Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

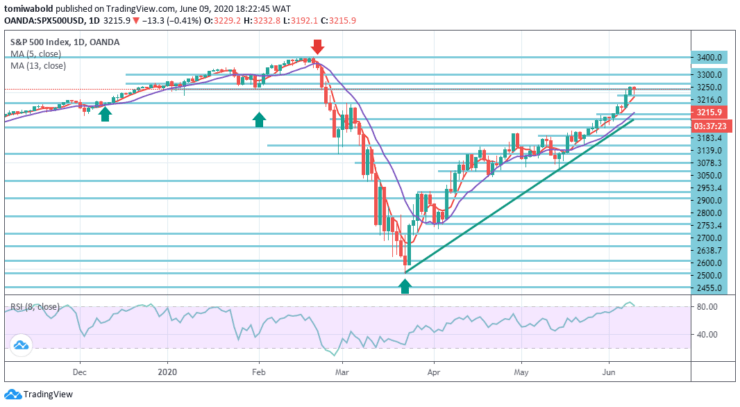

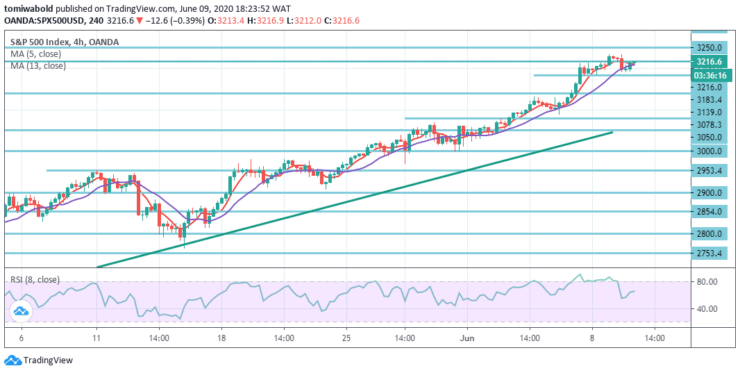

S&P 500 Price Analysis – June 9

Alongside an unbeaten run of 7 days, S&P 500 launched marginally lower on Tuesday as the risk rally does seem to have lost its flows, with the S&P 500 losing 1 percent on the day with a pullback towards 3200 levels.

Key Levels

Resistance Levels: 3400, 3300, 3250

Support levels: 3183.4, 2953.4, 2753.4

As per RSI, the S&P 500 seems to be in a green zone and its rally is similar in intensity to that seen in early January 2020. The trend also supports the highly positive momentum during the American Session.

However, the partial bullish range from March low in the S&P 500 (SPX) indicates that the Index may remain supported. We anticipate the index to increase higher in the medium to long term, while pullback stays beyond the 2953.4 level, and more notably beyond 2753.4 level.

In so far as pivot at 2953.4 low level stays unchanged, a pullback is expected to find support around 3139 levels, or swing in the short term to 3250 levels for more upside. This implies that the markets in the recovery rally have accelerated too much, making it prone to remarkable corrections in the days and weeks to come.

However, with long positions beyond the 3183.4 level and targets at 3250.00 & 3320.00 levels in extension, traders may look for new inclination. In the opposite case, traders may go beneath level 3183.4 to aim for more downside with threshold levels of 3139.0 & 3078.00 as the focus.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus