Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

Many have become befuddled by the recent consolidating (and even depressed) state of Gold and Bitcoin. In a time shrouded by economic uncertainty, shouldn’t safe-haven assets be more preferred by investors? This is the question on the lips of many including a UK research team (CryptoMarketRisk project team) who have indicated that there is significant market manipulation influencing these assets.

According to Prof. Carol Alexander of the University of Sussex Business School, we are undergoing market manipulation on an unbelievable magnitude by a few market players who lack ‘integrity.’ She added that this act is triggering a melt-down from which the financial markets may never recover from.

The team involved in this research tracked trades across global financial markets and discovered “large-scale” manipulation that was going undetected by busy regulators. The team reports that some single trades on COMEX have been extraordinarily large in a bid to influence prices—believed to be a clear violation of US market laws. However, regulators like the CFTC have been busy with the ongoing market turmoil and have not picked wind of the manipulation occurring.

The university’s study reveals that these manipulations could likely be the reason Gold and Bitcoin failed to rally in the mid-March financial markets selloff.

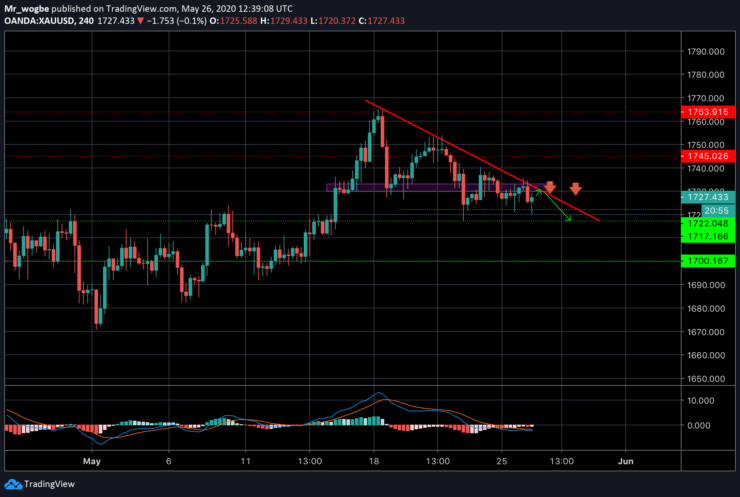

Gold (XAU) Value Forecast — May 26

XAU/USD Major Bias: Sideways

Supply Levels: $1,735, $1,745, and $1,763

Demand Levels: $1,722, $1,717, and $1,700

Gold remains caught up in a sideways trap. It has failed to sustain a break above the $1,730 level thereby putting it under heavy sell pressure. The 4-hour downtrend line has now intersected with the pivot level, further exposing the XAU/USD to more declines. Should the price fail to break above our pivot level soon, we could see a downward move to $1,717 this week.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus