Service for copy trading. Our Algo automatically opens and closes trades.

The L2T Algo provides highly profitable signals with minimal risk.

24/7 cryptocurrency trading. While you sleep, we trade.

10 minute setup with substantial advantages. The manual is provided with the purchase.

79% Success rate. Our outcomes will excite you.

Up to 70 trades per month. There are more than 5 pairs available.

Monthly subscriptions begin at £58.

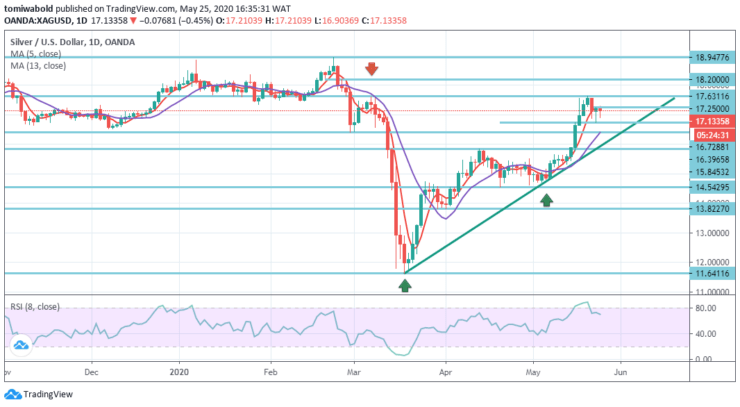

XAGUSD Price Analysis – May 25

SILVER finished the previous week at $17.21 level, 3.57 percent higher. The pair is trading at $17.12 level in today’s session at the time of posting. During the session, the market managed to reverse as sellers took control early but may close the day beneath its opening price.

Key Levels

Resistance Levels: $18.94, $18.20, $17.63

Support Levels: $16.72, $16.39, $15.84

XAGUSD Long term Trend: Bullish

The pair is expected to find support at $16.72 level on the daily chart, and a decline in could lead it to the next level of support at $16.69. The pair is supposed to discover its initial level of resistance at $17.63, and a spike through might take it to the next level of resistance at $18.94 level.

The potential bias gives preference for short positions underneath the level at $17.63, with extended targets at $16.72 & $16.39 levels. In the alternative scenario well beyond the $17.63 level we look for an increased upside with an emphasis for $18.94 level & beyond as goals.

While the XAGUSD is trading close to 10-week highs beneath $17.63 resistance level as seen on the 4-hour time frame. That being said buyers may assume control but probably on a daily closing basis may need a continuous split beyond the stated level.

Potential upside targets are therefore near the $18.20 and $18.94 levels. Also on the flip side, retracements down may offer initial support close to the levels of $16.72 and $15.84. For investors the level to break is the $17.63 resistance as seen both on the short-term and long-term closing basis.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Over 100 different financial products

- Invest from as little as $10

- Same-day withdrawal is possible

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus