicated at well above 0.9500 levels. Initially, the pair had been in a sharp declining trend week, so bear market pressures may revert soon as the price approaches the pressure zone for selling.

USDCHF intraday bias remains neutral for consolidation beyond a temporary low level of 0.9370. Another plunge is anticipated as long as the resistance level is lower than 0.9500. The 0.9370 level breach may increase the entire fall from 0.9902 to t 100 percent forecast of 0.9902 to 0.9500 from 0.9724 to 0.9370 levels.

However, a strong violation of 0.9500 levels may imply a short-term bottoming and bring a firmer rebound to a moving average of 13 (now at 0.9650). On Friday, the pair needs to print gains to confirm a bullish reversal.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus